- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD bulls under pressure below 0.6250

NZD/USD bulls under pressure below 0.6250

- NZD/USD bulls were pressured following a fresh high in the daily chart´s correction.

- Uncertainty over the US debt ceiling and hawkish Fedspeak may fuel USD safe-haven demand.

NZD/USD is down by some 0.16% as the forex markets head towards a close on Tuesday. The pair traveled from a high of 0.6259 and made a low of 0.6223.

´´The Kiwi lost a little of yesterday’s shine and is down a touch as we get underway today, but moves have been orderly and contained, mostly reflecting a slight uptick in the USD DXY as bond yields rose, data and Fedspeak surprised to the up/hawkish side,´´ analysts at ANZ Bank explained.

The analysts also explained that 1) ´´local participants are starting to size up the Budget, with the bond markets nervous about bond supply and FX markets worried about how credit rating agencies will perceive the Budget, hoping for a tick, but fearing the opposite,´´and 2) ´´More bonds pose an upside risk to bond yields, but not in a “good” way, as it’s supply, not demand driven. But going the other way, uncertainty over the US debt ceiling and hawkish Fedspeak may fuel USD safe-haven demand and it seems reasonable to expect more volatility.´´

NZD/USD technical analysis

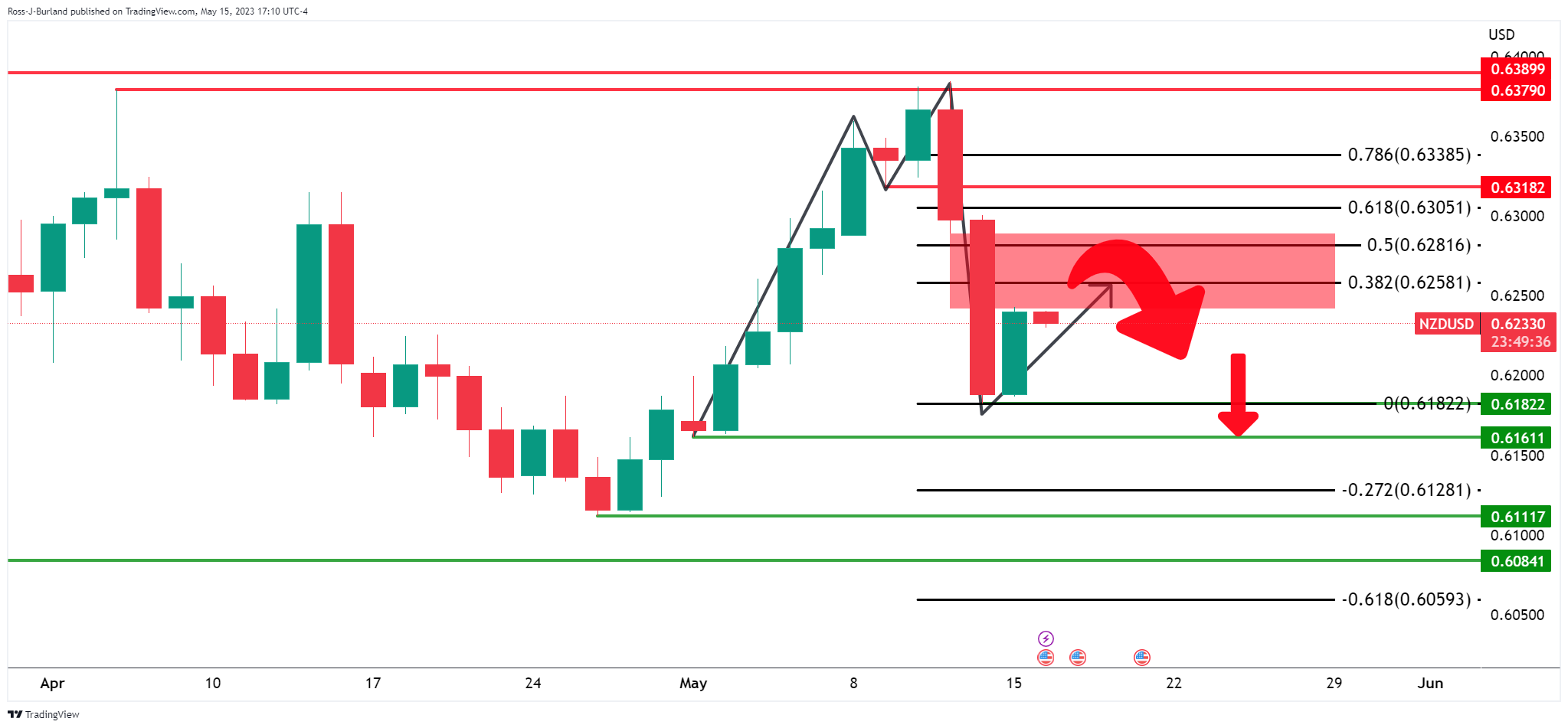

As per the prior day´s analysis, NZD/USD bulls in the market and eye a firm correction, the pair moved up into the 38.2% Fibonacci resistance:

Prior analysis:

Update:

There are prospects of a move lower although the 4-hour and 1-hour charts can be used to gauge as to whether there is going to be a deceleration in the bullish correction and so far, it is early days still.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.