- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/JPY Price Analysis: Climbs for 6-straight days on risk-on mood, RBA’s last week’s hike

AUD/JPY Price Analysis: Climbs for 6-straight days on risk-on mood, RBA’s last week’s hike

- AUD/JPY nears weekly high at 94.22, gaining for the sixth consecutive day.

- The pair shows upward bias, but RSI and three-day RoC indicators suggest a potential retreat.

- Following support for AUD/JPY lies at a June 12 low of 93.84, followed by the 93.00 mark.

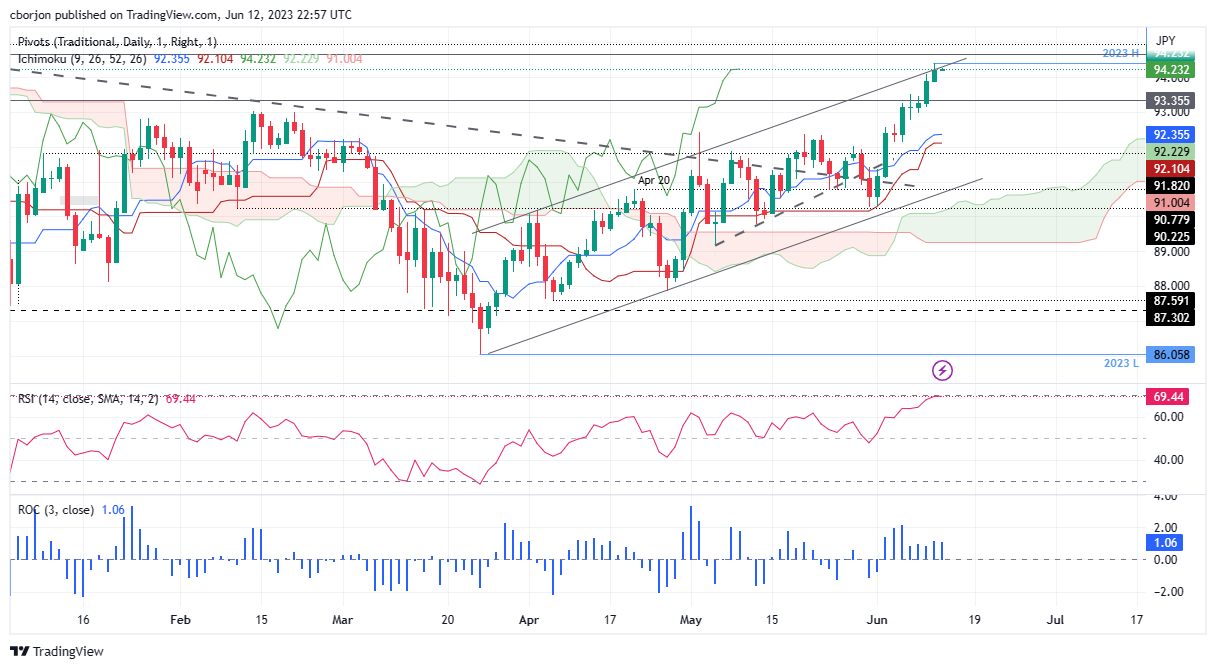

AUD/JPY stays on track toward its six straight days of gains as the Asian session begins. A risk-on impulse underpins the Australian Dollar (AUD), which is still gaining momentum after last week’s rate hike by the Reserve Bank of Australia (RBA). At the time of writing, the AUD/JPY trades at 94.22, nearby the weekly high of 94.41, with minuscule gains of 0.02%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart portrays the pair as upward biased, at the brisk of breaking the November 16 high at 94.65, which could open the door for further upside. That would clear the path toward a new year-to-date (YTD) high and propel the Aussie towards challenging resistance at around the 95.00 psychological price level.

Even though the Ichimoku cloud supports the uptrend thesis, the Relative Strength Index (RSI) indicator signals the pair is overbought, warranting a pullback is expected. Another factor suggests the pair could retrace the three-day Rate of Change (RoC), showing that buying pressure is easing.

If AUD/JPY drops below 94.00, the following support to be tested would be the June 12 low of 93.84. Once cleared, the AUD/JPY next stop would be December’s 13 high turned support at 93.35 before testing the psychological 93.00 mark.

AUD/JPY Price Action – Daily chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.