- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY Price Analysis: Remains confined around 145.40 amid the cautious mood

USD/JPY Price Analysis: Remains confined around 145.40 amid the cautious mood

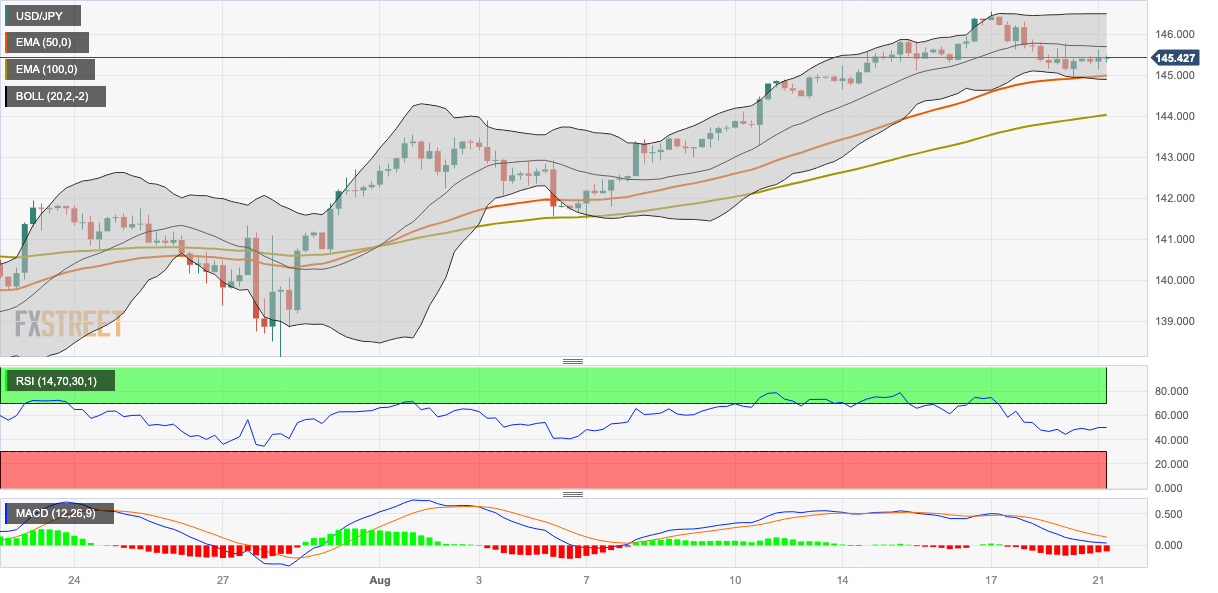

- USD/JPY consolidates around the 145.15-145.65 region in a narrow trading band.

- The major pair stands above the 50- and 100-hour EMAs with an upward slope.

- The immediate resistance level appears at 145.85; he key contention level is seen at 144.90-145.00 region.

The USD/JPY pair oscillates in a narrow range below the mid-145.00s heading into the early Asian session on Monday. Traders prefer to wait on the sidelines amid the risk-averse mood and await the Federal Reserve (Fed) Chairman Jerome Powell Speaks at the Jackson Hole Symposium on Friday. The major pair currently trades near 145.43, gaining 0.03% on the day.

Meanwhile, traders will keep an eye on the potential intervention by the Bank of Japan (BoJ). The Japanese government may step in to prevent the Japanese Yen. However, the monetary policy differential between the US and Japan is the main driver of the Yen's weakening.

According to the four-hour chart, the USD/JPY pair stands above the 50- and 100-hour Exponential Moving Averages (EMAs) with an upward slope, which means the path of least resistance is to the upside for the major pair.

That said, the key contention level for the major pair is seen at the 144.90-145.00 region, representing a confluence of the lower limit of the Bollinger Band and 100-hour EMA. The additional downside filter is seen at 144.40 (low of August 11), followed by 144.00 (100-hour EMA), and finally at 143.30 (low of August 10).

On the upside, the immediate resistance level for USD/JPY appears at 145.85 (high of August 15). The critical barrier for the pair is seen at a YTD high and the boundary of the Bollinger Band of 146.55. Any meaningful follow-through buying above the latter would challenge a psychological round figure at 147.00, which will be a tough nut to crack for the USD/JPY pair.

It’s worth noting that the Relative Strength Index (RSI) stands below 50 and Moving Average Convergence/Divergence (MACD) stays in bearish territory, which indicates that the upside momentum has been activated for the time being.

USD/JPY four-hour chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.