- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY edges upward as US bond yields propel gains amid Fed-BoJ’s decisions

USD/JPY edges upward as US bond yields propel gains amid Fed-BoJ’s decisions

- USD/JPY experiences a modest gain of 0.22%, influenced by rising US Treasury bond yields.

- Despite signs of economic slowdown, upbeat US market sentiment sees the greenback recover, with DXY at 103.722.

- Japanese PPI figures undershoot estimates, increasing focus on upcoming US CPI and Japanese Balance of Trade data.

USD/JPY turned positive at the beginning of the week, lifted by higher US Treasury bond yields as investors prepared for the US Federal Reserve (Fed) monetary policy decision, followed by the Bank of Japan (BoJ). The USD/JPY is trading at 139.65, printing modest gains of 0.22% after hitting a daily low of 139.06.

Increased US Treasury yields bolster the USD/JPY

US equities portray an upbeat market sentiment, despite rising US bond yields. The 10-year benchmark note rate sits at 3.778%, up three and a half basis points (bps), a tailwind for the USD/JPY. The greenback is recovering lost ground, climbing 0.16%, per the US Dollar Index (DXY), at 103.722, shy of reclaiming the 104.000 figure.

Fundamentally speaking, an absent US economic docket keeps investors focused on the last week’s data. The Non-Manufacturing ISM, although at expansionary territory, dipped close to 50, suggesting an ongoing economic slowdown. That, alongside Initial Jobless Claims (IJC) rising above estimates, hitting its highest figures since October 2021, justified the Fed’s need to pause its tightening cycle and wait for upcoming data.

On the Japanese front, the latest data revealed the Producer Price Index (PPI) for May, climbed 5.1% YoY, below estimates of 5.6%, while month-over-month figures showed a plunge of -0.7%, compared to April’s 0.3% gain. Annual-based PPI hit its slowest since July 2021 after hitting 5.9% in April.

Upcoming events

On Tuesday, the US economic docket will feature May’s Consumer Price Index (CPI), the NFIB Business Optimism Index, followed by Wednesday’s Fed decision. On the Japanese front, the calendar will feature the Balance of Trade ahead of the Bank of Japan’s (BoJ) monetary policy meeting.

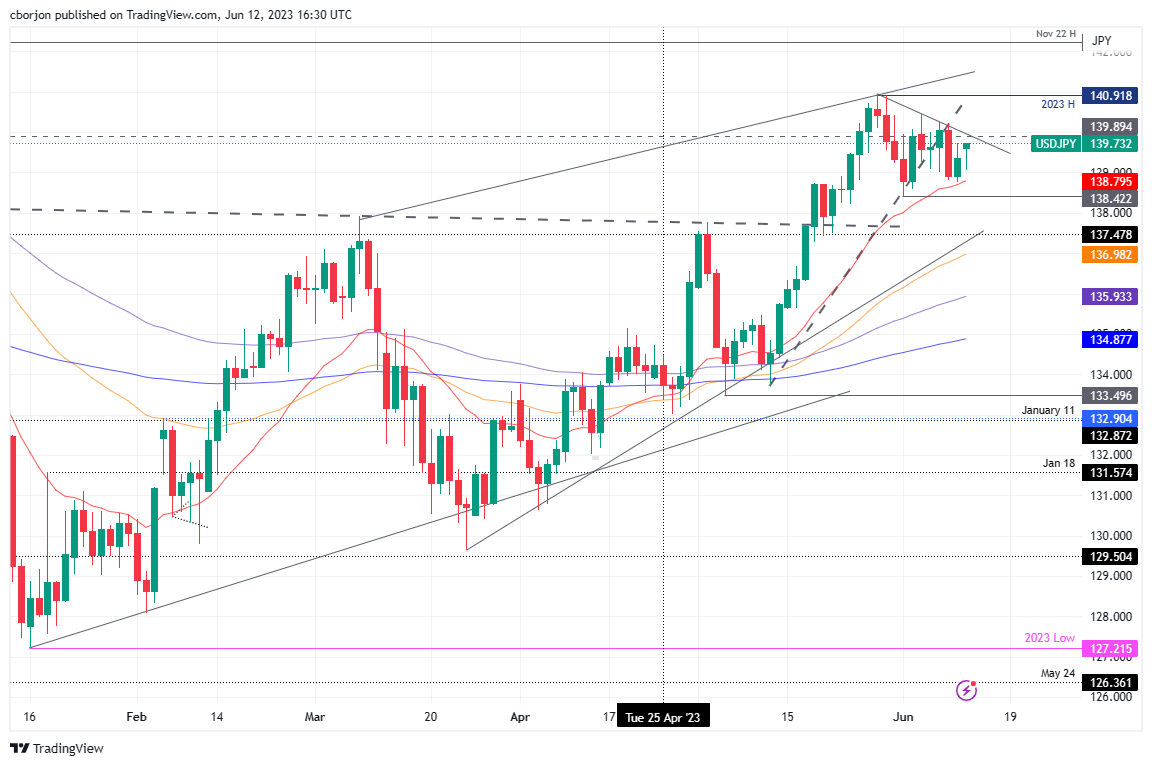

USD/JPY Price Analysis: Technical outlook

The USD/JPY is neutrally biased after failing to crack below/above the boundaries of a 200-pip range at around 138.40/140.45. However, from a medium-term view, with the daily Exponential Moving Averages (EMAs) positioned below the spot price, the pair is upward, but it needs to crack the top of the range, so the USD/JPY can test the year-to-date (YTD) high of 140.92. In the case of being broken, the USD/JPY next stop is 141.00, ahead of the November 22 high at 142.24. Conversely, a drop below the 20-day EMA at 138.79 will expose the bottom of the range at 138.40, ahead of 138.00.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.