- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD Price Analysis: Retreats towards 1.3300 with eyes on Canada inflation, BoC’s Macklem

USD/CAD Price Analysis: Retreats towards 1.3300 with eyes on Canada inflation, BoC’s Macklem

- USD/CAD renews intraday low as it fades bounce off five-month-old support line, snaps two-day recovery.

- Canada CPI, BoC Governor Tiff Macklem’s speech appear crucial for Loonie pair traders.

- Failures to cross 200-DMA, descending resistance line from late March challenge USD/CAD bulls.

- Downbeat oscillators keep Loonie bears hopeful of breaking multi-month-old support trend line.

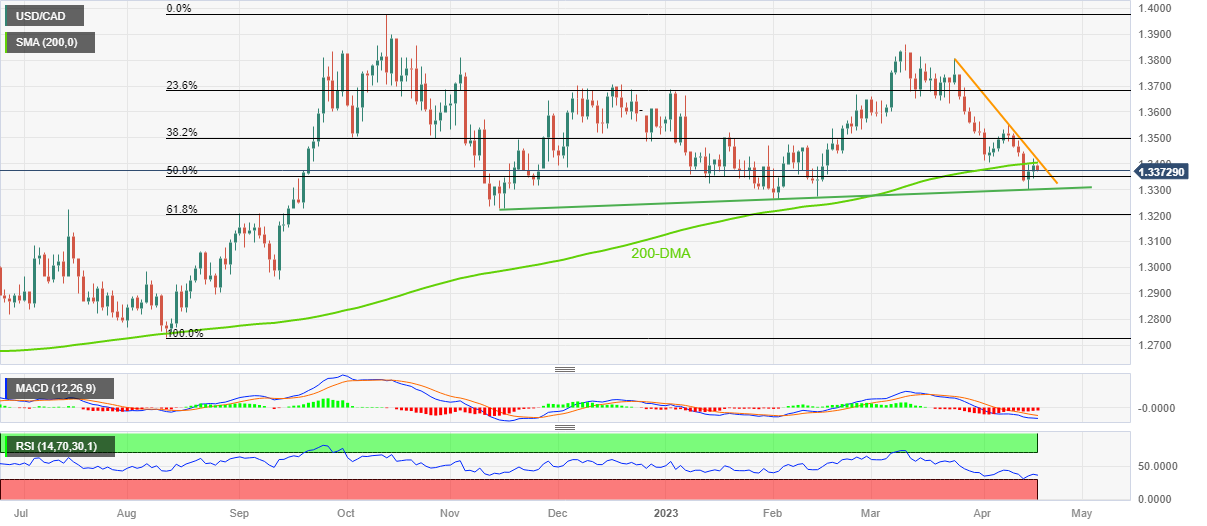

USD/CAD holds lower grounds near the intraday bottom of 1.3375 heading into Tuesday’s European session. In doing so, the Loonie pair reverses from the 200-DMA, as well as a three-week-old resistance line while printing the first daily loss in three.

Not only the failures to cross the key DMA hurdle and the trend line but bearish MACD signals and the RSI’s (14) failure to recover also keeps USD/CAD sellers hopeful ahead of key Canada Consumer Price Index (CPI) data and a speech from the Bank of Canada (BoC) Governor Tiff Macklem.

Also read: USD/CAD Analysis: Struggles to find acceptance above 200 DMA, focus shifts to Canadian CPI

As a result, the USD/CAD pair is well set to break the immediate support, namely the 50% Fibonacci retracement of its August-October 2022 upside, near 1.3350.

Following that, an upward-sloping support line from late November 2022, close to the 1.3300 round figure, will be crucial to watch for the USD/CAD bears as a clear downside break of the same won’t hesitate to refresh the 2023 low, currently around 1.3225.

In that case, the 61.8% Fibonacci retracement level of near 1.3200 will be in focus.

On the contrary, the 200-DMA and aforementioned resistance line from late March, respectively near 1.3405 and 1.3415, guard short-term USD/CAD rebound.

Should the Loonie pair remains firmer past 1.3415, the monthly high of around 1.3455 can act as the last defense of the USD/CAD bears.

USD/CAD: Daily chart

Trend: Further downside expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.