- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bears prowl near psychological $2,000 level

Gold Price Forecast: XAU/USD bears prowl near psychological $2,000 level

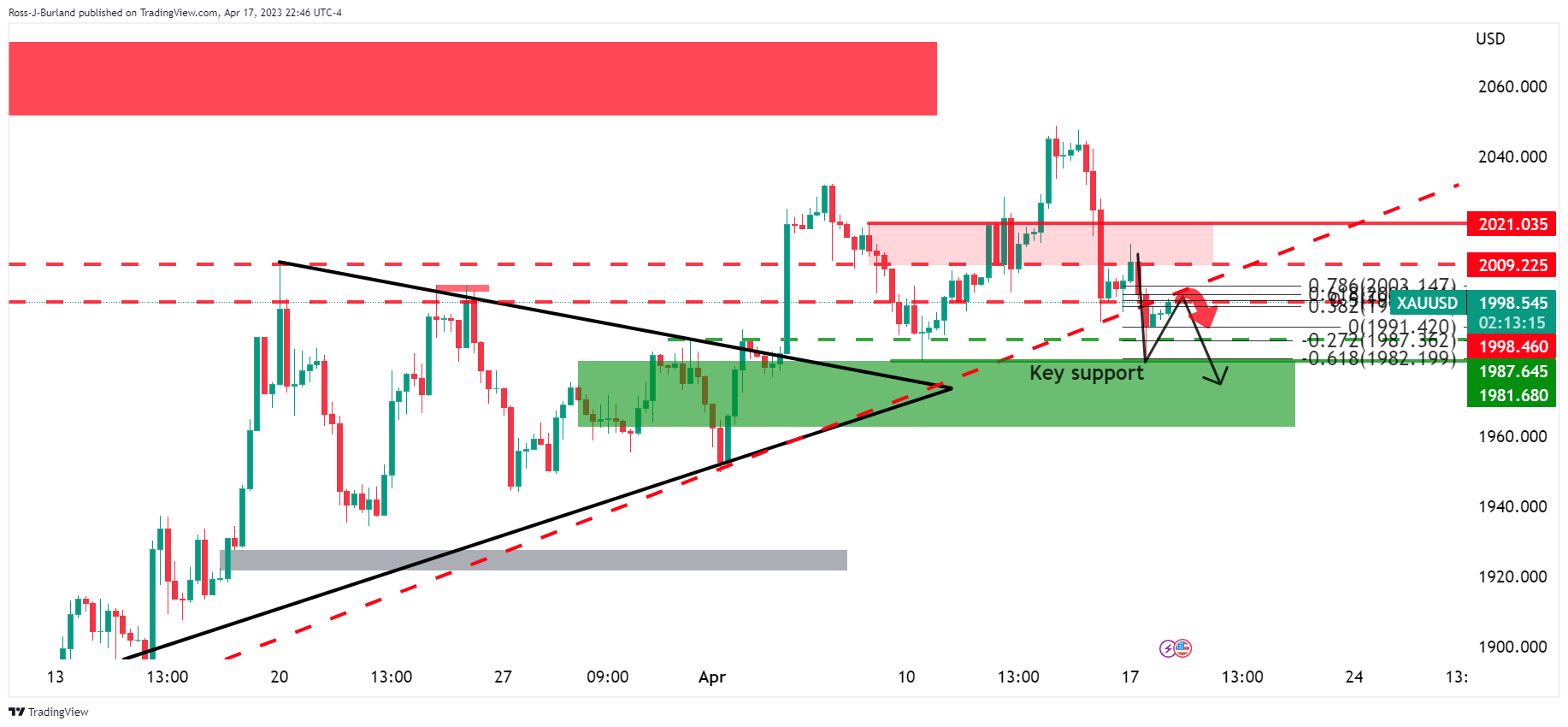

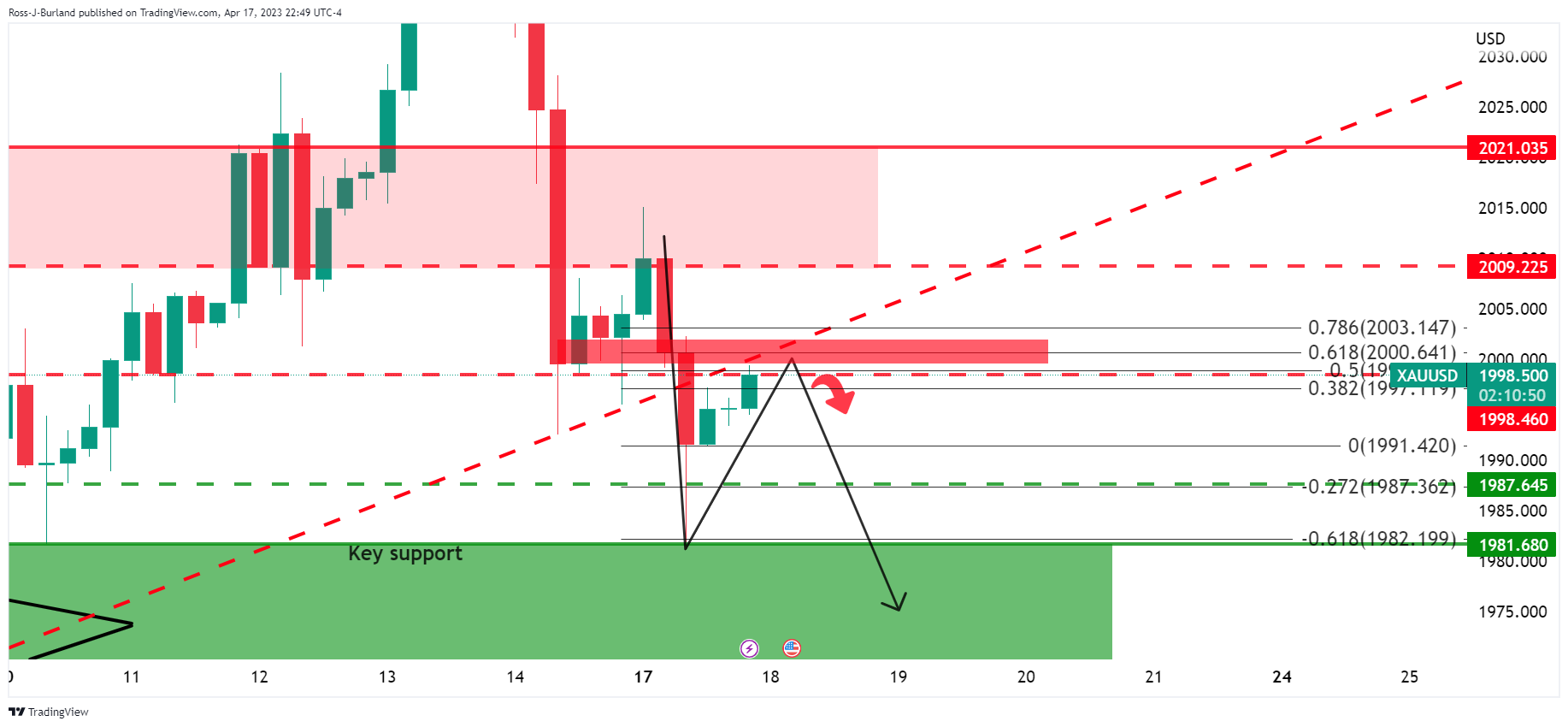

- Gold price is probing the $2,000 near a 61.8% Fibonacci retracement.

- Gold price bears are on the prowl at key resistance.

Gold price remains in the key support area in Asia with the bulls probing the bearish commitments at the psychological $2,000/oz level. XAU/USD has moved up from a low of $1,993.41 to score a high of $1,999.41 so far.

The theme driving the markets on a low calendar week stays with the sentiment surrounding the Federal Reserve and questions over whether the central bank is on the brink of pausing or not. On Friday, the US Dollar was boosted by hawkish rhetoric from Federal Reserve´s Governor Christopher Waller. The top central banker said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up.

There were some bullish components in the latest US Retail Sales and Consumer spending for the past quarter was solid also. The April survey of business activity in New York State was rising for the first time in five months also. ´´New orders jumped by a record 46.8pts in the month to 25.1, a one-year high. The shipments gauge also surged more than 37pts. Prices received rose 0.8 to 23.7pts indicating mild inflationary pressure. Delivery times and the average workweek both increased,´´ analysts at ANZ Bank explained.

The combination of hawkish rhetoric and the recent data is making greenback-bullion less attractive for overseas buyers, while benchmark Treasury yields climbed to a more than two-week high. Fed funds futures are showing that the expectations that the Fed will start cutting rates later this year have been pushed back to November from September, with a smaller cut now anticipated also.

Looking ahead, investors will focus on US flash PMIs for April and any further comments from Fed officials before they enter into a blackout period from April 22 ahead of the Fed's May 2-3 meeting. In this regard, analysts at TD Securities said the S&P PMIs for early April will offer a first comprehensive look at the state of the US economy post-banking turmoil. ´´Note that the March data was not clearly impacted by banking jitters, but perhaps it was too soon to be reflected: both the mfg and services PMIs registered their third consecutive increase then, with the latter advancing further into expansion territory.´´

Gold technical analysis

Despite the bid, technically, the bears are in the market while below the trendline support that is currently acting as a counter-trendline:

There is a bullish correction in the making but bears are lurking at this juncture, guarding $2,000 near a 61.8% Fibonacci retracement of the prior 4-hour bearish sell-off.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.