- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD Price Analysis: Bears about to make a move at courageous bullish recovery

USD/CAD Price Analysis: Bears about to make a move at courageous bullish recovery

- USD/CAD bulls come up to meet resistance on the correction of the BoC induced sell-off.

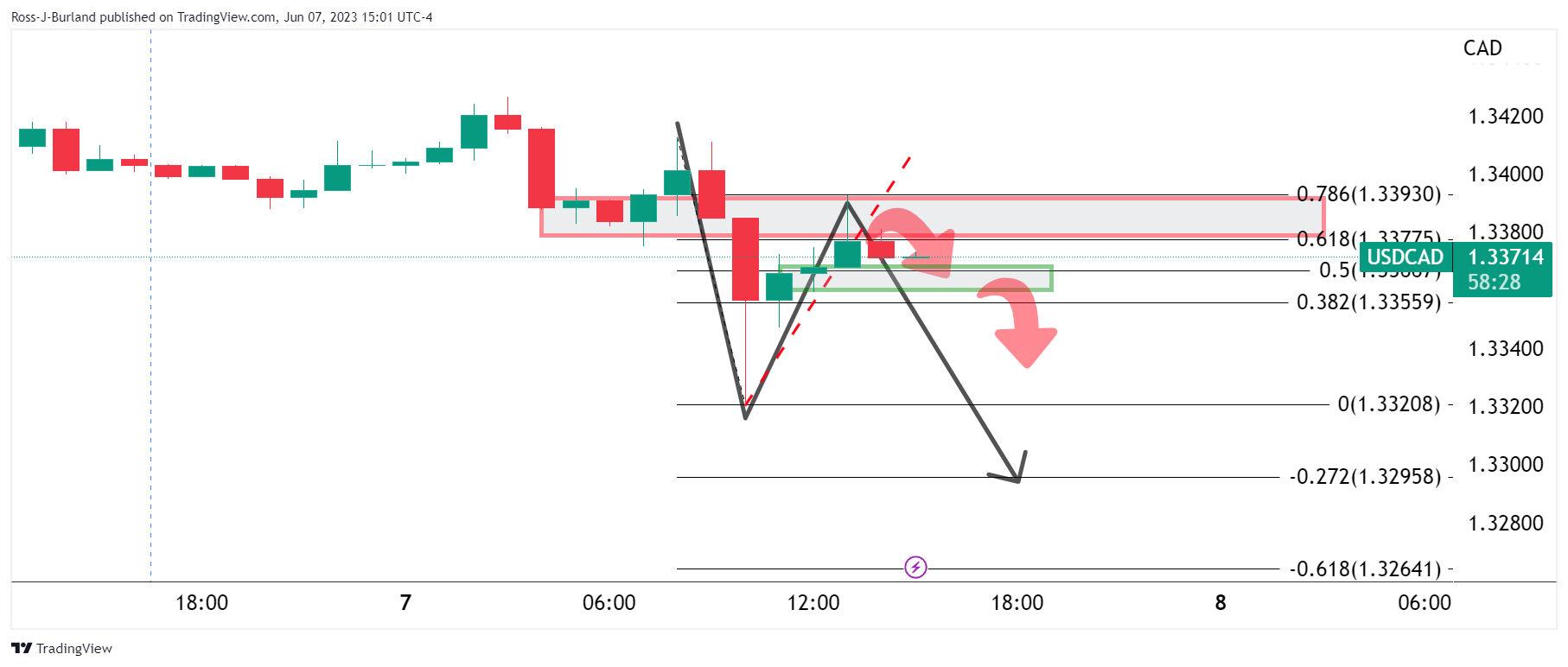

- USD/CAD bears eye a downside extension on a break of 15-minute support area between 1.3370 and 1.3360.

The Canadian Dollar popped to a four-week high vs. the Greenback on Wednesday after the Bank of Canada said it would continue to raise interest rates next month after it tightened for the first time since January. The BoC showed its hand to the market as it warned that inflation could get stuck significantly above its 2% target amid persistently strong economic growth.

This has flipped the script technically ahead of US Consumer Price Index and the Federal Reserve events next week, putting the bears in control again as the following technical analysis will illustrate:

USD/CAD daily chart

The bears are targeting the lows and we could see further selling coming in following this meanwhile correction. However, traders would be aware of the CPI and Fed events at the start of next week and thus we could see some derisking into the events that would likely see a deceleration of the bearish impulse as drawn above.

USD/CAD H1 and M15 charts

For the time being, however, it appears that the correction is decelerating at resistance and this could lead to further selling pressure in the sessions and days ahead before the week is out. A downside extension could be on the cards if the 15-minute support area between 1.3370 and 1.3360 gives way with sellers potentially encouraged to add below 1.3350.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.