- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD Index extends the rebound from lows near 102.00

USD Index extends the rebound from lows near 102.00

- The index adds to Thursday’s gains north of 102.00.

- US markets will be closed on the Monday.

- Investors started to assess the potential Fed’s move in July.

The USD Index (DXY) tracks the greenback, which starts the week on the positive foot and revisits the 102.40 region, marking an increase for the second session in a row so far.

USD Index looks at risk trends, Fed

The index rises for the second session in a row and attempts to put further distance from last week’s multi-week lows around the 102.00 neighbourhood (June 16), as the recent upbeat mood in the risk complex appears to take a breather at the beginning of the week.

In the meantime, investors continue to expect a 25 bps rate hike by the Federal Reserve at the July 26 gathering following June’s hawkish skip, according to CME Group’s FedWatch Tool.

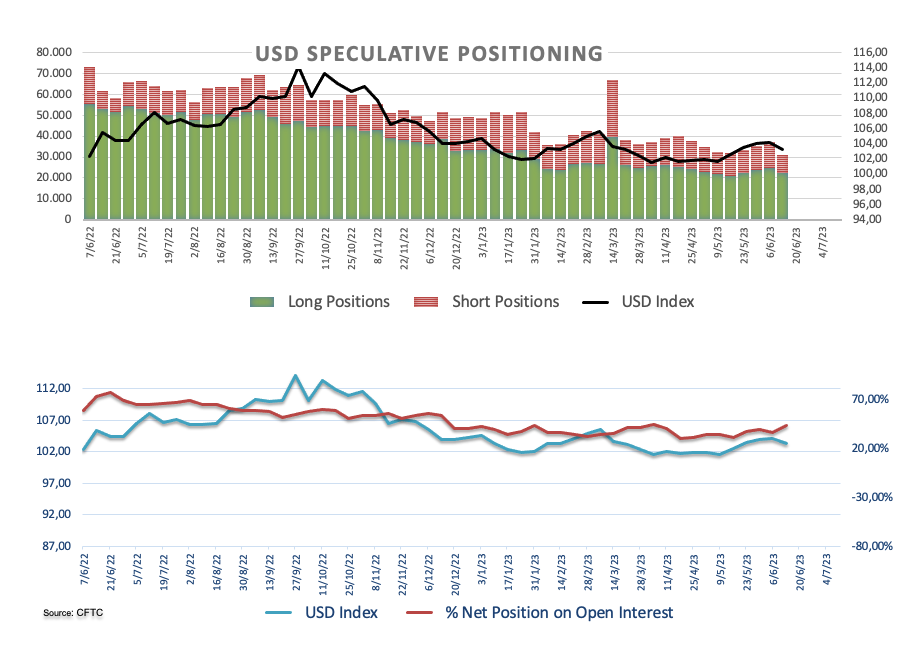

On another front, net longs in the greenback rose to the highest level since early April in the week ended on June 13, just ahead of the crucial FOMC event considering the latest CFTC report.

The only release of note in the US data space will be the NAHB Housing Market Index for the month of June amidst the inactivity in the domestic markets due to the Juneteenth holiday.

What to look for around USD

Despite a three-week negative streak, the index appears to have encountered significant contention around the 102.00 neighbourhood.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high, supported by the continued strength of key US fundamentals such as employment and prices.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: NAHB Housing Market Index (Monday) – Building Permits, Housing Starts (Tuesday) – MBA Mortgage Applications. Fed’s Powell Testimony (Wednesday) – Chicago Fed National Activity Index, Initial Jobless Claims, Fed’s Powell Testimony, Existing Home Sales (Thursday) – Advanced Manufacturing/Services PMIs (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.05% at 102.35 and the breakout of 103.04 (100-day SMA) would open the door to 104.69 (monthly high May 31) and then 105.25 (200-day SMA). On the downside, the next support emerges at 102.00 (monthly low June 16) followed by 100.78 (2023 low April 14) and finally 100.00 (round level).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.