- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD faces headwinds amid Chinese deflation and upcoming US CPI data

NZD/USD faces headwinds amid Chinese deflation and upcoming US CPI data

- NZD/USD dips 0.24% following economic slowdown fears in China, trading cautiously at 0.6050 ahead of US inflation data.

- US CPI expectations: Forecasts suggest a MoM rate of 0.2% and a YoY decrease from 3.3% to 3%. Core CPI might slightly decline to 4.7% YoY.

- RBNZ anticipation: With no significant NZ data releases, the market focus shifts to the potential RBNZ stance, expected to maintain rates at 5.50%.

NZD/USD extended its losses for two straight days on Wednesday, losing 0.24% after hitting a daily high of 0.6094, but deflation in China spurred fears of an economic slowdown. That, alongside the release of inflation in the United States (US), would keep the NZD/USD trading within narrow ranges. The NZD/USD changes hands at 0.6050 as the Asian session commences.

Kiwi dollar on the defensive, as traders brace for US inflation report, anticipate next RBNZ’s move

The lack of economic news turned market sentiment sour, but the greenback, as shown by the US Dollar Index (DXY) failed to gain traction ahead of an important US inflation report. The Consumer Price Index (CPI) for July is estimated to dip to 0.2% on MoM, while annually based to dip to 3% from 3.3% in June. Regarding core CPI, which strips out volatile items, is estimated to remain at 0.2%, unchanged, while Year-over-year is estimated to slow from 4.8% to 4.7%.

Aside from data in the calendar, Federal Reserve officials remain focused on data, which has shown that monetary policy is lagging, but the deflationary process started. Additional policymakers are turning neutral, while Michelle Bowman commented that further tightening is needed.

The CME FedWatch Tool shows odds for a rate hike in September at 13.5%, as money market futures do not expect more borrowing costs to increase. Nonetheless, if Fed officials begin to pile into the dovish stance, any rate cut signals would weaken the greenback; hence further NZD/USD upside is expected.

An absent docket on the New Zealand (NZ) front will keep traders focused on US Dollar dynamics. ANZ analysts expect the Reserve Bank of New Zealand (RBNZ) to hold rates at 5.50% at its next monetary policy meeting next Wednesday. “The RBNZ is expected to reiterate their “watch, worry and wait” stance.

NZD/USD Price Analysis: Technical outlook

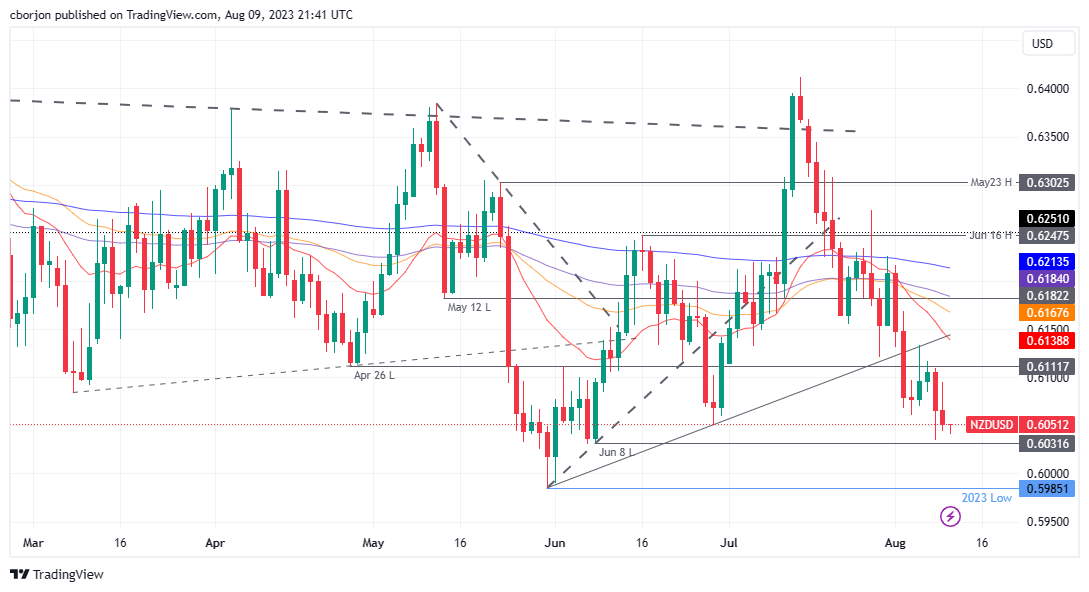

The NZD/USD downtrend remains intact after dropping below the daily Exponential Moving Averages (EMAs). Also, successive series of lower peaks and throughs open the door to test yearly lows. It the NZD/USD dives below the current week’s low of 0.6034, the next support would emerge at the July 8 low of 0.6031. Once cleared, the next demand area would be the 0.6000 mark, below testing the year-to-date (YTD) low of 0.5985.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.