- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bears lurking in the right hand shoulder

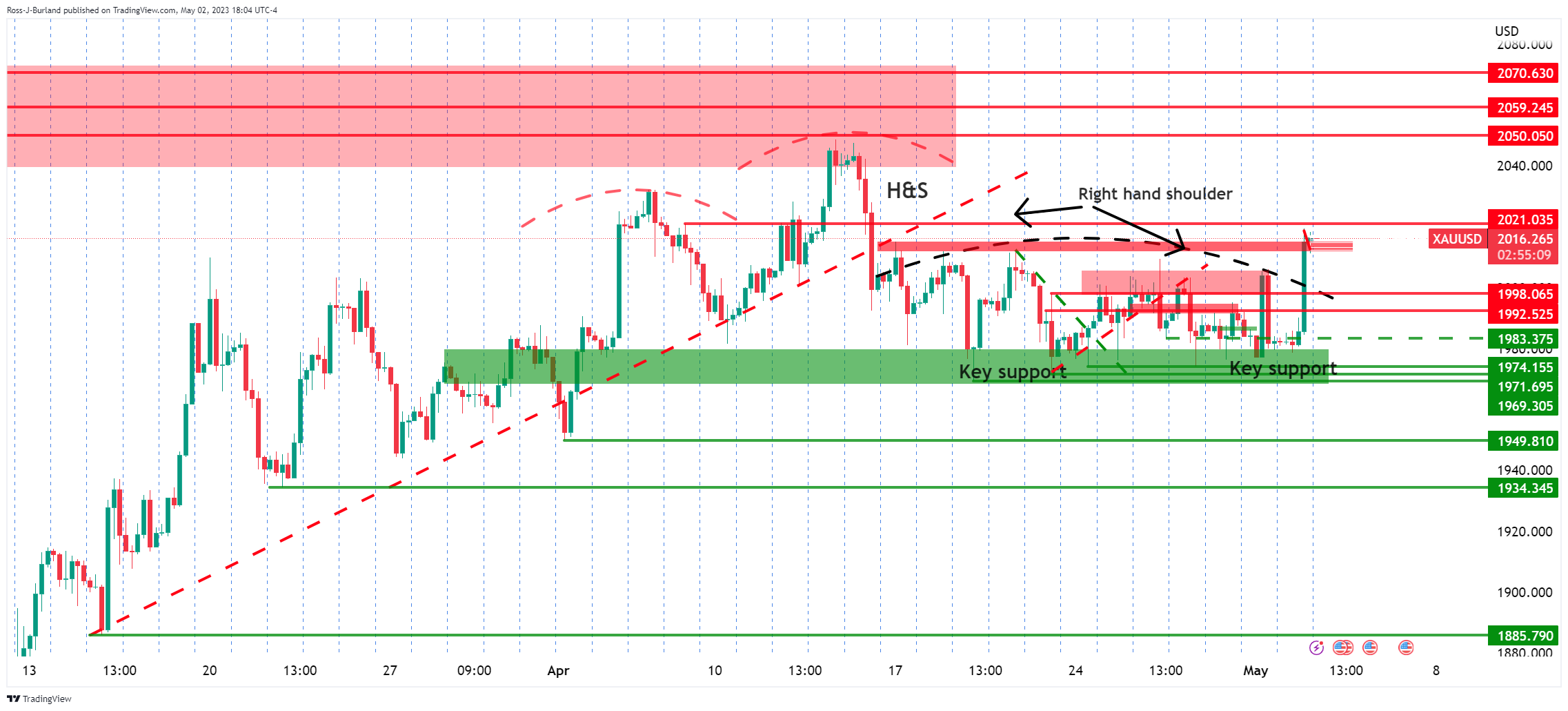

Gold Price Forecast: XAU/USD bears lurking in the right hand shoulder

- Gold price rallies into a key resistance area.

- Gold price bears on the look-out for a break lower around the Fed.

Gold price has rallied on the day in a parabolic move ahead of the Federal Reserve using the JOLTS disappointment as the trigger. The yellow metal jumped through the prior channel resistance and rallied from a low of $1,978 to a high of $2,019.

´´Job openings in the US eased to 9.590m in March, down from 9.974m in February. Job openings are now at their lowest level in two years. Demand for labour is continuing to soften, indicating the aggressive tightening is rates is starting to curb demand for workers,´´ analysts at ANZ Bank explained.

In other date, the analysts explained that ´´factory orders in the US increased by 0.9% m/m in March, following a downward revision of the February data to -1.1% MoM. However, orders excluding transportation were down 0.7% m/m indicating there is still some weakness in the manufacturing sector.´´

The weaker US Dollar on Tuesday was positive for the yellow metal while the decline in global bond yields Tuesday was also bullish. Gold has come one of the go-to places in the banking system worries and concerns over the U.S. government heading towards default without an extension of the debt ceiling.

Meanwhile, the focus will be on the Federal Reserve. Analysts at TD Securities are expecting a 25 bp hike ´´and anticipate that post-meeting communication will: (i) emphasize that disinflation has been evolving slower than expected, leaving open the possibility of additional tightening, and (ii) acknowledge the more uncertain economic environment, especially with regard to credit conditions post SVB collapse,´´ the analysts said.

Gold technical analysis

While the move into resistance was sharp, there are still prospects of a downside move below key support and this may only be part of the schematic of the right-hand shoulder still. It all comes down to the Fed and Nonfarm Payrolls.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.