- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY challenges weekly peaks past 23.60 on CBRT hike

USD/TRY challenges weekly peaks past 23.60 on CBRT hike

- USD/TRY resumes the upside north of 23.600.

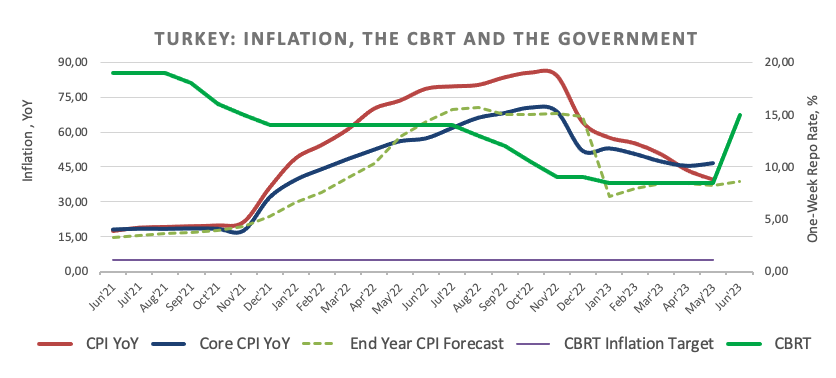

- The CBRT hiked rates for the first time since August 2021.

- The central bank raised rates by 650 bps to 15.00%.

The Turkish lira gives away part of the gains seen earlier in the week and lifts USD/TRY back to the area beyond the 23.6000 level on Thursday.

USD/TRY stronger post-CBRT

After two consecutive daily declines, the USD/TRY currency pair has rebounded and continued its upward trend past the 23.6000 level. This occurred despite investor disappointment following the Turkish central bank's decision to raise the One-Week Repo Rate by 650 basis points during its event on Thursday.

The central bank's move was intended to kick-start the monetary tightening process, establish a disinflation course, anchor inflation expectations, and control pricing behavior.

The CBRT reiterated its commitment to the 5% inflation target and did not rule out additional monetary tightening measures to achieve this target.

What to look for around TRY

USD/TRY now seems to have embarked on a consolidative phase in the upper end of the recent range.

In the meantime, investors are expected to closely monitor upcoming decisions on monetary policy. By appointing Mehmet Simsek and Hafize Gaye Erkan, both former Wall Street bankers, to oversee the country's finances, President R. T. Erdogan seems to suggest a possible move away from heavy state intervention in favor of letting the market dictate the fair value of the currency.

Although it remains uncertain whether Mr. Erdogan's preference for combating inflation through lower interest rates will allow Simsek and Erkan's orthodox approach to monetary policy to thrive, the news of their appointment has been so far cautiously welcomed by market participants.

In a broader sense, price action around the Turkish currency is expected to continue to revolve around the performance of energy and commodity prices, which are directly tied to developments from the Ukraine conflict, broad risk appetite trends, and dollar dynamics.

Key events in Türkiye this week: Consumer Confidence (Monday) – Capacity Utilization, Manufacturing Confidence (Wednesday) – CBRT Interest Rate Decision (Thursday) – Economic Confidence Index, Trade Balance (Friday).

Eminent issues on the back boiler: Persistent skepticism over the CBRT credibility/independence. Absence of structural reforms. Bouts of geopolitical concerns.

USD/TRY key levels

So far, the pair is gaining 0.61% at 23.6595 and faces the next hurdle at 23.6804 (all-time high June 12) followed by 24.00 (round level). On the downside, a break below 20.5294 (55-day SMA) would expose 19.8125 (100-day SMA) and finally 19.2064 (200-day SMA).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.