- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY fluctuates at around 135.90s ahead of Powell’s speech

USD/JPY fluctuates at around 135.90s ahead of Powell’s speech

- USD/JPY is trading almost flat following Monday’s session.

- US Federal Reserve Chairman Jerome Powell is expected to reiterate the Fed’s commitment to inflation.

- A weaker US Dollar and rising UST bond yields capped the USD/JPY movement.

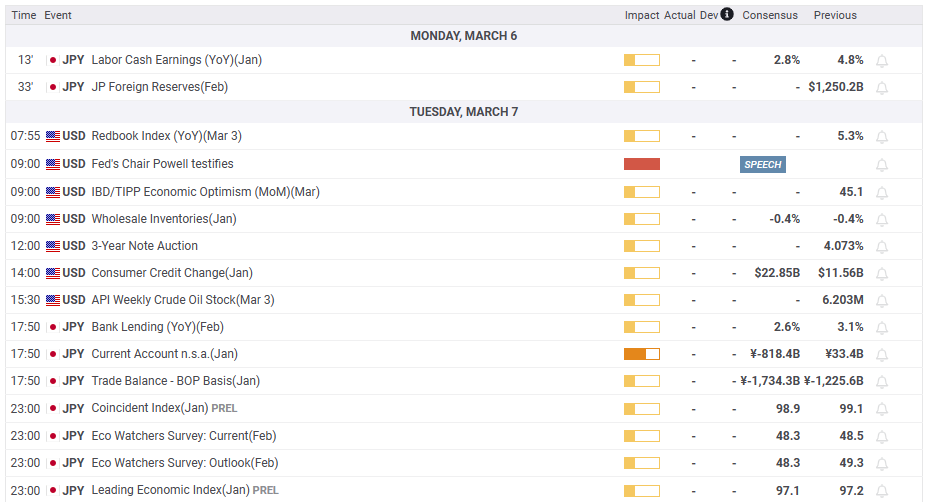

The USD/JPY registers minuscule gains as the Asian Pacific session opens after Monday’s session, printed a doji. A light US economic calendar and Federal Reserve’s (Fed) Chair Jerome Powell testifying before the US Congress will likely keep the pair within familiar levels. At the time of writing, the USD/JPY is exchanging hands at 135.91 after hitting on Monday a weekly low of 135.36.

USD/JPY stays below 136.00 due to USD weakness

Wall Street finished mixed, with the Dow Jones and the S&P 500 gaining between 0.07% and 0.12%. The Nasdaq printed losses of 0.11%. The greenback registered losses, of 0.22%, at 104.292. Contrary to UST bond yields. The 10-year benchmark note rate finished almost unchanged but in positive territory at 3.966%.

On March 7th and 8th, the Chair of the US Federal Reserve, Jerome Powell, is scheduled to testify before the US Congress. Market participants anticipate that he will give a speech reaffirming the Fed’s dedication to controlling inflation and keeping interest rates elevated for a certain period. However, analysts predict that if asked about the Federal Funds Rate (FFR) peak, Chair Powell may not provide a specific answer.

On the Japanese front, the upcoming policy meeting of the Bank of Japan (BoJ), scheduled for March 10th, would be Governor Kuroda’s final meeting. The markets believe he will use this opportunity to initiate policy normalization by adjusting the Yield Curve Control (YCC). Rabobank analysts commented that the BoJ would take a cautious approach to loosen conditions of the YCC, and it would be the first step towards monetary policy normalizations.

USD/JPY Technical levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.