- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD retraces from five-week high, amidst rising US bond yields, eyes key US-UK economic data releases

GBP/USD retraces from five-week high, amidst rising US bond yields, eyes key US-UK economic data releases

- GBP/USD dips after failing to breach 1.2600, now trading at 1.2497 amid climbing US Treasury bond yields.

- GBP/USD traders lean on last week’s US PMI, highlighting an ongoing economic slowdown.

- BoE’s rate hike hints echo amid inflation concerns as the market keenly awaits US CPI and UK employment figures.

GBP/USD slumps in the North American session after reaching a fresh five-week high at 1.2599 amidst a light economic calendar, which would gain interest since Tuesday. Rising US Treasury bond yields and some US Dollar (USD) strength keep the Sterling (GBP) under downward pressure following the GBP/USD failure to crack 1.2600. At the time of writing, the GBP/USD is trading at 1.2513.

Sterling struggles against strengthening USD and climbing US Treasury yields as the market awaits US and UK economic indicators.

Wall Street continues to trade in a positive direction. At the same time US Treasury bond yields climb, as the 10-year US T-note yields 3.774%, three basis points (bps) up from its opening yield. Consequently, the DXY is printing modest gains of 0.15% at 103.706.

Given the lack of economic data revealed on Monday, GBP/USD traders lean onto the last week’s US data. The ISM revealed its Services PMI, which expanded but is dangerously edging towards the 50 lines, seen as an expansionary/recessionary level, suggesting the economy continues to deteriorate. That, alongside the jump in unemployment claims for the week ending June 2, justified the US Federal Reserve (Fed) stance to pause rate increases.

Aside from this, a parade of Bank of England (BoE) policymakers crossed newswires, led by Jonathan Haskel, who said the BoE “may need to raise rates more than once, from the current 4.5% level to control inflation.

Echoing some of his comments, Catherine Mann said that inflation expectations remain high, but the latest drop was important to shift her stance from a 50 to a 25 bps hike in the latest meeting. She said service inflation and wage price increases are a concern “for achieving the 2% CPI target.” Mann added, “Monetary policy is not good at fine-tuning, should focus on inflation.”

Upcoming events

On Tuesday, the US economic docket will feature May’s Consumer Price Index (CPI), the NFIB Business Optimism Index, followed by Wednesday’s Fed decision. On the UK front, employment figures will be featured on Tuesday, ahead of growth figures on Wednesday.

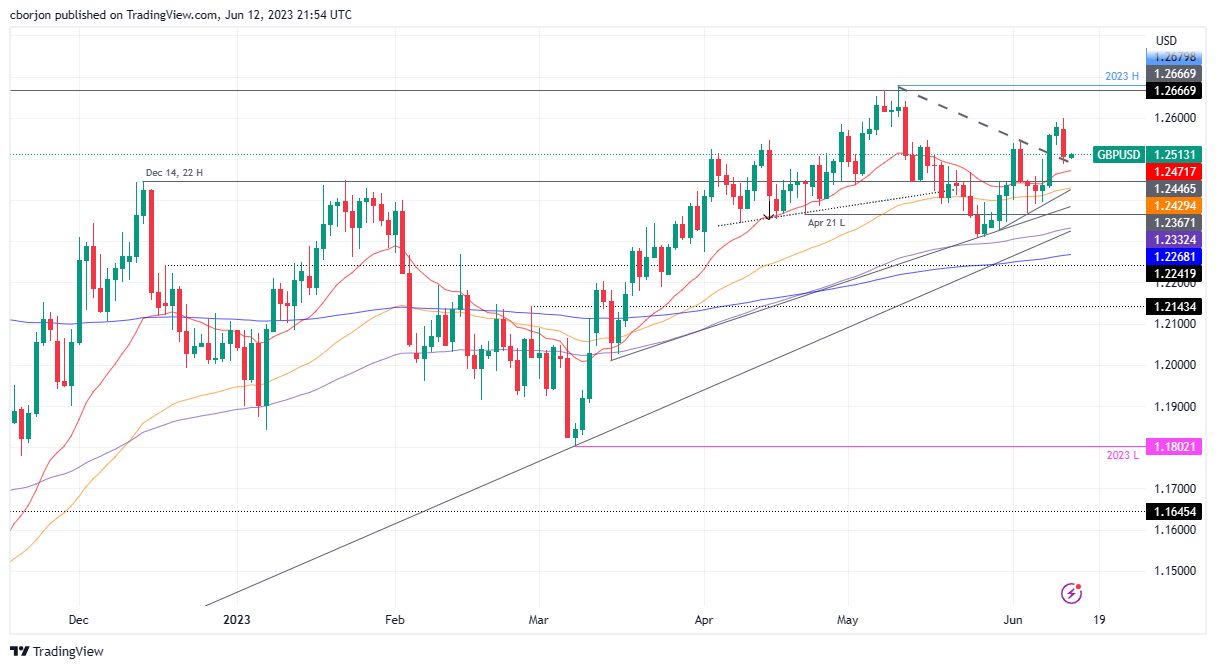

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD is upward biased, trending well above the Exponential Moving Averages (EMAs) on the daily chart. Still, the pullback could put at risk support at the 20-day EMA at 1.2466. If GBP/USD falls below 1.2500, that could put the latter in the sellers’ eyesight, followed by dynamic support at the 50-day EMA at 1.2426. A break below will expose the 1.2400 figure. Conversely, the GBP/USD first resistance would be the 1.2600 mark, followed by the year-to-date (YTD) high of 1.2680.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.