- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD 50% mean reversion resistance eyed

Gold Price Forecast: XAU/USD 50% mean reversion resistance eyed

- Gold price bulls are in the market and there is a scope for a move higher to $2,000.

- If Gold price bears commit, then we could see a 50% mean reversion area hold the fort around $1,992 and a subsequent sell-off from there.

Gold price is robust on Monday as the US Dollar and US Treasury bonds yields fell. Precious metals on Monday recovered from early losses and posted moderate gains. A drop in the US Dollar index printed a 1-week low due to a larger-than-expected increase in the German Apr IFO business climate index and hawkish comments Monday from European Central Bank Governing Council member Pierre Wunsch set off a rally in EUR/USD.

The German Apr IFO business climate index rose +0.4 to a 14-month high of 93.6, stronger than expectations of 93.4. Wunsch said we are "not seeing" inflation going in the right direction yet, and the ECB will only agree to halt interest rate increases once wage growth starts to fall. "We are waiting for wage growth and core inflation to go down, along with headline inflation, before we can arrive at the point where we can pause," the official said.

Meanwhile, the weaker dollar, making the precious metal more affordable for international buyers, offered support. DXY, an index that measures the currency vs. a basket of others was down 0.37/ and fell from a high of 101.9090 to a low of 101.330. Bond yields, bullish for gold since it offers no interest were lower with the US two-year note was paying as low as 4.097% on the day.

Gold technical analysis

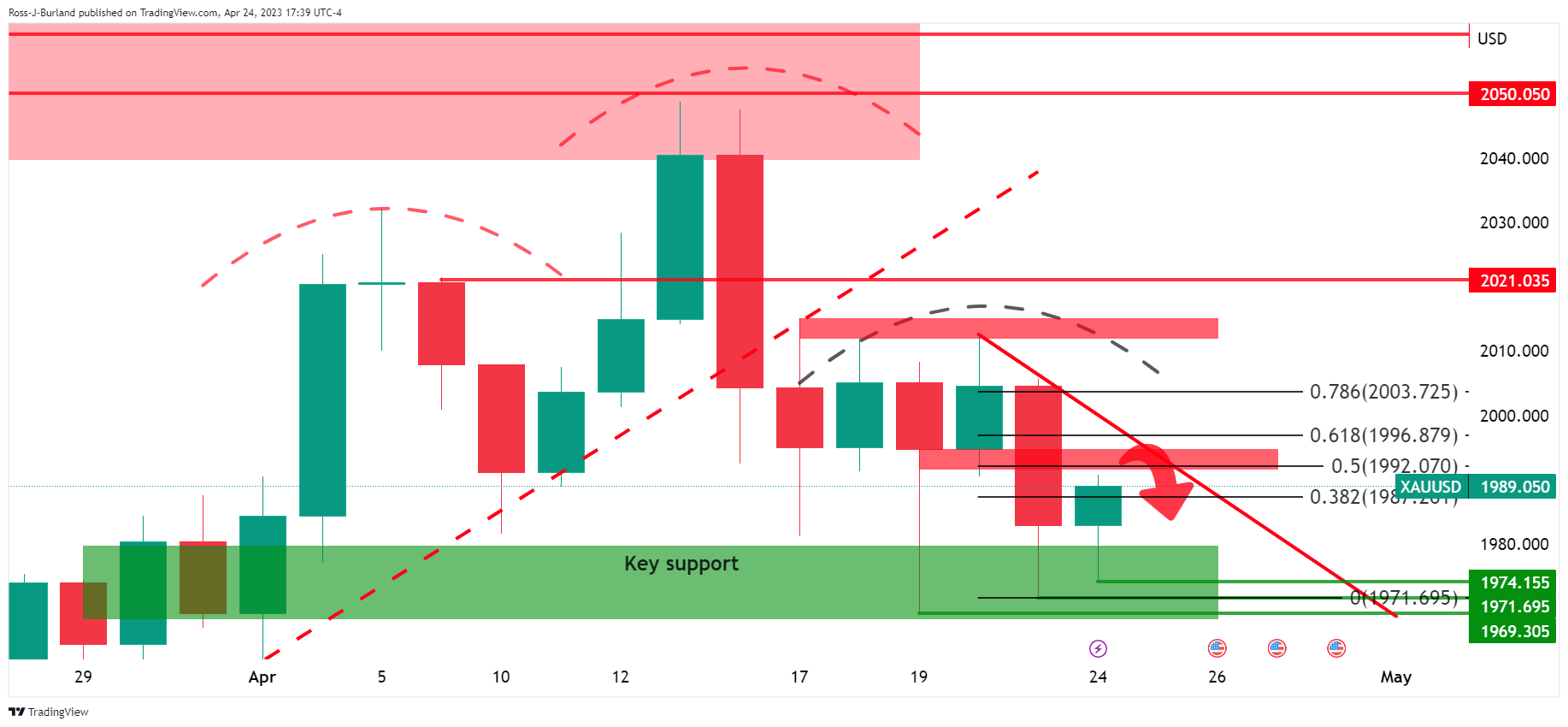

That is a daily head and shoulders, a topping pattern forming at the end of the bullish cycle.

Zoomed in, we can see how things could play out.

While below the Fibonacci scale´s 78.6%, the bias is bearish, especially while being on the front side of the trendline resistance.

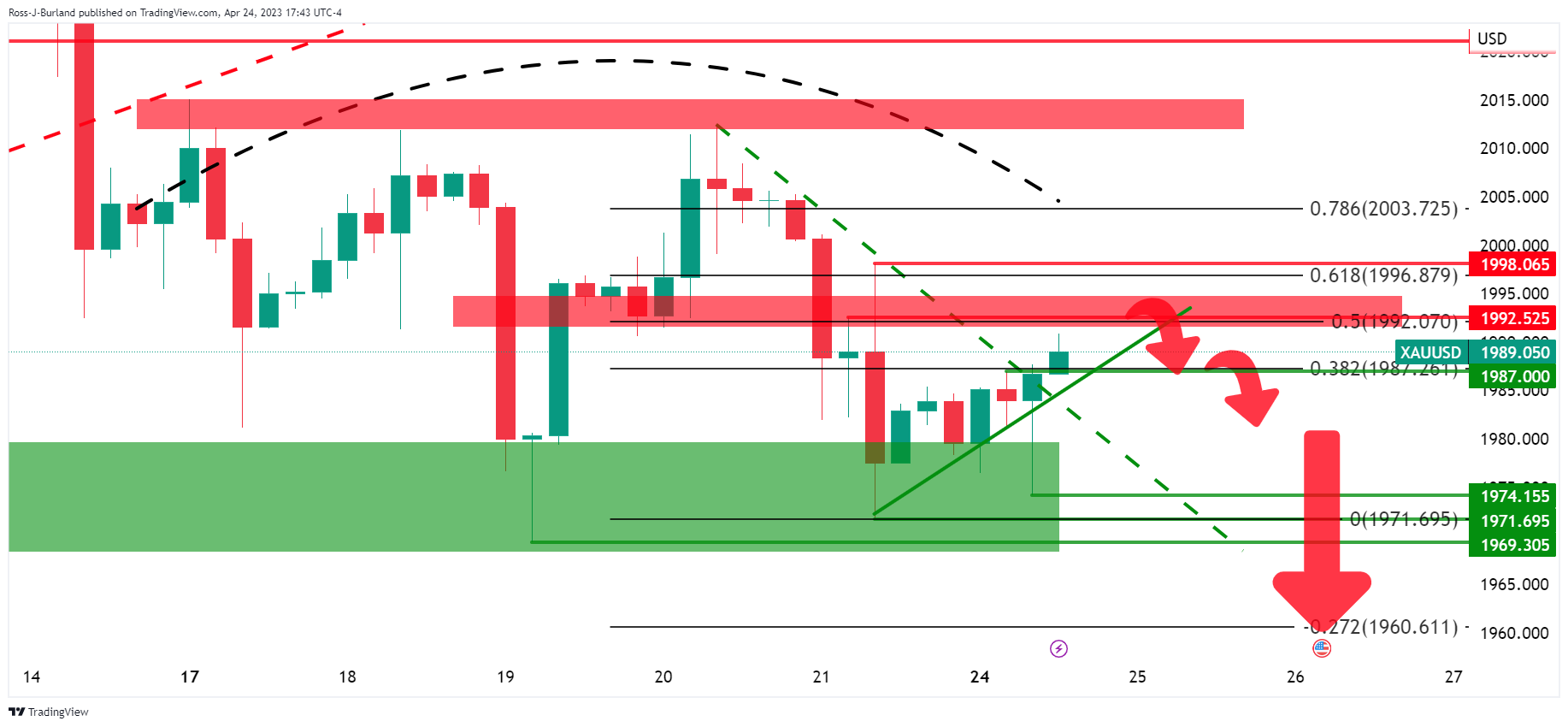

A deeper look into the right-hand shoulder, on the 4-hour time frame, we can see that the price has broken the micro trendline resistance that would now be expected to act as a counter-trendline. This leaves scope for as move higher into the bearish impulse to target towards $2,000. However, if bears commit, then we could see a 50% mean reversion area hold the fort around $1,992 and a subsequent sell-off from there.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.