- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/MXN plummets to fresh 5-year lows below $18.00 despite Powell’s hawkish comments

USD/MXN plummets to fresh 5-year lows below $18.00 despite Powell’s hawkish comments

- The US ADP Employment Change report exceeded estimates but failed to boost the USD vs. the MXN.

- US Federal Reserve Chair Jerome Powell will testify in the US House of Representatives, expected to remain hawkish.

- USD/MXN Price Analysis: A break below 18.000 warrants further downside, with bears eyeing 17.4498.

The USD/MXN tumbled below the psychological $18.00 barrier on Wednesday despite hawkish remarks by US Federal Reserve’s (Fed) Chair Jerome Powell. On Tuesday, the Mexican Peso (MXN) depreciated towards the weekly high of 18.1800, but it’s staging an astonishing recovery, and dived to 5-year lows at 17.9255. At the time of writing, the USD/MXN is trading at 17.9690, down 0.76%.

US ADP employment data exceeded estimates ahead of the US NFP report

Wall Street opened in the green. The February US ADP National Employment Report showed that private hiring in the United States (US) increased by 242,000 jobs, above estimates of 200,000. That reinforces Fed Chair Jerome Powell’s stance that the labor market is tight and that there is work to do.

On Tuesday, Fed Chair Jerome Powell testified before the US Senate Finance Committee. He acknowledged that the rate peak would be higher and opened the door for significant rate hikes. Powell added that would be decided based on incoming data. Traders should be aware that the US Nonfarm Payrolls report for February and next week’s inflation data will be featured ahead of the Fed’s March meeting.

In the meantime, the US Dollar Index (DXY), a gauge of the buck’s value vs. six currencies, retraces 0.11%, down at 105.502, influenced by falling UST bond yields. The US 10-year T-note rate is at 3.913%, dropping five bps.

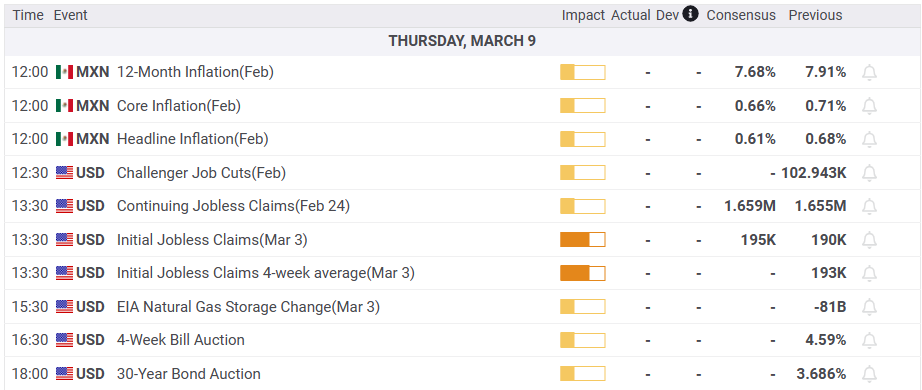

Aside from this, inflation in Mexico is expected to slow its pace in February, according to a Reuters poll. Seventeen analysts forecasted by Reuters expect inflation at 7.69% in February, below January’s 7.91%.

The Bank of Mexico (Banxico) central bank members expressed that rates could be raised moderately since the next monetary policy meeting, as shown by the latest meeting minutes. Even though there’s one dissenter, most of the board agreed that the tightening cycle is about to end.

That could favor a recovery of the US Dollar (USD) in the medium to long term. Therefore, the USD/MXN bias could shift upwards based on reduced interest rate differentials between the Fed and Banxico.

USD/MXN Technical analysis

The USD/MXN remains downward biased after plummeting below the 18.0000 barrier. Oscillators like the Relative Strength Index (RSI) accelerate to the downside. Meanwhile, the Rate of Change (RoC) is back below neutral, suggesting that sellers are gathering momentum. That said, the USD/MXN first support would be the July 2017 lows at 17.4498. A breach of the latter would expose April’s 2016 lows at 17.0509, ahead of $17.00.

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.