- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold price uptrend limited ahead of crucial US PCE inflation

Gold price uptrend limited ahead of crucial US PCE inflation

- Gold price uptrend continues despite shrinking volatility.

- US PCE inflation data on Friday has huge market implications.

- Federal Reserve future rate hike bets are shaping precious metal markets.

Gold price (XAU/USD) continues to trade within a solid uptrend, even in a calmer week in the financial markets. Things could get lively again on Friday as the market gets ready for the biggest data release of the week, the United States Personal Consumption Expenditures (PCE) inflation numbers, scheduled to be released at 12:30 GMT.

US PCE inflation numbers are crucial for Gold investors

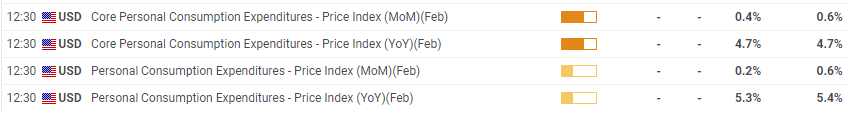

US PCE data is the Federal Reserve’s preferred gauge of inflation, and the markets will scrutinize the numbers deeply to start figuring out the chances of another Fed interest rate hike in the next FOMC meeting on May 3. Market expectations for the March numbers are at 4.7% for the yearly core PCE measure, and 0.4% for the monthly change. Any relevant discrepancy from these figures will certainly have an impact on the financial market landscape.

US PCE inflation data consensus and previous numbers (source: FXStreet Economic Calendar)

Such development is crucial for Gold investors, as the bright metal moves the opposite direction to interest rates, which are highly correlated with US Treasury bond yields and the US Dollar. When yields and the Greenback are higher, that diminishes Gold value, as precious metals are yield-less and are priced in US Dollars.

Matías Salord, Senior Analyst at FXStreet, explains how a lower-than-expected PCE release could benefit Gold bulls, by damaging the US Dollar and US T-bond yields:

On the contrary, if the Core PCE eases, it would be great news for the Fed, but not for the Dollar. Signs that inflation continued to slowdown would alleviate the pressure for the Fed to do more. US bond yields could resume the slide and the US Dollar print fresh monthly lows.

Is Gold price capped despite recent rally?

Gold price uptrend has slowed down in the past days, but bulls still keep the edge, with the bright metal comfortably trading above $1,970 at the time of writing.

ANZ Bank strategists have analyzed the current Gold trend, and believe the bright metal is capped as they do expect the Federal Reserve to still hike interest rates one or two more times this year:

“Gold is well supported by US recession fears, easing inflationary pressure and more dovish monetary policy. Nevertheless, the upside looks limited in the near term amid easing banking risks and further Fed rate hikes.”

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.