- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bears eye a move to a 61.8% Fibo, but bulls test key resistance

Gold Price Forecast: XAU/USD bears eye a move to a 61.8% Fibo, but bulls test key resistance

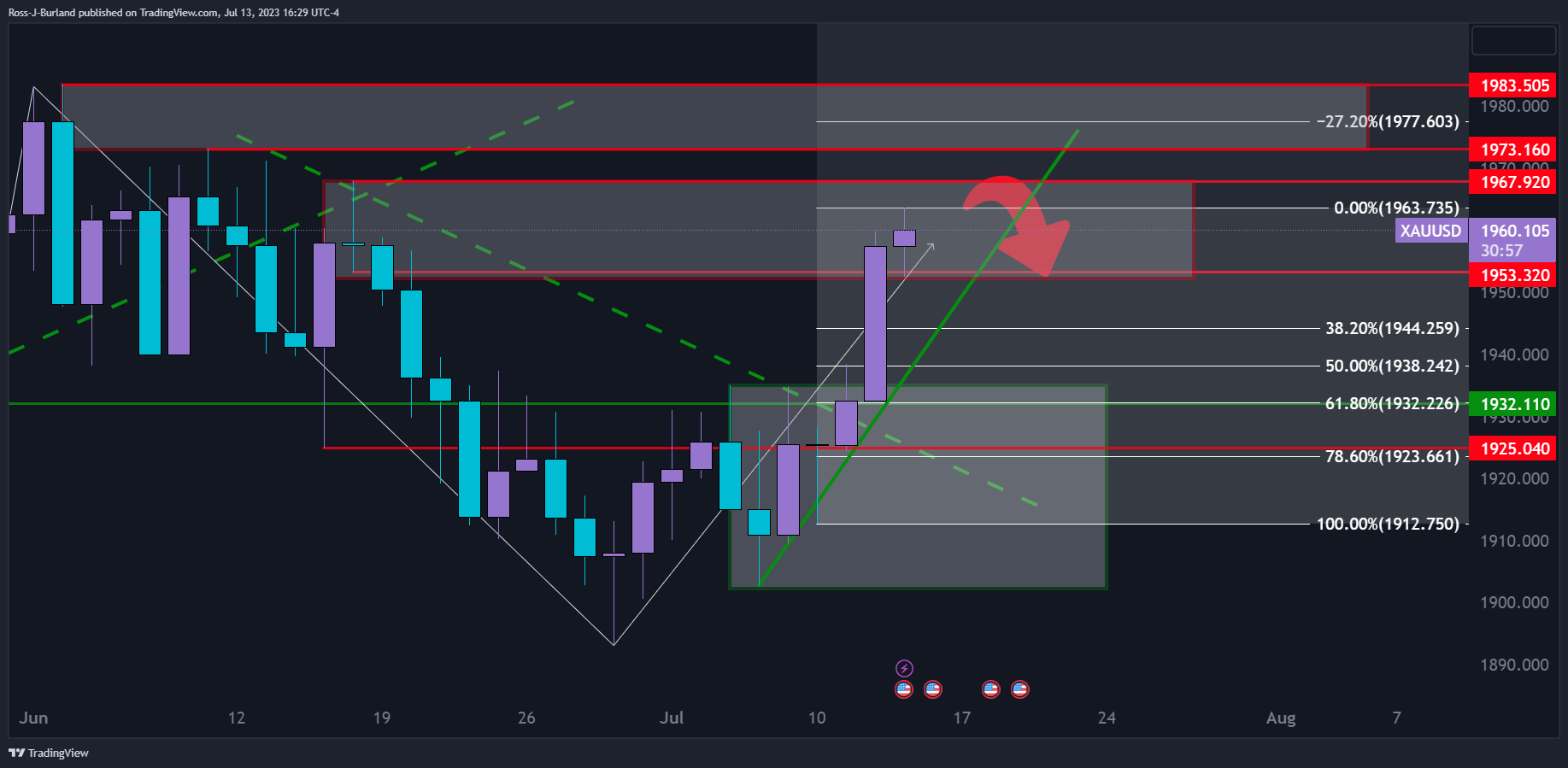

- Gold price could be on the verge of a correction as per resistance, but the bulks are still in control.

- A move through the current resistance of the $1,970s opens risk for a test of the $1,983 highs.

- Gold price bears eye the 61.8% ratio to the downside in line with $1,932 support.

Gold prices edged higher on Thursday while the Greenback continued lower as data continue to dictate the market's sentiment. US Treasury yields were the driver on yet another report that showed slowing US price pressures, pushing investors to add risk.

This benefitted the Gold price that was already glowing on the United States reported inflation report that showed that the Consumer Price Index rose by just 3% annualized in June, which was down from a 4% rate in May. On Thursday, the price pressures were shown to have eased in June, with the Producer Price index rising 0.1% annualized from 1.1% in May.

The DXY is already down for the sixth straight day and traded at its lowest since April 2021 near 99.97. A close below 100.00 will open risk for a test of the late March 2022 low near 97.685. Looking to US Treasury yields, the 2-year traded as low as 4.622% today and has fallen nearly half a percentage point from last week’s peak near 5.12%.

Gold technical analysis

The daily charts show that the price is now in a resistance area and could be on the verge of a correction. The 61.8% Fibonacci retracement area is eyed as support to $1,932.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.