- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD attempting to correct from US session lows

AUD/USD attempting to correct from US session lows

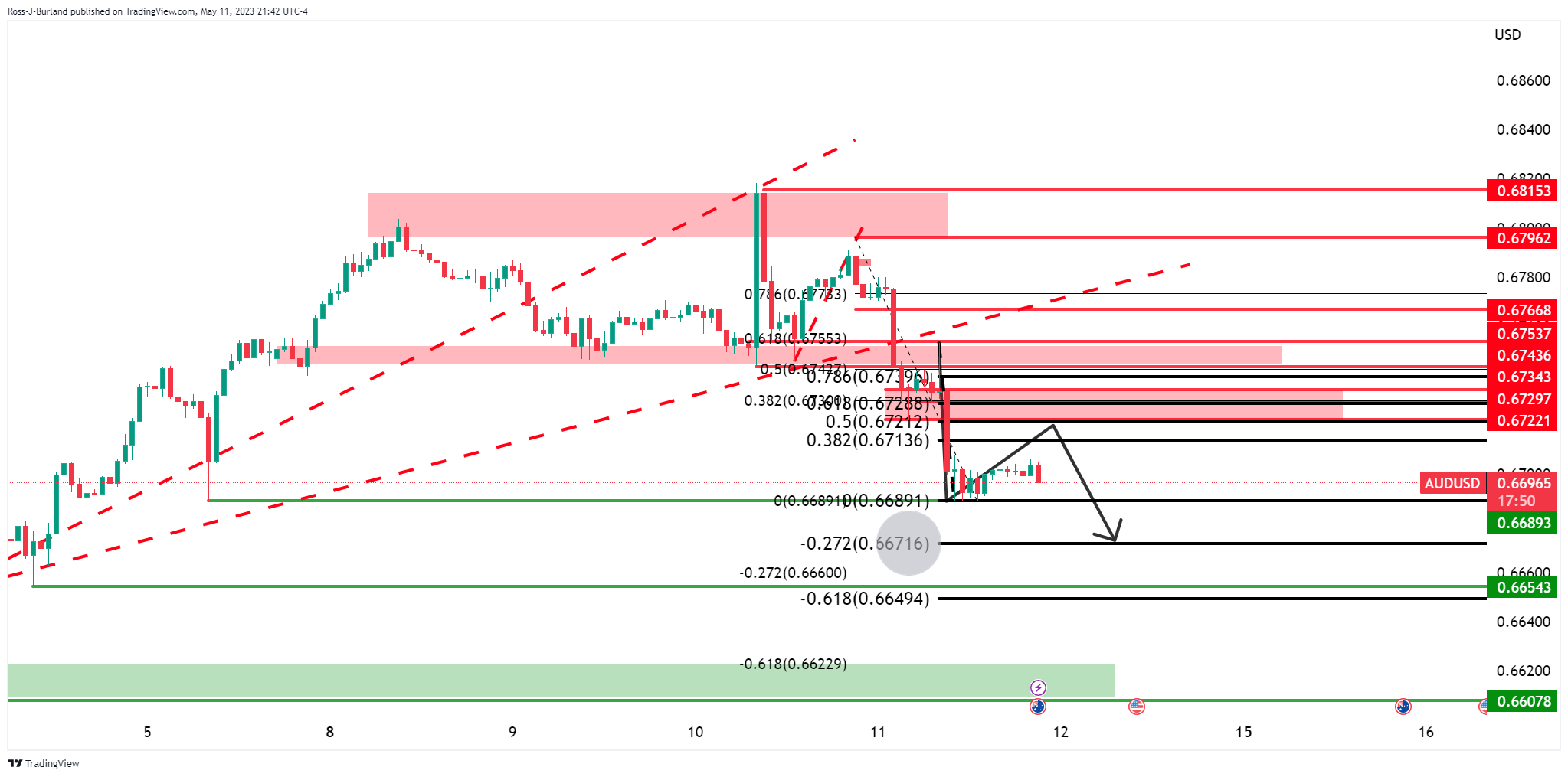

- AUD/USD has started to correct but is slowing in Asia.

- AUD/USD bulls stepped in at US session lows, a steeper correction is eyed toward a 50% mean reversion.

AUD/USD is flat at around 0.6700 in Tokyo, correcting from the US session lows. In the US data, prices are rising, but more slowly than expected. The PPI data for April increased 0.2% MoM with annual growth now at 2.3% YoY. Petrol prices in the US lifted more slowly than expected, while food prices actually fell. Core prices are now up 3.4% YoY. ´´The data indicates ongoing price pressures in core services,´´ analysts at ANZ Bank explained.

Elsewhere, the number of Americans filing new claims for unemployment benefits leaped to a 1-1/2-year high last week, and producer prices rebounded modestly in April. US Weekly Initial Unemployment Claims Rose +22,000 to 264,000, showing a weaker labor market than expectations of 245,000.

Domestically, the analysts at ANZ Bank explained that the Western Australian budget estimates a AUD4.2bn surplus in 2022-23, the same as the federal budget.

´´This is AUD 1.8bn larger than was expected in the Mid-Year Financial Projections Statement, published in December 2022. The state treasury forecasts a smaller net operating surplus of AUD3.3bn in 2023-24, AUD1bn lower than in the mid-year update,´´ the analysts explained, adding, ´´the smaller surplus reflects the increase in expenses to provide cost-of-living support and additional investment in front-line service delivery in the health, education and disability services sectors.´´

AUD/USD technical analysis

- AUD/USD Price Analysis: Bulls move in at key support, 0.6720s eyed

A drive into the hourly resistance could equate to a downside continuation towards 0.6670 initially.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.