- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD clings above 1.3600 after upbeat US jobs data

USD/CAD clings above 1.3600 after upbeat US jobs data

- Upbeat labor market data boosted the US Dollar.

- The Federal Reserve pressured to deliver after solid US data warrants further tightening.

- USD/CAD headed upwards due to interest rate differentials between the Fed and the BoC.

The USD/CAD stages a comeback after losing 0.41% on Wednesday and rises above 1.3600 courtesy of broad US Dollar (USD) strength, sponsored by higher UST bond yields. Data from the United States (US) reinforced the economy is solid, particularly the labor market. Therefore, the USD/CAD advances 0.24% and trades at around 1.3600s after hitting a low of 1.3582.

USD/CAD pierces 1.3600 as US jobless claims edge down

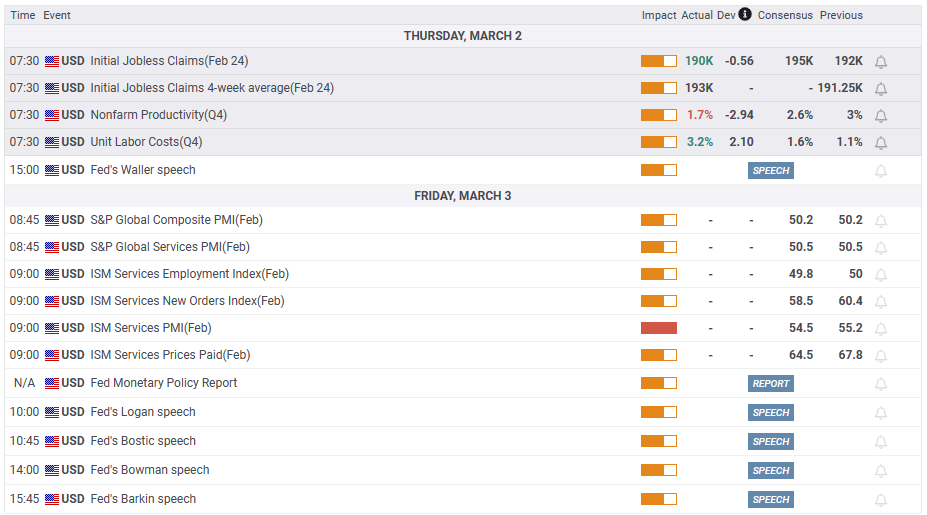

On Thursday, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ending February 25 came at 190K below the 195K foreseen by analysts. The 4-week moving average, which smooths volatile movement from week to week, stood at 193K and climbed from last week’s 191K. The USD/CAD rose and printed a daily high of 1.3641 before settling at current levels.

Since then, the US !0-year Treasury bond yield skyrocketed above the 4% threshold, at the time of writing, stands at 4.056%, gains six basis points, and underpins the greenback. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, gains 0.55% at 104.944.

On Wednesday, Federal Reserve officials continued their hawkish rhetoric after last week’s data disappointed investors hopeful of witnessing lower inflation readings. Minnesota Fed President Neil Kashkari commented that he is inclined “to push up my policy path” and foresees the Federal Fund Rate (FFR) to peak at around 5.4%. Echoing some of his comments was Atlanta’s Fed President Raphael Bostic though he was moderate, projects the FFR to peak at 5.0% - 5.25% but emphasized that it will stay there “well into 2024.”

On the Canadian front, traders should be aware that the Bank of Canada (BoC) lifted rates 25 bps to 4.50% on January 25 and commented that it would pause hiking rates. Therefore, that would keep the Loone (CAD) pressured as interest rate differentials between the Fed and the BoC would increase flows to the US Dollar. Given the backdrop, the USD/CAD path of least resistance is upwards.

The USD/CAD rally was capped by high oil prices, as WTI extended its rally to three days, with investors assessing China’s oil demand once it completes its reopening.

USD/CAD Technical analysis

Technically speaking, the USD/CAD is still upward biased, but it has consolidated during the week. If the USD/CAD pair stays around 13600.1.3660, that could lead to desperate bulls, which need to reclaim the YTD high of 1.3685, on its way to 1.3700 and beyond. On the other hand, a break below 1.3600 could exacerbate a correction toward the 20-day Exponential Moving Average (EMA) at 1.3507.

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.