- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/MXN conquers the 18.000 figure ahead of Fed’s Powell speech before US Congress

USD/MXN conquers the 18.000 figure ahead of Fed’s Powell speech before US Congress

- USD/MXN reclaims 18.0000 post US factory data, ahead of Fed’s Powell speech.

- The US Dollar remained offered, though it was no excuse for the USD/MXN to register gains.

- USD/MXN Price Analysis: Downward biased, but it would need a daily close below $18.00 to expose 6-year lows.

The USD/MXN is recovering some ground on Monday after falling to 5-year lows below $18.00, at 17.9409, and climbing above the 18.0000 figure amidst overall US Dollar (USD) weakness. The USD/MXN is exchanging hands at 18.0022 and gains 0.27%.

USD/MXN reclaims $18.00 as the pair consolidates

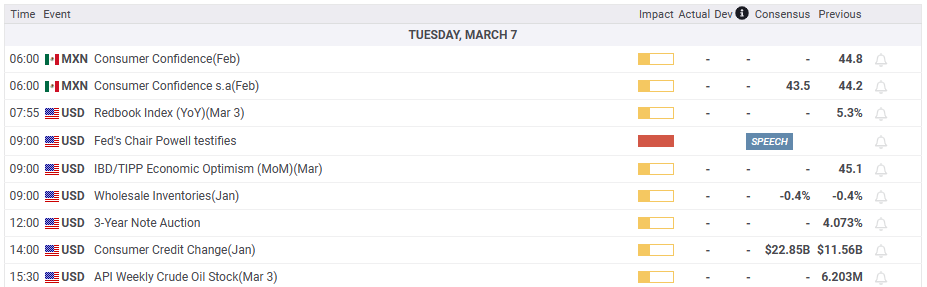

Wall Street is set to finish Monday’s session with gains. The US Federal Reserve Chair Jerome Powell will take the stand in the United States (US) Congress on March 7 and 8. He’s expected to deliver a speech reiterating the Fed’s commitment to taking inflation and holding higher rates for a certain time. Nevertheless, analysts expect Chair Powell to be vague if asked where the Federal Funds Rate (FFR) would peak.

In the meantime, data revealed during the day showed that US Factory Orders plunged less than estimates of -1.8%; it came at -1.6%. The US Commerce Department report indicated an increase in the shipment and production of goods, which ended a two-month consecutive decline trend.

The US Dollar Index (DXY) a gauge for the buck’s value vs. a basket of six currencies, continued its downtrend last week by -0.19%, at 104.325, capping the USD/MXN gains during the day.

On the Mexican front, data from the National Statistics Agency, known as INEGI, showed that automotive production and exports climbed more than expected a year ago. Additionally, Tesla’s 10 billion US dollars investment in Mexico keeps the Mexican Peso (MXN) afloat.

USD/MXN Technical Analysis

The USD/MXN daily chart portrays the MXN would continue to strengthen vs. the US Dollar. Nevertheless, it could consolidate as traders assess the USD/MXN current exchange rate. An extension below $17.94 could witness the USD/MXN reaching the July 2017 low of 17.4498. A break below will expose the April 2016 low of 17.0509. Conversely, if the USD/MXN reclaims 18.1208, that would open the door to testing the 20-day EMA at 18.3757.

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.