- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD rebound to lose momentum below $1,920 – Confluence Detector

Gold Price Forecast: XAU/USD rebound to lose momentum below $1,920 – Confluence Detector

- Gold Price stays defensive at five-month low, keeps week-start rebound.

- Risk aversion, firmer Treasury bond yields challenge XAU/USD recovery ahead of mid-tier catalysts.

- Central bankers’ defense of hawkish policy at Jackson Hole eyed to keep Gold bears on the table.

Gold Price (XAU/USD) portrays bearish consolidation at the lowest level in five months while defending the week-start rebound amid mixed sentiment.

US Dollar’s downbeat performance allows the XAU/USD to pare previous losses at the multi-day bottom. However, the firmer Treasury bond yields and fears surrounding China, one of the world’s biggest Gold customers, prod the recovery moves amid a light calendar.

That said, the mostly upbeat US data and looming fears about the US banking industry, especially after the recent credit rating downgrade from Moody’s and the S&P Global, underpin the market’s cautious mood and the bond coupons, which in turn weigh on the Oil price. Furthermore, China’s efforts to defend the post-COVID economic recovery, via a slew of stimulus measures, fail to impress market optimists and exert downside pressure on the risk profile.

Against this backdrop, US Dollar Index (DXY) renews its intraday low near 103.20, down for the second consecutive day, as market players brace for Friday’s speech for Fed Chair Jerome Powell at the Kansas Fed’s annual event called at the Jackson Hole Symposium. Furthermore, the US 10-year Treasury bond yields refreshed the highest level since November 2007 earlier in the day to 4.36% before easing to 4.34% at the latest. On the same line, the S&P500 Futures print mild losses to reverse the previous recovery from a nine-week low.

Also read: Gold Price Forecast: XAU/USD recovery seeks daily closing above $1,891, Fedspeak eyed

Gold Price: Key levels to watch

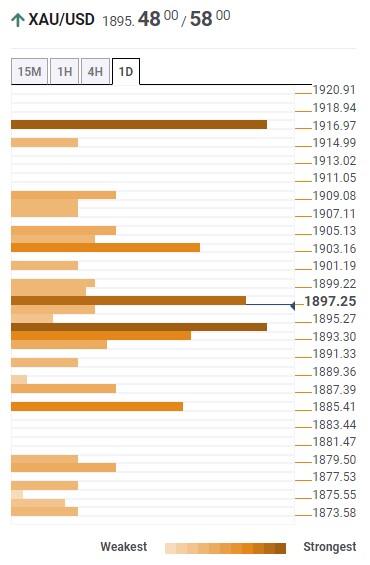

Our Technical Confluence indicator suggests the sluggish recovery of the Gold Price even as it recently poked the mid-tier resistance confluence surrounding $1,895 comprising Fibonacci 38.2% on one day, 100-HMA and the middle band of the Bollinger on the hourly chart.

However, a convergence of the Fibonacci 38.2% on one-week and the upper band of the Bollinger on the four-hour (4H) play prods the immediate upside of the Gold Price near the $1,900 round figure.

Following that, the previous monthly, 10-DMA and 200-HMA will together challenge the Gold buyers near $1,905.

Above all, the joins of the Pivot Point one-month S1 and the previous weekly high of around $1,920 acts as the final defense of the XAU/USD bears.

On the contrary, a downside break of the aforementioned $1,895 resistance-turned-support could quickly fetch the Gold price toward the lows marked in the previous day and during the last week around $1,885.

In a case where the XAU/USD remains bearish past $1,885, the Pivot Point one-week S1 and one-day S2, near $1,878 will hold the gate for the bear’s ride towards the early March swing high of around $1,858.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.