- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD trades at new YTD lows at 0.6103 as investors expect a 50 bps hike in March

NZD/USD trades at new YTD lows at 0.6103 as investors expect a 50 bps hike in March

- NZD/USD dropped 85 pips of 1.38% in Tuesday’s session on hawkish comments by Fed officials.

- The US Federal Reserve Chair Jerome Powell commented that higher rates are needed and opened the door for aggressive tightening.

- NZD/USD Price Analysis: A break below 0.6100 will pave the way toward 0.6000.

NZD/USD plummets as the New York session wanes following the US Federal Reserve Chairman Jerome Powell’s testimony at the US Senate. Powell rattled equity markets as it shifted toward a hawkish stance and turned sentiment sour. Therefore, the NZD/USD is dropping 1.29% and exchanges hands at 0.6114.

NZD weakens on an aggressive Fed that bolstered the USD

Wall Street closed with losses following Powell’s speech. The US Fed Chair commented that the US central bank would increase rates at larger sizes if needed. Powell added, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

The US economy showed improvement in January, as wholesale trade rose by 1.0% MoM, beating forecasts. Stock levels dropped 0.4%, matching what the market expected.

Money market futures are beginning to reprice an aggressive Fed, as shown by the CME FedWatch Tool, with odds that the Fed would hike 50 bps at 70.5% at the upcoming meeting. Consequently, the US Dollar Index (DXY) hit a fresh nine-week high at 105.654, gaining more than 1%. The US 10-year bond yields pierced the 4% threshold before retreating to 3.972%.

The NZD/USD tumbled to new YTD lows of 0.6103, and levels last reached on November 21, 2022. The NZD/USD collapsed from around 0.6190s toward the day’s low when Powell’s headlines crossed news screens.

On the New Zealand (NZ) front, the kiwi was slightly bolstered by the Reserve Bank of Australia’s (RBA) 25 bps interest rate increase, which was perceived as a “dovish” hike. Data-wise, the latest Global Dairy Trade (GDT) in the NZ docket showed that most dairy products cooled down, except for whole milk powder. The GDT Price Index fell 0.7%, shrugging off analysts’ expectations of higher prices.

NZD/USD Technical analysis

The NZD/USD daily chart portrays the pair as bearish-biased, further cemented by oscillators with negative readings. A death cross is confirmed, with the 50-day Exponential Moving Average (EMA) crossing below the 200-day EMA, which would warrant further downside in the NZD/USD.

Once the NZD/USD tumbles below 0.6100, that would exacerbate a fall toward the November 17 low at 0.6064. A breach of the latter would clear the path towards 0.6000.

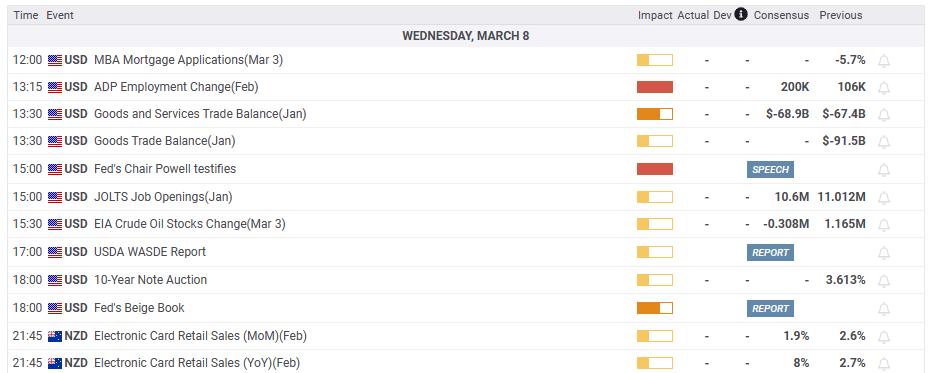

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.