- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD rips higher on Credit Suisse risk aversion and tumbling US yields

Gold Price Forecast: XAU/USD rips higher on Credit Suisse risk aversion and tumbling US yields

- Gold price firmer on risk-off sentiment due to the Credit Suisse crisis.

- Investors question whether the Federal Reserve can keep hiking interest rates to curb inflation.

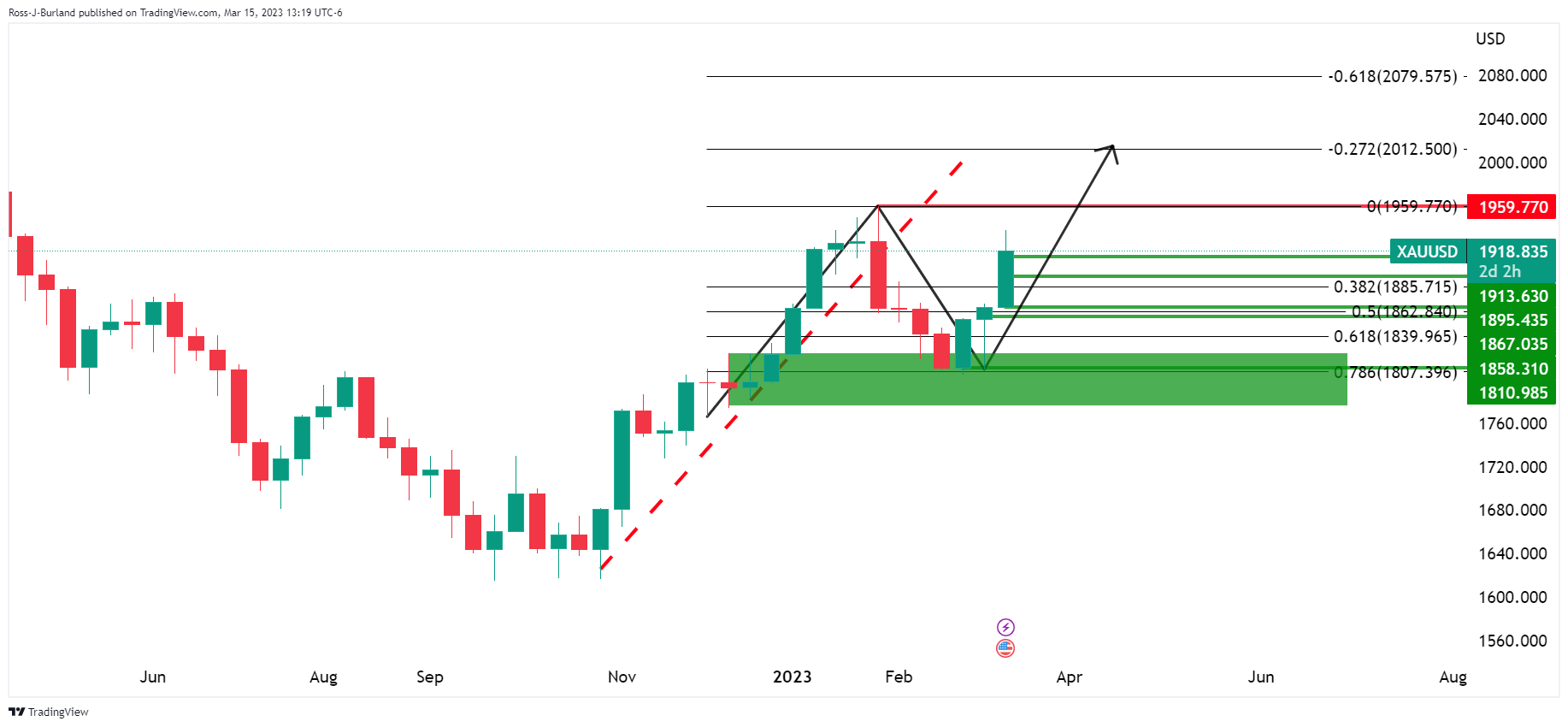

- On a weekly basis, a continuation in the Gold price opens the risk of a move to test $2,012.50 as the -272% Fibonacci.

Gold price soared from a low of $1,885.79 to a high of $1,937.39 on the day but has come under some selling pressure in recent trade. Gold price has fallen back to trade around $1,916 at the time of writing, reflecting the volatility in the market as a consequence of the Credit Suisse risk.

Credit Suisse is in crisis

Bank stocks, already reeling from two large bank failures in the past week, were under pressure on Wednesday as the sharp drop of Credit Suisse. Shares of the Swiss lender fell more than 20% after the chairman of its biggest backer — the Saudi National Bank — said it won’t provide further financial support. On Tuesday, the institution announced that it had found “material weakness” in its financial reporting process from prior years.

The Guardian reports,´´the bank is in the process of a major restructuring plan, meant to stem major losses, which ballooned to 7.3bn Swiss francs (£6.6bn) in 2022, and revive operations hampered by multiple scandals over the past decade involving alleged misconduct, sanctions busting, money laundering and tax evasion.´´

Long story short, there is a loss of confidence in the bank and this is leading to additional fears of contagion in the global banking arena which is benefitting the Gold price on derisking as well as dialed-back expectations for central bank tightening.

Federal Reserve rate hike expectations dialed back

As recently as last week, markets were getting set for the return of large Fed interest rate rises. However, concerns about the banking sector have triggered a sharp decline US bond yields as investors questioned if the Federal Reserve and other central banks can keep hiking interest rates to curb inflation.

Two-year Treasury notes, which move in step with interest rate expectations, have tumbled 98 basis points in the last five days, the biggest drop since the week of Black Monday on Oct. 19, 1987. On Wednesday, they have fallen from 4.413% to pay as low as 3.72%. Markets are now pricing in an 80% chance of a 25 basis point Federal Reserve hike next week and are pricing in a 50% chance of no change. Moreover, the December Fed funds futures, which reflect the overnight rate that banks use to lend to each other has dropped to 3.62% in a sign market expect the Federal Reserve to be cutting interest rates by year's end, if not before.

Gold price shines on falling US Treasury yields

Consequently to the turmoil, the Gold price is recovering and has rallied in four of the past five trading sessions. Last year, higher interest rates made it more appealing to hold government bonds over gold, since the latter doesn't pay any regular income. However, a jolt of uncertainty among investors is seeing the yields paid on government debt tanking. The yield curve, as a result, narrowed its inversion further, with the gap between two-year and 10-year yields contracting to -28.60 bps and the tightest spread since October.

Gold price technical analysis

From a daily perspective, the momentum is with the Gold price bulls and a bullish close on Wednesday opens prospects of a move to test the 2023 highs near $1,960.

On a weekly basis, the Gold price has recovered from support and a 78.6% Fibonacci correction. A continuation in the Gold price opens the risk of a move to test $2,012.50 as the -272% Fibonacci.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.