- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD seesaws around 1.0540s shy of the 200-DMA at 1.0536

EUR/USD seesaws around 1.0540s shy of the 200-DMA at 1.0536

- EUR/USD meanders slightly above the 200-day EMA, a magnet for EUR/USD bears.

- Hotter-than-expected US labor market data warrants further rate hikes by the Fed.

- ECB’s policymakers split by tightening aggressively or gradually.

- EUR/USD Price Analysis: If the pair tumbles below the 200-DMA, that would pave the way towards 1.0400.

EUR/USD remains unchanged at 1.0545, below the 200-day Exponential Moving Average (EMA) as Fed Chair Jerome Powell testifies before the US Congress. Meanwhile, US equities continued to fluctuate, portraying a mixed sentiment, while the US Dollar turned positive. At the time of writing, the EUR/USD is trading at 1.0545.

EUR/USD stays firm around familiar levels amidst the lack of a catalyst

The EUR/USD has failed to gain traction either way after US economic data backed the latest commentaries by Jerome Powell. Although January’s JOLTs report showed a decrease In openings at 10.8M, it exceeded estimates of 10.5M.

Earlier, the February US ADP Employment Change report revealed that the US private sector added 242,000 jobs, more than the expected 200,000. That said, figures from both reports reinforced what Federal Reserve officials have commented about a tight labor market, which would warrant further tightening by the Federal Reserve. That could weigh on the Euro (EUR); therefore, a further downside in the EUR/USD is expected.

Before Wall Street opened, the Richmond Fed President Thomas Barkin commented that inflation is still high and that the Fed stills have work to do. Later at the US House of Representatives, Fed Chief Jerome Powell said that the Fed had not decided yet about the upcoming March meeting. Powell added that China’s reopening could spur another round of inflation due to higher commodity prices.

In the Euro area (EU), European Central Bank (ECB) policymakers have remained hawkish. Earlier in the week, ECB’s Knot said that the central bank needs to keep hiking rates for some time, echoing Robert Holzmann’s words to raise rates by 50 bps due to stubborn inflation.

Ignazio Visco, ECB’s Governing Council (GC) member, commented that monetary policy must remain cautious and driven by economic data, favoring gradual rate increases. In the meantime, an ECB survey showed that EU consumers expect inflation to moderate and wages to rise. Meanwhile, Citigroup expects the ECB to raise rates to 4% by mid-2023.

EUR/USD Technical levels

The EUR/USD is neutral biased, though about to test the 200-day EMA. Tuesday’s fall below the 100-day EMA at 1.0554 exacerbated a fall toward the 200-day EMA, viewed as a trendsetter level for EUR/USD traders. A decisive break below 1.0536, the 200-day EMA would accelerate the EUR/USD pair fall toward 1.0500. Once cleared, the following support would be the YTD low at 1.0482, followed by the November 30 low at 1.0290.

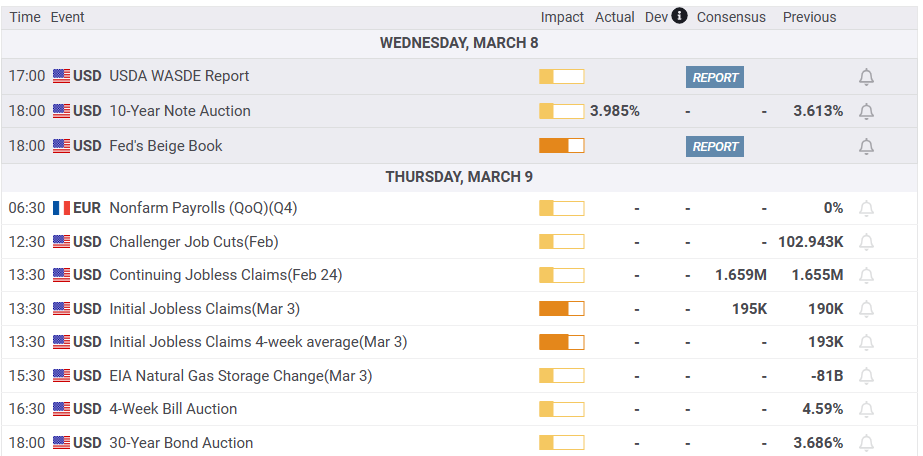

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.