- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD succumbs as market players buy US Dollars on weekly, quarter, and monthly-end flows

GBP/USD succumbs as market players buy US Dollars on weekly, quarter, and monthly-end flows

- Fed’s favorite inflation gauge signals that cumulative tightening continues to curb inflation.

- University of Michigan’s Consumer Sentiment was worse than expected, though inflation expectations cooled.

- GBP/USD Price Analysis: Above 1.2400 could challenge the YTD high; otherwise, it would remain sideways, at around 1.2300-1.2400.

The Pound Sterling (GBP) traded with decent losses in the mid-North American session, pressured by a resurgence of the US Dollar (USD), trimming its Thursday’s losses. Although inflation data could spur a pivot in the US Federal Reserve (Fed) policy stance, market participants buy the US Dollar as the weekly, monthly, and quarter-end looms. At the time of writing, the GBP/USD is trading at 1.2331.

US inflation edged lower, though Fed officials remain resilient in fighting inflation

US economic data from the Department of Commerce revealed that the Fed’s favorite inflation gauge, the core PCE rose 4.6% YoY, beneath forecasts and a prior’s month reading of 4.7%. Headline inflation was 5%, beneath January’s 5.3%, signaling that the cumulative tightening by the Fed continues to temper inflation.

The Fed Boston President Susan Collins welcomed the news but reiterated that the Fed has work to do. The New York Fed President, John Williams, will cross newswires later.

On other data, the University of Michigan (UoM) showed that Consumer Sentiment on its final March reading was 62, worse than expected. At the same time, inflation expectations dropped. For the one-year horizon, the estimated inflation rate is 3.6%, while for the 5-year horizon, consumers estimate inflation to be 2.9%.

After the US inflation data release, the GBP/USD hovered around 1.2400 before collapsing beneath the central pivot point at 1.2357 and extending its losses towards the 1.2340 area. However, an upward correction was capped at the former, and the GBP/USD resumed its downward trajectory, eyeing a test of the S1 pivot at 1.2320.

On the UK front, the economy expanded by 0.1% in Q4 2022, and by 0.6% YoY, according to data from the Office for National Statistics (ONS).

GBP/USD Technical analysis

From a daily chart perspective, the GBP/USD would remain trading sideways after diving below 1.2400. However, the GBP/USD could consolidate in the 1.2300-1.2400 area before extending its recovery past the 1.2423 YTD high. That would pave the way towards 1.2500, with upside risks at a May 27 high of 1.2666. Otherwise, if the GBP/USD prints a close at around 1.2300, that could form a bearish engulfing candle pattern, setting the major for a pullback toward the 20-day Moving Average (MA) at 1.2213.

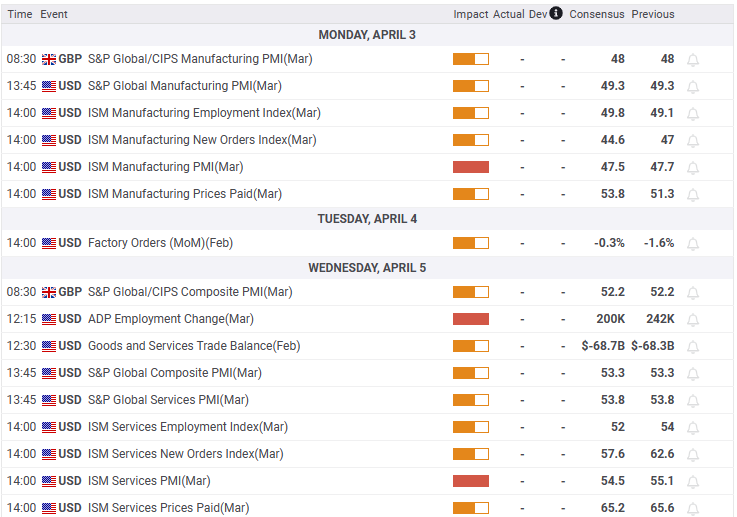

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.