- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold price at $2,000, banking crisis brings ultimate safe haven back

Gold price at $2,000, banking crisis brings ultimate safe haven back

- Gold price has rallied over 10% in the past two weeks.

- Trust issues in banking sector continue despite the UBS takeover of Credit Suisse.

- Federal Reserve decision looms over current safe-haven dominance.

Gold price bulls have been the biggest beneficiaries of the international banking crisis that has taken over the financial markets in the past week. The bright metal has rallied more than 10% since March 8 and reached the round $2,000 level on Monday during the European trading session. Gold is nearing its double-top all-time highs from summer 2020 and March 2022 as traders try to find refuge in the most traditional safe-haven asset, ditching cash in the process.

The spark that started this extreme risk-off mood scenario was the collapse of Sillicon Valley Bank (SVB), and it didn’t take long before a big international bank, Credit Suisse, got in trouble. With news over the weekend of Swiss giant bank UBS taking over its rival in shambles in a deal orchestrated by authorities in Switzerland, the markets have not calmed down.

Gold price rally at mercy of Federal Reserve conundrum

With the Federal Reserve meeting within the market sight this week, market players are asking themselves whether this flight to safe haven will keep benefiting Gold, or if the US Dollar can make a comeback. Eren Sengezer, Senior Analyst at FXStreet, depicts this conundrum in his weekly Gold price article:

“At this point, it looks very unlikely the Fed will opt for a 50 bps rate hike. If that were to be the case, the initial reaction could provide a boost to the USD and weigh on XAU/USD. However, such a decision could also revive fears over a deepening financial crisis and trigger a fresh bout of flight to safe-haven bonds, causing US T-bond yields to fall sharply and opening the door for a leg higher in Gold price.

At the other extreme, markets are likely to go back into panic mode even if the Fed were to leave its policy rate unchanged to address the tightening of financial conditions. Investors could assess such a decision as the situation in the banking sector being much worse than what they were led to believe.”

Forecast poll experts not buying into Gold price hype

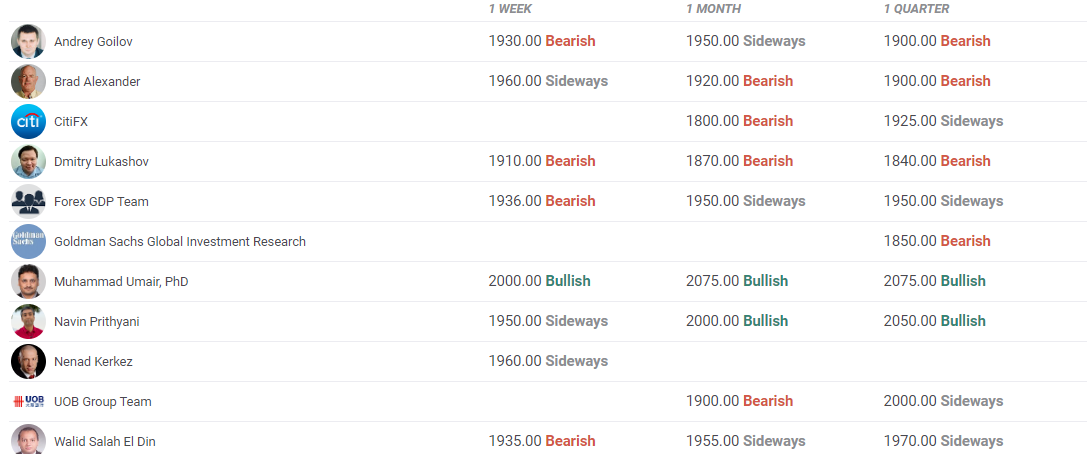

Despite the huge bullish momentum in Gold price, FXStreet Forecast Poll respondents are way more cautious, with the consensus not buying the current hype of XAU/USD bulls. The average end-of-the-week target for the bright metal in the poll $1,947.62, with 50% of the experts in bearish territory.

This might reflect a cautious market positioning ahead of a super busy week, with the FOMC Meeting looming, but can also be read in a counter-intuitive way, with US Dollar bulls (or US Treasury bond bears) vulnerable to more losses if the nervousness of the market persists throughout the week.

FXStreet Forecast Poll on Gold price (published on March 17)

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.