- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- S&P 500 bears in control following break of structure amid banking sector woes

S&P 500 bears in control following break of structure amid banking sector woes

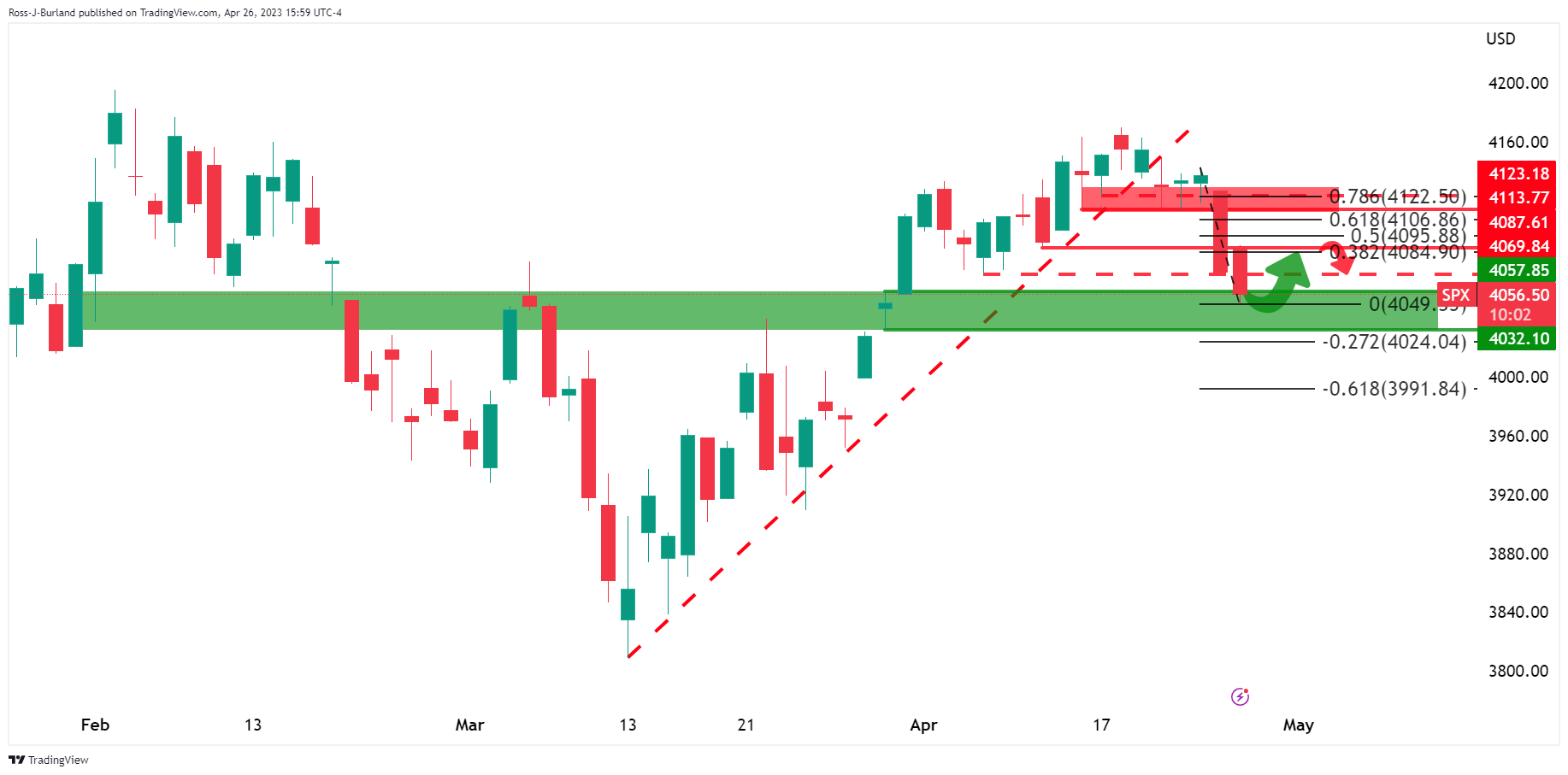

- S&P 500 index is moving into what could be a support area after breaking the structure of 4,069.

- The market will remain biased to the downside while below the 78.6% Fibonacci level and on the backside of the prior bullish trendline.

the S&P 500 dropped again on Wednesday and took out structure on the daily chart at 4,069 to print a low of 4,049.35 so far at the time of writing. The market remains offered towards the close and bears have been motivated by bank stocks which remained under pressure.

´´Support from tech stocks following Q1 earnings from Google’s parent Alphabet Inc. and Microsoft Corp. beating expectations was offset by a further 20% fall in First Republic Bank,´´ analysts at ANZ Bank explained.

First Republic Bank's shares sank more than 20%, hitting a fresh record low for the second day in a row, on a report that the US government was unwilling to engineer its rescue, after the lender reported plunging deposits earlier this week.

Analysts at ANZ bank explained that ´´the latest survey of US community banks showed that expectations of tighter regulation are now their biggest concern. If smaller banks in the US are to be regulated more tightly, that could precipitate a keener focus on bank asset quality, which amid high inflation and expected slower growth, could underpin more cautious lending behavior.´´

The analysts added that ´´it will take time to observe how behaviors are changing and the impact that can have on credit provision, but the ongoing concerns over the future of First Republic are continuing to unsettle risk.´´

Still, analysts are expecting a 3.2% contraction in first-quarter profit for S&P 500 companies compared with expectations for a 3.9% decline just a day ago, Reuters reported.

´´Of the 163 S&P 500 companies that reported first-quarter profit through Wednesday, 79.8% topped analysts' expectations, as per Refinitiv IBES data. In a typical quarter, 66% of companies beat estimates.´´

Meanwhile, the Federal Reserve's monetary policy decision on May 3 is coming up and traders will be on the lookout for clues on policymakers' next steps regarding interest rates. Traders have priced in a 79% chance of the U.S. central bank hiking rates by 25 basis points next week, as per CMEGroup's Fedwatch tool.

Elsewhere, ´´the US House of Representatives could vote as early as Wednesday on a bill that sharply cuts spending for a decade in exchange for a short-term hike in the debt ceiling, though it was unclear if it had enough support in the Republican majority to pass,´´ Reuters reported.

S&P 500 technical analysis

The daily chart shows the index moving into what could be a support area after breaking the structure of 4,069. A move back to 4,080s could be on the cards but the market will remain biased to the downside while below the 78.6% Fibonacci level and on the backside of the prior bullish trendline.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.