- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD rises amid easing US inflation, stays firm around 0.6650s

AUD/USD rises amid easing US inflation, stays firm around 0.6650s

- AUD/USD surges 0.66%, eyes 0.6700 as US inflation shows signs of slowing, softening the US dollar.

- Despite weaker Chinese data and lower CPI, AUD finds support from diminished expectations of aggressive Fed hikes.

- Aussie’s surge and the US Dollar Index’s 0.48% drop reflect a reassessment of the Fed’s future tightening stance.

AUD/USD climbs sharply and eyes a test of the 0.6700 figure after economic data from the United States (US) showed that inflation is cooling, weakening the US Dollar (USD) despite solid data revealed on Thursday. Hence, the Australian Dollar (AUD) gets a respite, and the AUD/USD pair exchanges hands at 0.6658, gaining 0.66% after hitting a daily low of 0.6603.

Cooling inflation in the US softens the greenback and boosts the Aussie, despite weaker Chinese data, subdued RBA expectations

The US economic docket showed plentiful data as the week, month, and quarter-end approaches. The US Department of Commerce delivered the US Federal Reserve (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditures (PCE), which rose by 0.3% MoM, in line with estimates, below April’s 0.4%. Yearly data pointed lower to 4.6%, from 4.7% in the previous month, showing that inflation is becoming entrenched and not slowing at the pace projected by the Fed. Headline data showed that inflation edged much lower than monthly figures.

In other data, the Chicago National Activity Index PMI rose by 41.5, exceeding May’s 40.4 print, a slight improvement but shy of getting to expansionary territory. At the same time, the University of Michigan (UoM) Consumer sentiment survey rose by 64.4, above estimates and the preliminary reading of 63.9.

On the Australian front, the Aussie (AUD) remains pressured by weaker Chinese data, as factory data dented market sentiment during the Asian session. Expectations for additional tightening by the Reserve Bank of Australia (RBA) sank after the latest CPI report showed inflation dipping to a 13-month low. Hence, money market futures show six basis points of tightening by July, but investors expect rates to peak at around 4.50% by December 2023.

Following the release of the US data, the AUD/USD soared from around 0.6620 to 0.6650. That reflects traders expect the Fed to hike rates, but not as aggressively as expected, following upbeat Thursday’s data. Consequently, US Treasury bond yields are falling, while the US Dollar Index, a measure of the buck’s performance against a basket of six currencies, edged lower by 0.48%, exchanging hands at 102.925.

Regarding monetary policy by the Fed, odds for a 25-bps hike are still up at 87%, as shown by the CME FedWatch Tool, with traders still expecting another rate increase towards November 2023.

AUD/USD Price Analysis: Technical outlook

After diving to a weekly low of 0.6595, the AUD/USD bounced off the lows and rose above 0.6650, a psychological level. It should be said that for a bullish continuation, the AUD/USD must crack June’s 23 daily low of 0.6662 turned resistance to open the way to a confluence of daily EMAs, with the 20, 50, and 100 hoovering around the 0.6700 figure. Otherwise, the AUD/USD pair will be exposed to further selling pressure, with sellers eyeing the 0.6600 figure, the weekly low of 0.6590s, and the May 30 daily high turned support at 0.6559.

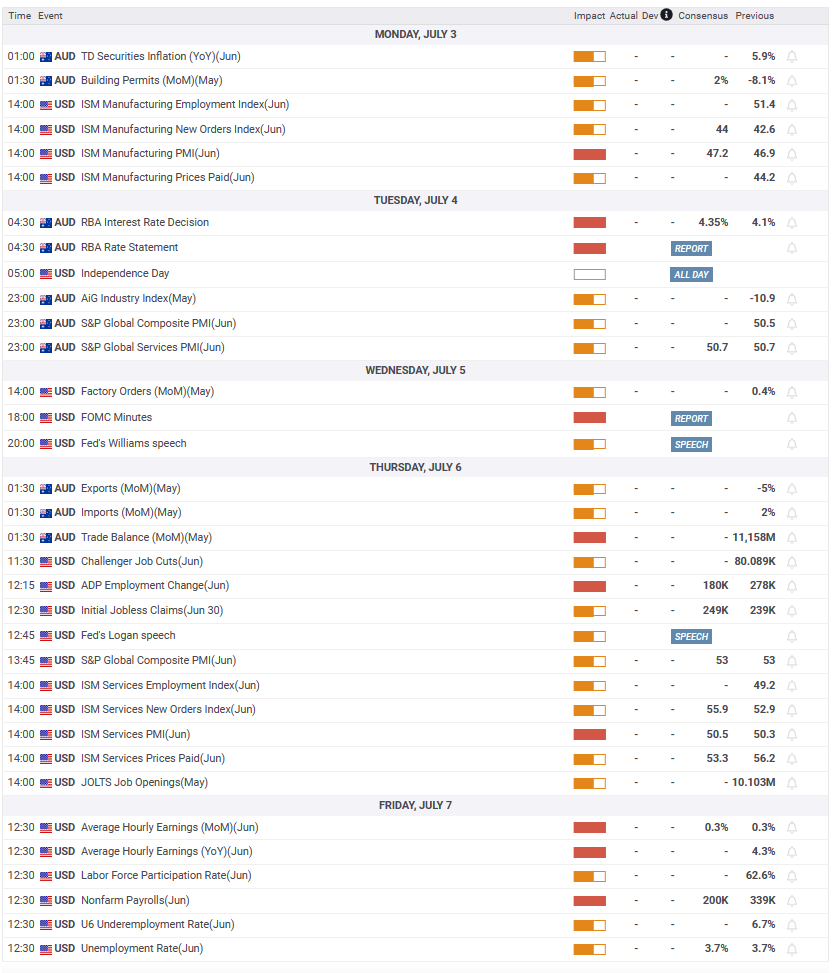

Upcoming events

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.