- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bulls seek a test of daily resistance

Gold Price Forecast: XAU/USD bulls seek a test of daily resistance

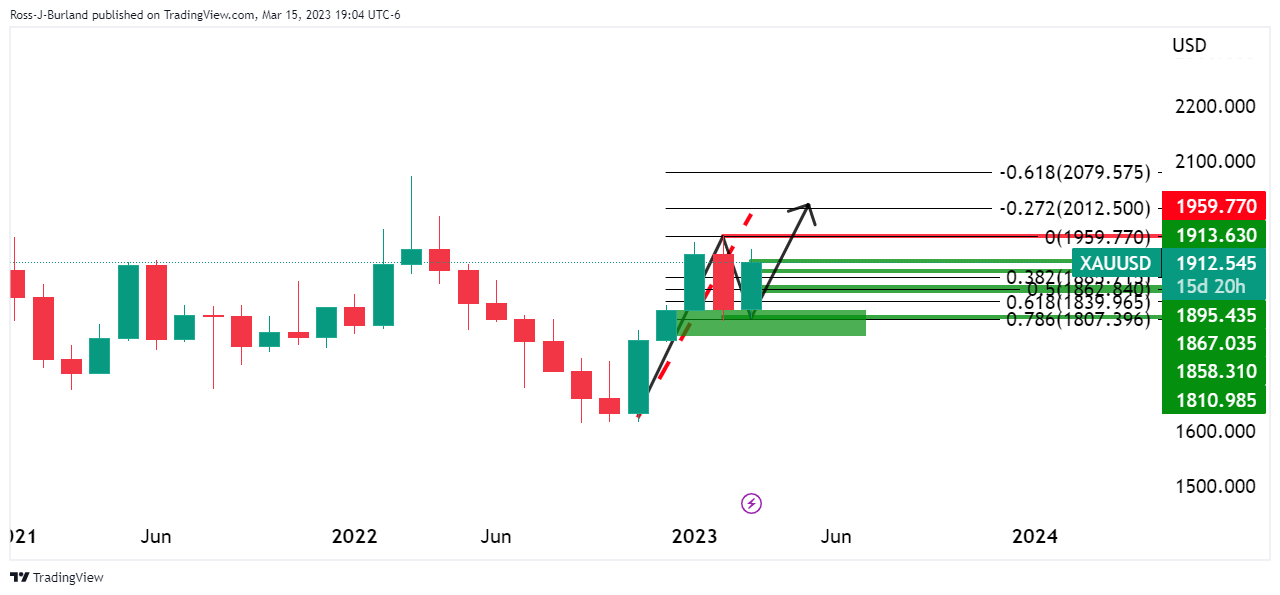

- Gold price bulls in the market as derisking favors the safe havens.

- Bulls eye a break of recent highs and then the $2,000s.

Gold price rallied sharply as investors rushed to have assets. Bank stocks, already reeling from two large bank failures in the past week, were under pressure due to the Credit Suisse crisis. Shares of the Swiss lender dropped more than 20% after the chairman of its biggest backer — the Saudi National Bank — said it won’t provide further financial support. Gold price hit a high of $1,937.

The US Dollar weas also bid on safe-haven flows and despite producer prices in the US unexpectedly falling in February. This comes following strong consumer prices earlier in the week. However, fresh woes at Credit Suisse saw safe haven buying continue to pick up. This was aided by the sharp drop in yields on US Treasuries.

The two-year Treasury notes, which move in step with interest rate expectations, have tumbled 98 basis points in the last five days, the biggest drop since the week of Black Monday on Oct. 19, 1987. On Wednesday, they dropped further from 4.413% to pay as low as 3.72%. Benefitting Gold price, the yield curve, as a result, narrowed its inversion further, with the gap between two-year and 10-year yields contracting to -28.60 bps and the tightest spread since October.

Looking to the Federal Reserve next week, markets are now pricing in an 80% chance of a 25 basis point hike and are pricing in a 50% chance of no change. Moreover, the December Fed funds futures, which reflect the overnight rate that banks use to lend to each other has dropped to 3.62% in a sign that the market expects the Federal Reserve to be cutting interest rates by year's end, if not before.

Gold technical analysis

Gold price bulls are in the market and the bullish close on Wednesday opens prospects of a move to test the 2023 highs near $1,960 that guard a monthly move towards the $2,000s.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.