- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bears need a break of current daily lows

Gold Price Forecast: XAU/USD bears need a break of current daily lows

- Gold bears are licking their lips as p[rice is technically coiled and biased lower.

- A break of resistance opens risk of higher highs.

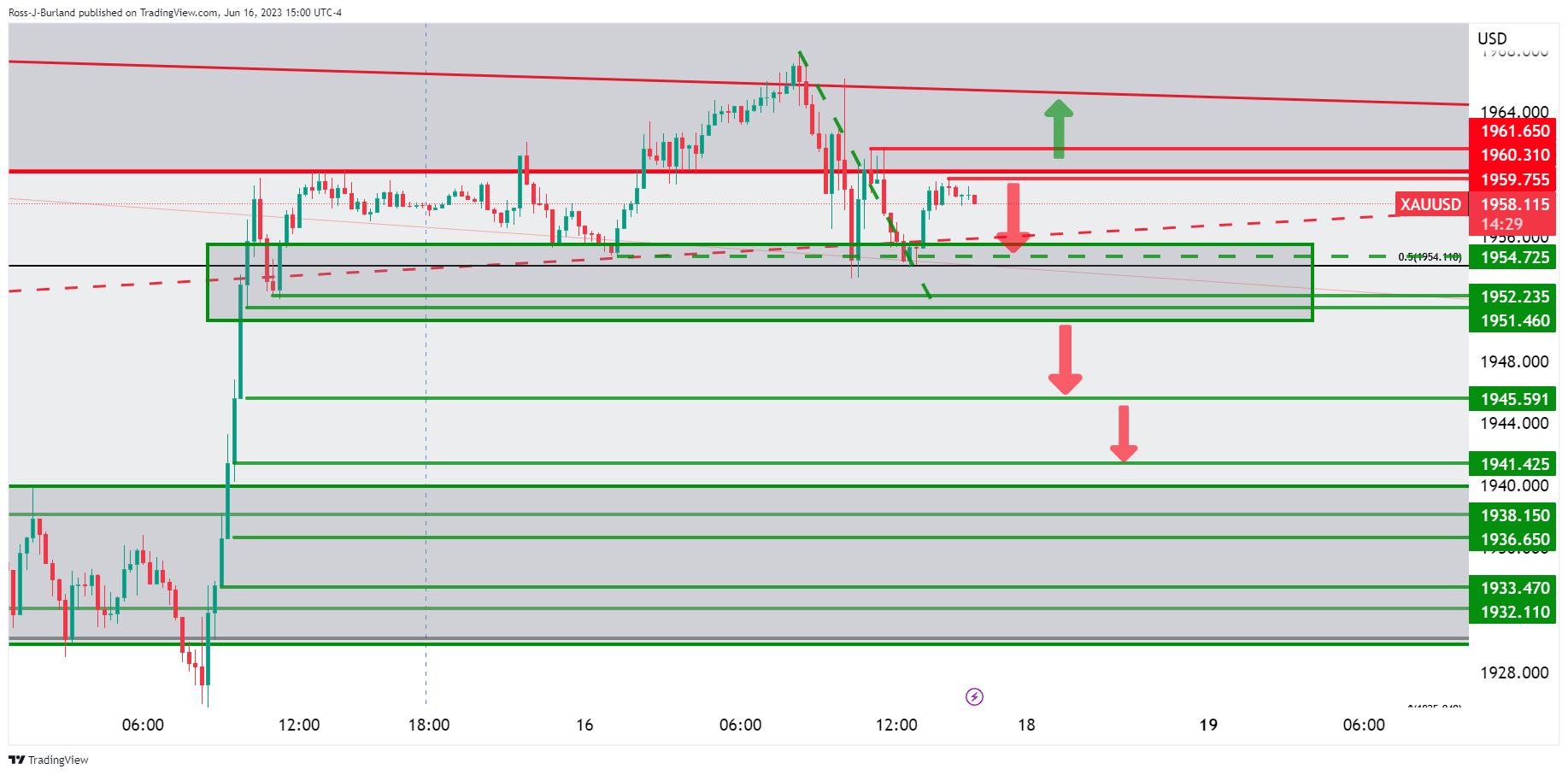

Gold dropped from a high of $1,967 on Friday's US session and cleaned up the prior session's length, creating a fresh low of the day down at $1,953.32.

The focus has been on the Federal Reserve which issued a hawkish outlook for interest rates on Wednesday even as it ended its two-day meeting without hiking rates. The Fed forecast 50 basis points of additional increases prior to year-end.

''It’s likely the Fed will need to see softening in the labour market to be confident that inflation is sustainably on its way down. Little guidance was offered for upcoming meetings, with Fed Chair Powell noting decisions will be made meeting to meeting. We continue to expect a 25bp hike in July,'' analysts at ANZ Bank argued.

Meanwhile, the dollar rose early following three losing sessions. Bond yields were also higher, with the US two-year note last seen paying 4.733%, up 8.2 basis points and the 10-year note up 4.9 basis points to 3.772%. DXY traded 0.13% higher form a low of 102.006 to a high of 102.427.

'' As trend signals improve, CTA trend followers have already begun adding to their length in silver, where current prices could spark a buying program totaling +6% of this cohort's max size. In gold markets, the bar for algo buying activity is also razor-thin. Prices need only break the $1980/oz mark to spark the first marginal buying program, and the risk for subsequent buying flows is elevated above the $2000/oz range,'' analysts at TD Securities argued.

Gold technical analysis

The 15min chart shows a number of levels to the downside to break while the daily offers a bearish bias while below trendline resistance and a break out of the channel:

With that being said, there will be prospects of a move higher if bulls stay committed and break trendline resistance.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.