- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD rises to 0.6250 on soft USD, with traders eyeing NZ data

NZD/USD rises to 0.6250 on soft USD, with traders eyeing NZ data

- NZD/USD was the strongest peer in the FX space and rallied more than 1%.

- US manufacturing activity stabilized, but input prices rose, sparking inflation concerns.

- NZD/USD Price Analysis: Will test solid resistance around 0.6280-0.6300, with daily Mas hoovering around the area.

Despite sentiment shifting sour, the NZD/USD rallies and stays firm above the 0.6250 area, bolstered by a softer greenback, albeit UST bond yields are rising sharply. US equities are pointing toward registering losses, which could weigh on risk-sensitive currencies at the beginning of the Asian session. At the time of writing, the NZD/USD is gaining 1.16% or 71 pips.

NZD/USD continued its uptrend on a soft US Dollar

Wall Street is set for a lower close. The Institute for Supply Management (ISM) reported that the February US Manufacturing Purchasing Managers’ Index (PMI) was 47.7, lower than the estimated value of 48. Although it seems to have stabilized compared to the previous month’s reading of 47.4., the prices subcomponent increased significantly, causing concerns about inflation among investors.

That augmented speculations that the Federal Reserve would continue tightening monetary conditions as traders pushed back rate cuts, as the CME FedWatch Tool reported.

The NZD/USD trimmed some of its earlier gains on the ISM release and dipped toward 0.6222, before resuming the uptrend, despite hawkish comments by Federal Reserve officials.

Neil Kashkari of the Minnesota Fed commented that he’s open to raising rates by 25 or 50 bps at the upcoming meeting, while he foresees rates peaking around 5.4%. Of late, Atlanta’s Fed President Raphael Bostic commented that rates need to go as high as 5% - 5.25% and stood there “well into 2024.”

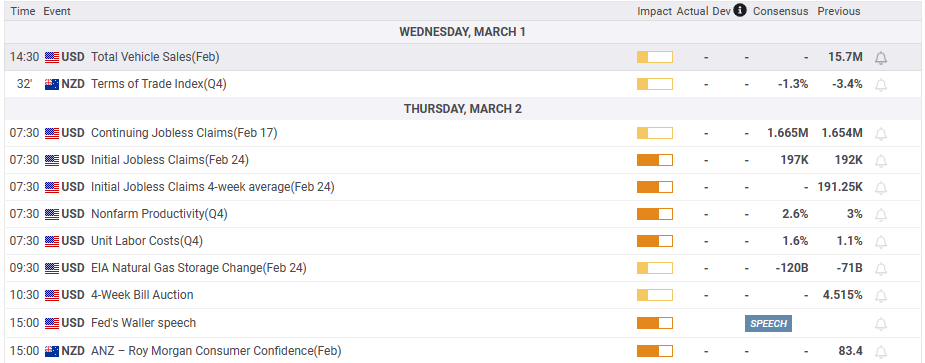

On the New Zealand (NZ) docket, the lack of data kept investors leaning on US Dollar dynamics and expectations that the Reserve Bank of New Zealand (RBNZ) is expected to raise rates in April, with odds for a 50 bps standing at 51%, per money market futures.

NZD/USD Technical analysis

The NZD/USD is neutral to upward biased, even though it sits below the daily Exponential Moving Averages (EMAs). However, at the time of typing, it faces solid resistance with the 50 and 200-day EMAs, at 0.6293 and 0.6282, respectively. If the NZD/USD cracks the 200-day EMA, that will exacerbate a rally above the 0.6300 mark. Otherwise, failure to do it would pave the way for further downside.

Trend: Neutral upwards.

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.