- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD accelerates gains and retargets 1.1000 post-US CPI

EUR/USD accelerates gains and retargets 1.1000 post-US CPI

- EUR/USD hits new monthly peaks near 1.0990 on Wednesday.

- US inflation figures surprised to the downside in March.

- The FOMC Minutes will take centre stage later in the NA session.

EUR/USD gathers extra steam and approaches the psychological 1.1000 barrier on Wednesday.

EUR/USD remains bid ahead of FOMC Minutes

EUR/USD extends the weekly recovery and records new monthly highs near 1.0990 after the greenback lost the composure following lower-than-expected US inflation figures for the month of March.

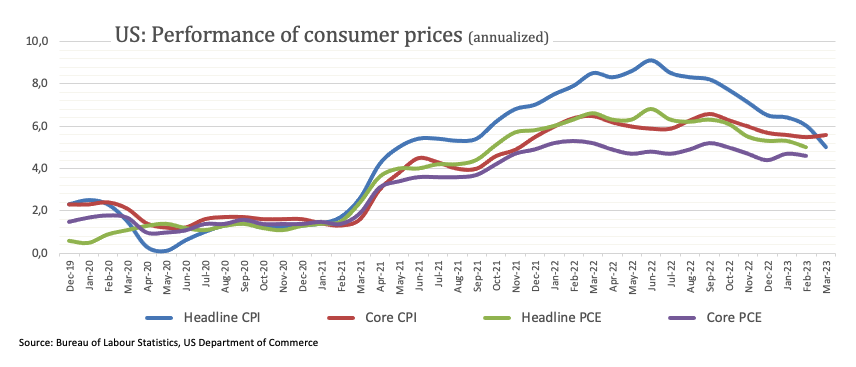

Indeed, US inflation gauged by the CPI rose 5.0% in the year to March, while probed to be sticky when it comes to the Core CPI, which matched previous estimates and edged a tad higher to 5.6% over the last twelve months.

Following the release of the US CPI, the probability of a 25 bps rate hike by the Fed in May decreased to around 63% (nearly 72%) along with the U-turn in US yields across the curve.

Later in the NA session, the Fed will release its Minutes of the March gathering.

What to look for around EUR

EUR/USD advances to the vicinity of the 1.1000 hurdle in response to the renewed weakness in the buck following the below-consensus US CPI print.

In the meantime, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Final Inflation Rate, EMU Industrial Production (Thursday).

Eminent issues on the back boiler: Continuation, or not, of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.60% at 1.0975 and a break above 1.0989 (monthly high April 4) would target 1.1032 (2023 high February 2) en route to 1.1100 (round level). On the flip side, the next support comes at 1.0788 (monthly low April 3) followed by 1.0747 (55-day SMA) and finally 1.0712 (low March 24).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.