- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY climbs to fresh tops near 26.1000 post-CPI

USD/TRY climbs to fresh tops near 26.1000 post-CPI

- USD/TRY surpasses the 26.0000 mark and clinches new highs.

- Türkiye inflation loses further traction in June.

- Investors’ attention remains on the next steps by the CBRT.

Further depreciation of the Turkish currency lifts USD/TRY to new all-time highs near 26.1000 on Wednesday.

USD/TRY: Rally appears unabated so far

On Wednesday, the USD/TRY continued its weekly rebound and surpassed the 26.0000 hurdle, as negative sentiment towards the Turkish lira persisted.

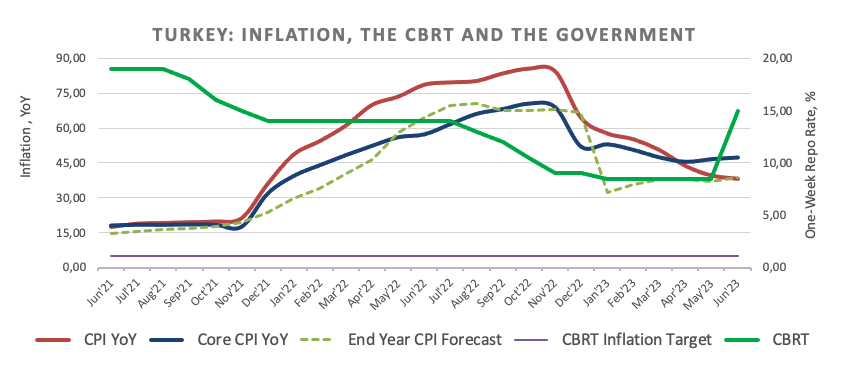

Despite the release of inflation figures in Türkiye, which showed a 3.92% MoM increase in June and a 38.21% rise over the past twelve months, the FX market did not react significantly. These figures came in lower than expected and indicated that disinflationary pressures remained in place last month. Additionally, Producer Prices rose 6.5% MoM and 40.42% YoY.

As the lira falls off the cliff, market participants are increasingly skeptical about the newly appointed economic team's ability to reverse the trend and restore credibility to both the government and the central bank.

Furthermore, investors are concerned about national lenders spending approximately $1B to support the domestic currency earlier this week.

What to look for around TRY

USD/TRY now seems to have resumed the uptrend following a brief consolidation period of several sessions.

In the meantime, investors are expected to closely monitor upcoming decisions on monetary policy. By appointing Mehmet Simsek and Hafize Gaye Erkan, both former Wall Street bankers, to oversee the country's finances, President R. T. Erdogan seems to suggest a possible move away from heavy state intervention in favor of letting the market dictate the fair value of the currency.

Although it remains uncertain whether Mr. Erdogan's preference for combating inflation through lower interest rates will allow Simsek and Erkan's orthodox approach to monetary policy to thrive, the news of their appointment has been so far cautiously welcomed by market participants.

In a broader sense, price action around the Turkish currency is expected to continue to revolve around the performance of energy and commodity prices, which are directly tied to developments from the Ukraine conflict, broad risk appetite trends, and dollar dynamics.

Key events in Türkiye this week: CPI, Producer Prices (Wednesday).

Eminent issues on the back boiler: Persistent distrust over the CBRT credibility/independence. Absence of structural reforms. Bouts of geopolitical concerns.

USD/TRY key levels

So far, the pair is gaining 0.48% at 26.0739 and faces the next hurdle at 26.0813 (all-time high July 5) followed by 27.00 (round level). On the downside, a break below 23.4189 (weekly low June 21) would expose 21.6268 (55-day SMA) and finally 20.4611 (100-day SMA).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.