- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- WTI Price Analysis: Oil remains vulnerable to further downside past $70.00

WTI Price Analysis: Oil remains vulnerable to further downside past $70.00

- WTI crude oil holds lower ground near the weekly bottom after falling the most in a fortnight.

- Clear downside break of two-week-old ascending support line, looming bear cross on MACD favor Oil sellers.

- 50-DMA adds to the upside filters; ascending trend line from early May lures black gold bears.

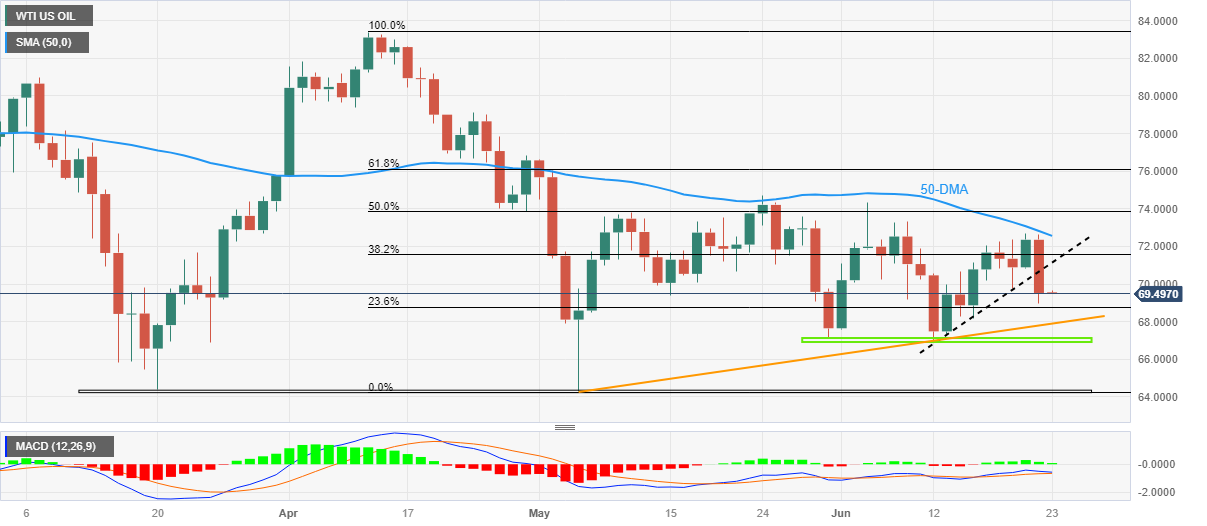

WTI crude oil returns to the bear’s radar, with Thursday’s heavy fall, even as the black gold traders lick their wounds near $69.50 amid the early hours of Friday’s Asian session. In doing so, the energy benchmark reverses the previous week’s corrective bounce, as well as prepares for the third weekly loss in four.

That said, WTI dropped the most in two weeks the previous day and broke an ascending support line from June 12, now immediate resistance near $71.10. Adding strength to the downside bias is the impending bear cross on the MACD indicator.

With this, the Oil price is likely to decline towards an upward-sloping support line from May 04, close to $67.90 by the press time. However, the 23.6% Fibonacci retracement of its April-May fall, around $68.75, may act as immediate support for the black gold.

It should be noted that the quote’s weakness past $67.90 trend line support will be challenged by the monthly horizontal support of around $67.10-67.00 before dragging the quote towards the yearly low marked in May, around $64.30.

Meanwhile, an upside break of the support-turned-resistance of near $71.10 isn’t a welcome note for the WTI crude oil buyers as the 50-DMA hurdle of $72.555 stands tall to challenge the Oil bulls afterward.

WTI crude oil: Daily chart

Trend: Further downside expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.