- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/MXN stumbles below $19.00 on risk-on impulse and soft US Dollar

USD/MXN stumbles below $19.00 on risk-on impulse and soft US Dollar

- USD/MXN retreated after hitting a six-week high of around 19.2327.

- Last Friday, US economic data pointed to further weakness in the economy.

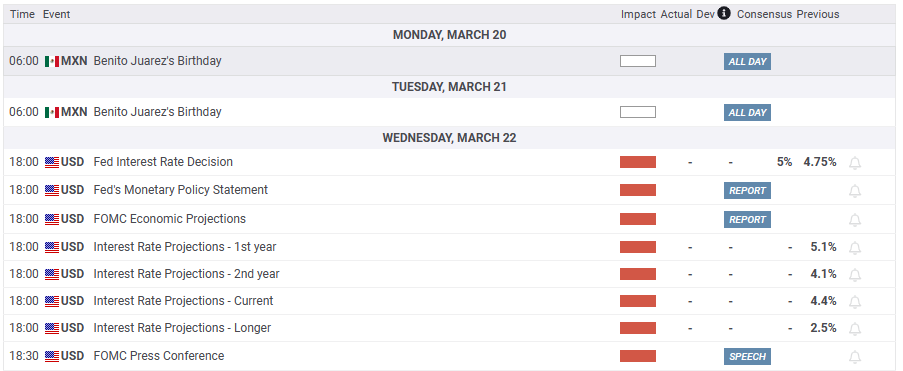

- Traders are expecting a 25 bps rate hike by the Federal Reserve.

USD/MXN is almost flat on Monday, losing 0.18% after traveling from a daily low of 18.8123. But buyers stepped in and lifted the pair above the $19.00 threshold. Nevertheless, the 100-day Exponential Moving Average (EMA) at 18.9929 capped the USD/MXN pair gains. The USD/MXN is trading at 18.8390at the time of writing.

Sentiment improvement bolstered the Mexican Peso

Investors shrugged off fears of the banking crisis after UBS’s takeover of Credit Suisse. Global central banks welcomed the news, though sentiment would remain fragile ahead of the Federal Reserve’s (Fed) interest rate decision this week. Money market futures odds for a 25 basis point rate hike lie at 73.1%, compared to last week’s 65%.

Friday’s data in the United States (US) revealed that Industrial Production for February contracted for the first time in the last 12 months, at -0.2% YoY. The monthly reading came at 0%, below the 0.2% estimates. In the meantime, as measured by the University of Michigan (UoM), March’s Consumer Sentiment in the US dropped for the first time in four months, from 67, to 63.4 in March.

The UOM poll updated American’s inflation expectations for a 5-year from 2.9% to 2.8%, while for one year, it dropped to 3.8% from 4.1%.

That has weighed in the greenback, as shown by the US dollar Index (DXY), falling 0.48%, at 103.371. US Treasury bond yields continue to collapse, a headwind for the USD/MXN

On the Mexican side, the Bank of Mexico (Banxico) Governor Victoria Rodriguez Oceja commented that she’s considering a more gradual approach to interest rate increases after hiking 50 bps in February. She added, “We’ll take into account the decision of the Fed and many other factors to the extent that they affect the inflation panorama.”

USD/MXN Technical analysis

The USD/MXN hit a daily high at 19.2327, shy of testing the 200-day EMA at 19.3888. Since then, the USD/MXN erased those gains and dropped beneath the 100-day EMA, though it found support at 18.8047. For a bearish continuation, the USD/MXN must reclaim the 50-day ENA at 18.6822 to test the 20-day EMA at 18.5487. Otherwise, if the USD/MXN regains the 100-day EMA at 18.99, the pair would be poised to finish the day above $19.00.

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.