- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD bulls flush out shorts to test 1.25s

GBP/USD bulls flush out shorts to test 1.25s

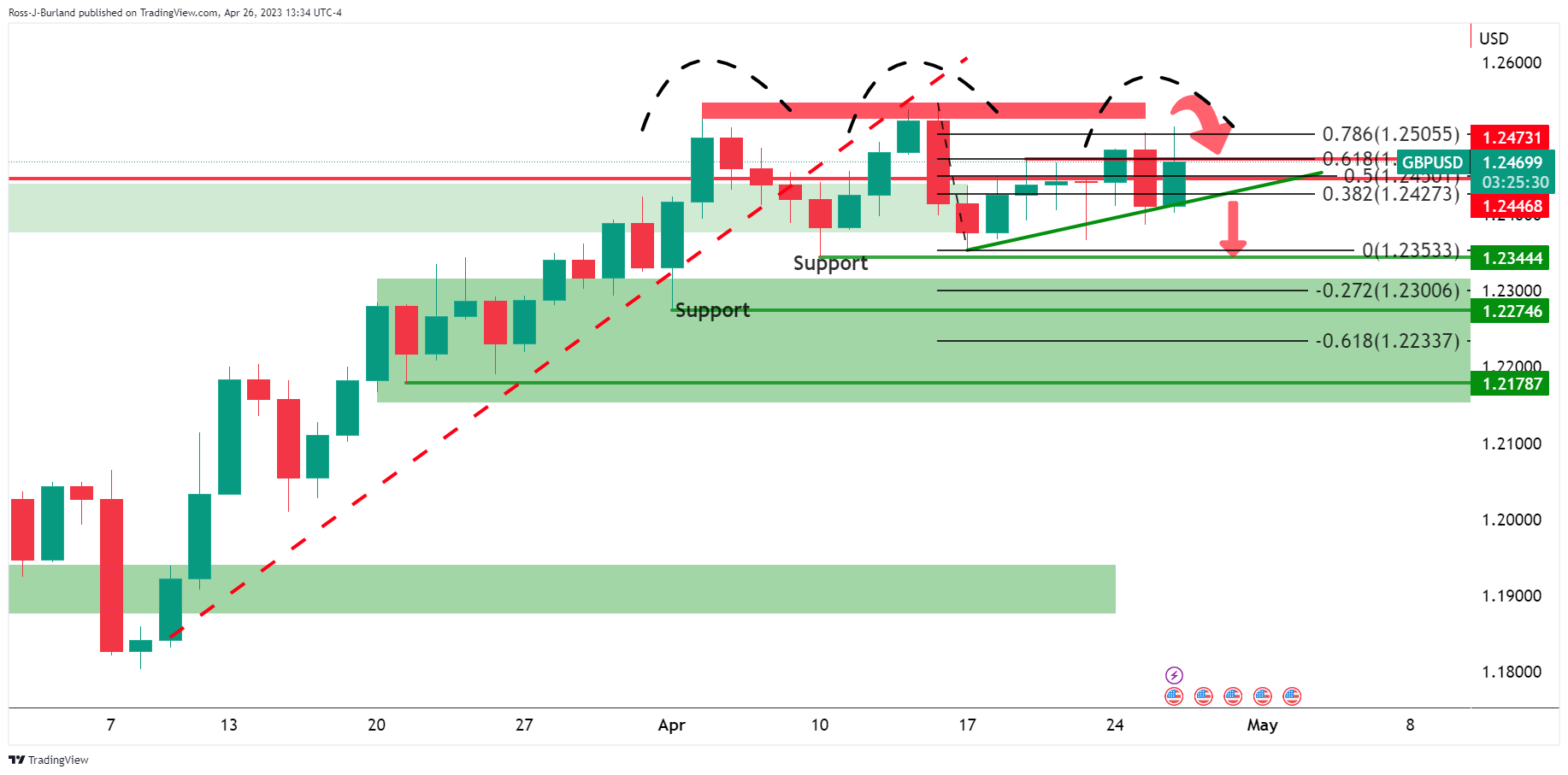

- GBP/USD bulls move into fresh daily highs testing bearish commitments in the 1.25s.

- A break of trendline support is eyed for the days ahead.

GBP/USD rallied on Wednesday to a fresh high of 1.2515 on further signs of a US economic slowdown that has dented the US Dollar. Data this week has not been favorable for the Greenback and today´s orders for core capital goods slipping more than expected in March has weighed on the currency further.

The US Dollar index, DXY, which measures the currency against six major rivals, dropped to a low of 101.013 as new orders for key U.S.-manufactured capital goods fell more than expected last month. Shipments also fell suggesting that business spending on equipment was likely a drag on economic growth while investors await the Gross Domestic Product numbers. All in all, driving the US Dollar versus other major currencies has been early signs of a US slowdown and decelerating inflation.

Meanwhile and domestically, investors are pricing in rate hikes from the Bank of England that will push up Bank Rate to around 4.9% by September from 4.25% currently. Last week´s strong wage and Consumer Price Index data have shown that underlying inflation pressures are more persistent than previously expected. the CPI data in fact revealed Britain's inflation rate remained above the 10% mark for a seventh straight month in March.

For that, analysts at TD Securities said that they expect a final 25bps hike in June, bringing the BoE's terminal rate to 4.75% (was 4.50%). ´´Strong inflation data continues to weigh on GBP rates. We believe the hawkish price action supports entering longs in GBP on a cross-market basis.´´

However, the more recent data have painted a mixed picture of the country's economy. Data from the ONS showed that Retail Sales fell more than expected in March amid the rising cost of living and poor weather conditions. The latest Markit PMI survey suggested that Britain's Gross Domestic Product grew the most in a year in April.

GBP/USD technical analysis

The rally in GBP/USD has moved into the prior day´s shorts and has squeezed positions above yesterday´s highs. This could be a signal that the market is preparing to finally head lower as per the head and shoulders. However, a close above 1.2505 and then 1.2537, April 23 highs, will leave the bias in the hands of the bulls.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.