- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- WTI bears taking control and eye 4-hour support targets

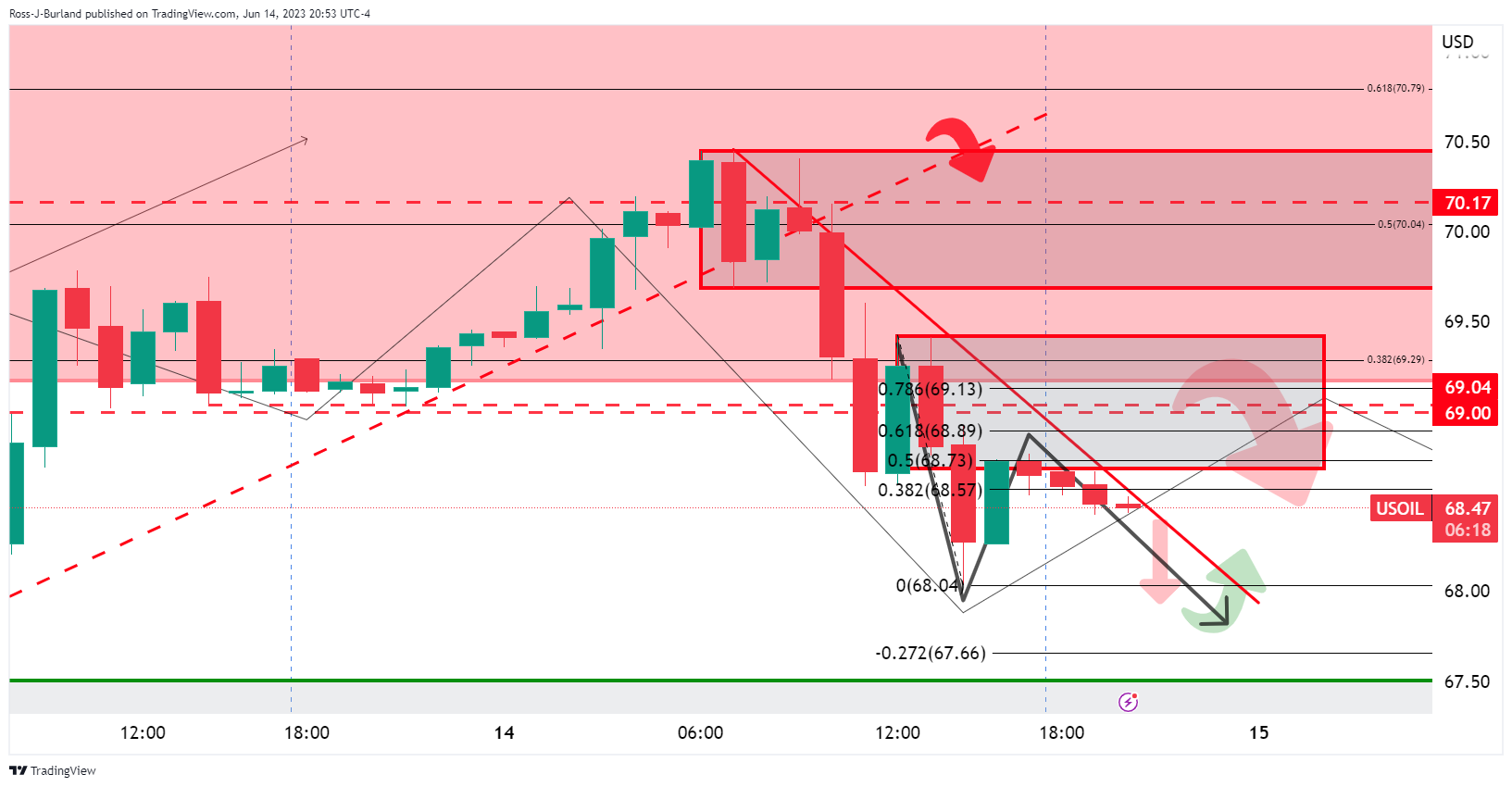

WTI bears taking control and eye 4-hour support targets

- WTI is on the offer following a series of impactful factors.

- WTI bears have eyes on $67.50/00 but there are prospects of a bullish correction.

West Texas Intermediate, WTI, is down some 0.2% in the Asian session and it has travelled between a low of $68.51 and $68.67 so far. Crude oil dropped on Wednesday, breaking key support structure on the downside as a pause in US interest rate hikes and along with an unexpected build in weekly EIA crude inventories.

Initially, Crude prices found support on the back of Chinese crude oil quotas. Bloomberg reported that the Chinese government gave refiners an allocation of 62.28 million tons, which took the total quota this year to around 194 million tons, +18% more than the same time last year.

However, in the early part of the US day, Wednesday's US May PPI report showed prices eased to +1.1% y/y from +2.3% YoY in Apr, better than expectations of +1.5% YoY and the smallest increase in over two years.

All in all, crude oil fell amid signs of weaker demand. Analysts at ANZ Bank explained that US crude oil stockpiles rose by 7.92kbbl last week, according to EIA data. ''This was exacerbated by inventories at the key storage hub of Cushing hitting its highest level since 2021. Gasoline and distillate stockpiles were also higher, rising 2,108kbbl and 2123kbbl respectively,'' the analysts explained.

''Earlier in the session sentiment was boosted by comments from the IEA that the oil market will tighten significantly in the near term as China’s consumption rebounds from the pandemic. This came after Beijing issued a large batch of crude import quotas, signalling stronger demand,'' the analysts explained further.

WTI technical analysis

- WTI Price Analysis: Bears make their moves during the Fed, break support structure

On the hourly chart, bears have eyes on $67.50/00 overall, but as the analysis above shows, there are prospects of a move to the upside also.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.