- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CHF tumbles and cracks the 0.9200 figure post-Fed’s decision

USD/CHF tumbles and cracks the 0.9200 figure post-Fed’s decision

- USD/CHF dived to its daily lows of 0.9147 after the Fed decided to raise rates.

- Powell Q&A: Fed officials are not expecting to cut rates in 2023, as it’s not their baseline scenario.

- US central bank policymakers foresee rates to stay at around 5.10%.

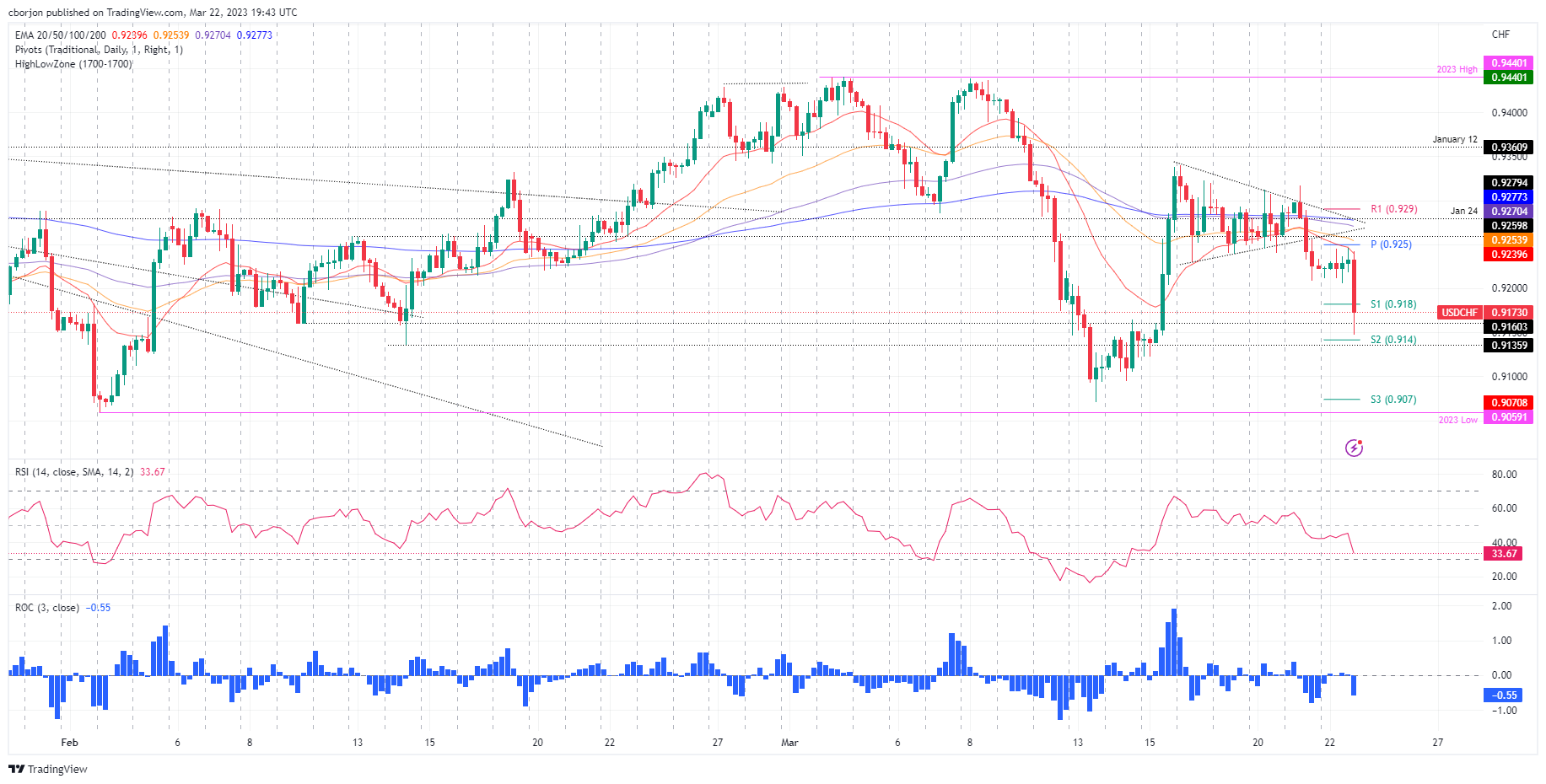

The USD/CHF stumbles to fresh 5-day lows beneath the 0.9200 figure as the Federal Reserve Chair Jerome Powell speaks. In addition, the US central bank decided to raise rates by 25 basis points on Wednesday, leaving the Federal Funds Rates (FFR) at 4.75% - 5.00%. At the time of writing, the USD/CHF is trading volatile, at around the 0.9170s – 0.9200 area.

Fed’s monetary policy statement and Powell’s remarks

The Federal Reserve announced on Wednesday that it has decided to increase interest rates by 25 basis points. The policymakers highlighted that inflation is currently high, and the labor market is experiencing a shortage of workers. Additionally, they recognized the banking crisis and said, “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”

Regarding monetary policy forward guidance, the Summary of Economic Projections (SEP) revealed the dot plot, which showed that policymakers expect rates to finish at around 5.10% in 2023. Regarding the balance sheet reduction, also known as Quantitative Tightening (QT), would remain unchanged, as planned in May of 2022.

Meanwhile, the US Federal Reserve Chair Jerome Powell began his Q&A. According to the Fed Chair, Fed officials are not anticipating a reduction in interest rates in the current year, as it is not their primary prediction. He also mentioned a disinflation trend and that the upcoming monetary policy decisions will be made, meeting by meeting. Powell recently stated that if there is a need to increase interest rates, the Federal Reserve will take action.

USD/CHF Price action

The USD/CHF resumed its downward trajectory and printed a new daily/weekly low at 0.9147, shy of testing the S2 daily pivot at 0.9141. The USD/CHF bounced off that level and is testing the S1 daily pivot at 0.9183. Once that resistance is cleared, the USD/CHF might regain the 0.9200 mark, opening the door to the daily pivot point at 0.9250.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.