- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD is subdued around 1.1840s after printing a YTD low around 1.1800

GBP/USD is subdued around 1.1840s after printing a YTD low around 1.1800

- GBP/USD trims Tuesday’s losses after hitting a YTD low of 1.1802.

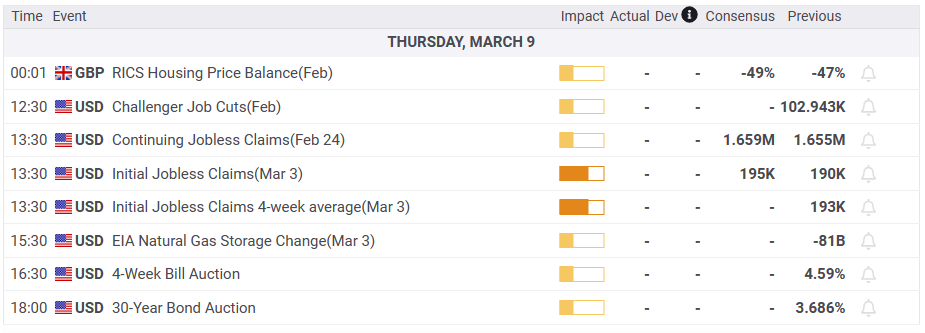

- Labor market data in the United States portrays a tight labor market; focus shifts to Friday’s Nonfarm Payrolls.

- BoE’s Mann: The Pound Sterling could be vulnerable to weakening based on other central banks’ outlooks.

GBP/USD stays firm at around 1.1840s, following hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell. Powell’s two-day meeting with the US Congress would conclude today at the US House o Representatives, with market participants expecting him to remain hawkish. Therefore, the GBP/USD is exchanging hands at 1.1843, gaining 0.10%.

Federal Reserve Chair Powell testifies at the US House of Representatives

The GBP/USD would likely remain at familiar levels, as the market has priced in Powell’s hawkishness on Tuesday. On Wednesday, labor market data revealed in the United States (US) economic docket reinforced the Federal Reserve’s worries about the tightness of the labor market. February’s ADP report revealed that the US private sector added 242,000 jobs, more than the expected 200,000.

Later, job openings for January in the United States dropped less than estimates, as shown by the JOLTS report. Job openings, a measure of labor demand, decreased to 10.8M. However, data came above forecasts of 10.5M. Given the backdrop, Jerome Powell and Co. could justify higher rates, which could be confirmed by next Friday’s US Nonfarm Payrolls report.

The US Dollar Index (DXY) has trimmed some of its losses and is down 0.08%, at 105.535, after diving to 105.365. US Treasury bond yields, namely the 10-year, is still pressured, falling two and a half bps to 3.942%.

At the time of typing, Fed Chair Jerome Powell is testifying at the US House of Representatives and has managed to stay hawkish as his previous appearance in the US Senate.

On the United Kingdom (UK) front, Bank of England (BoE) policymakers had been crossing the wires. Swati Dhingra said on Wednesday that risks of overtightening “pose a more material risk at this point, through potential negative impacts from increased borrowing costs and reduced supply capacity going forwards.” Of note, she voted for no change in the last two meetings.

Contrarily, Catherine Mann, one of the hawks at the BoE, commented that the Pound Sterling (GBP) could be vulnerable to other central banks’ outlooks. That could hurt the Pound’s prospects if the Federal Reserve and the Europen Central Bank (ECB) continued their tightening cycles.

What to watch?

GBP/USD Technical levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.