- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD stumbles below 1.2000, on US jobs data, high UST bond yields

GBP/USD stumbles below 1.2000, on US jobs data, high UST bond yields

- GBP/USD falls courtesy of US Dollar strength, as UST bond yields pushed above 4%.

- US Initial Jobless Claims continued to trend lower, below expectations.

- GBP/USD Price Analysis: Downward biased, though facing solid support around the 1.1900-1.1915 area.

The GBP/USD retraces back below the 1.2000 figure after US economic data warranted further tightening by the US Federal Reserve (Fed), as reflected by the US Treasury bond yields reaction. At the time of typing, the GBP/USD exchanges hand at 1.1950, below its opening price by 0.66%.

GBP/USD tumbled below 1.2000 as UST bond yields skyrocketed, lifting the US Dollar

On Thursday, the US Department of Labor (DoL) announced that Initial Jobless Claims for the week ending on February 25 were lower than the 195K predicted by analysts, coming in at 190K. The 4-week moving average, which helps to even out fluctuations from week to week, was at 193K and showed a slight increase from the previous week’s average of 191K. The GBP/USD extended its losses on the headline and printed a fresh daily low of 1.1924 before reversing its course.

In the meantime, US Treasury bond yields begin to reflect higher rates, with investors lifting US Treasury bond yields, with 2s, 3s, 5s, and 10s, above the 4% threshold. Consequently, the US Dollar is rising 0.57%, as shown by the US Dollar Index, at 104.971.

The Fed parade continued with Minnesota’s Fed President Neil Kashkari commenting that rates need to be raised to around 5.4%. On the contrary, Atlanta’s Fed President Raphael Bostic added that he projects the Federal Fund Rates (FFR) to peak at the 5.0% - 5.25% range. And reiterated that it will stay there “well into 2024.”

The lack of UK economic data keeps the GBP/USD pair leaning on the dynamics of the US Dollar and the Bank of England (BoE) Chief economist Huw Pill. Pill commented that economic activity in the UK may be stronger than projected and that inflation risks are skewed to the upside.

GBP/USD Technical analysis

Even though the GBP/USD edged lower, it’s facing a critical support area, with a four-month-old support trendline and the February low at 1.1914. A decisive break of the latter would expose the 1.1900 figure, which, once broken, the GBP/USD could fall to the YTD low at 1.1841. As an alternate scenario, the GBP/USD reclaiming the 1.2000 figure would expose the 20-day Exponential Moving Average (EMA) at 1.2064.

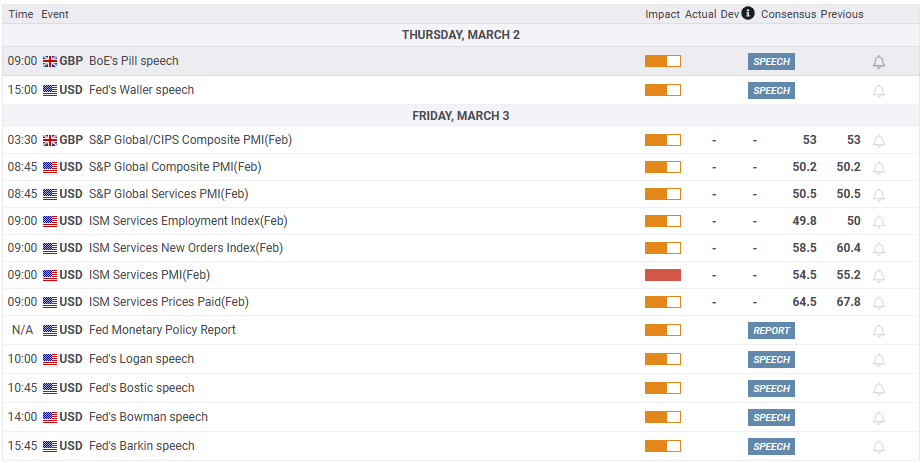

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.