- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD rises on ECB speakers, sentiment improvement, Lagarde’s eyed

EUR/USD rises on ECB speakers, sentiment improvement, Lagarde’s eyed

- As investors shrugged off banking crisis woes, EUR/USD gained traction above 1.0700.

- PPI in German was mixed, with annual reading shooting above 15%< while MoM data shrank.

- EUR/USD: Bullish in the near term but needs to clear 1.0760, to extend its gains.

The EUR/USD breaks the 1.0700 barrier and climbs 0.50% after hitting a daily low of 1.0631. An improvement in market mood and European Central Bank (ECB) speakers lend a hand to the Euro (EUR), while the US Dollar (USD) continues to weaken across the board. At the time of writing, the EUR/USD is trading at 1.0720.

Germany’s PPI and ECB speaking among the factors boosting the Euro

Market sentiment improved after UBS bought its Swiss rival Credit Suisse. The financial market turbulence has spurred speculations that global central banks could pause the pace of tightening. However, traders expect a 25 bps rate hike by the Federal Reserve (Fed) on Wednesday. The CME FedWatch Tool odds for a quarter of a percentage point lift at 73.10%.

The EUR/USD price action has been driven by ECB speakers. The President of the ECB, Christine Lagarde, said that inflation is expected to continue excessively high for a more extended period. She added that there’s no trade-off between inflation and financial stability, and without tensions, the ECB would’ve indicated that additional rate hikes were required.

At around the same time, ECB’s Stoumaras commented the ECB would not give more forward guidance and said that meetings would be data dependant.

Earlier, Germany’s inflation in the producer side, known as the Producer Price Index (PPI), contracted -0.3% MoM, less than estimates of -0.5%. Annually basis, the PPI jumped 15.45, above forecasts of 14.5%.

Aside from this, last Friday’s US economic data revealed that Industrial Production experienced a -0.2% YoY decrease, marking the first contraction in the past year. The monthly reading was 0%, lower than the estimated 0.2%. Additionally, Consumer Sentiment in the US, as measured by the University of Michigan (UoM), decreased from 67 in February to 63.4 in March, the first drop in four months.

The US Dollar Index, a measure of the buck’s value, extended its losses to 0.44%, down at 103.417, a tailwind for the EUR/USD. US Treasury bond yields are recovering but failing to underpin the greenback.

EUR/USD Technical analysis

The EUR/USD has printed three consecutive bullish candles, though it remains shy of testing last week’s high of 1.0759. The daily chart suggests a triple bottom is in place, though it would need to reclaim the latter to confirm its validity. That would pave the way for a rally towards the YTD high of 1.1032, but firstly, traders need to clear the February 14 at 1.0804 before aiming towards 1.1000. Conversely, a fall below the 100 and 200-day EMAs, around 1.0545/1.0569, would shift the EUR/USD bias to bearish.

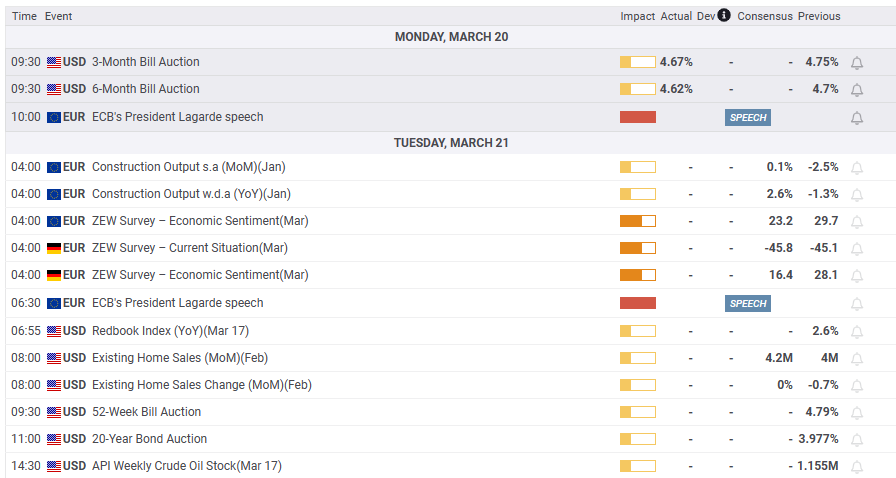

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.