- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/GBP looking for a run above 0.8560 to close out Friday, UK data in the pipe for next week

EUR/GBP looking for a run above 0.8560 to close out Friday, UK data in the pipe for next week

- The EUR has moved higher on the week against the GBP as ther BoE turns dovish.

- Soft data for the Eurozone caps upside capacity.

- It's the Pound Sterling's ballgame to lose with data-heavy calendar due next week.

The EUR/GBP pair has moved higher for the week, with the Euro (EUR) gaining some ground against the Pound Sterling (GBP). A dovish Bank of England (BoE) has struck the GBP with bearish undertones, and despite beleaguered economic data for the broader European Union (EU) region, the Euro is the tug-of-war winner for this week.

The EUR started the week on the low end after Purchasing Manager Index (PMI) figures for the EU showed economic sentiment is declining for the continent. Later, Eurostat sales figures showed the retail space contracted by -1%, further capping upside potential for the Euro.

BoE hits dovish notes

On the United Kingdom (UK) side, the BoE’s Governor Andrew Bailey and members of the BoE’s Monetary Policy Committee (MPC) testified before the UK Parliament, speaking about inflation expectations and the overall economy.

Governor Bailey and his fellow MPC members struck a decidedly dovish tone, stating that the rate hike cycle for the BoE could very well be at the top, as well as expressing concerns that too much more action from the UK’s central bank could worsen the odds of achieving a “soft landing” for the domestic economy.

The softening stance from the BoE sent the GBP broadly lower for the week.

Next week: data-heavy UK

The economic calendar for the first half of next week is notably GBP-heavy, with very little meaningful releases from the EU side.

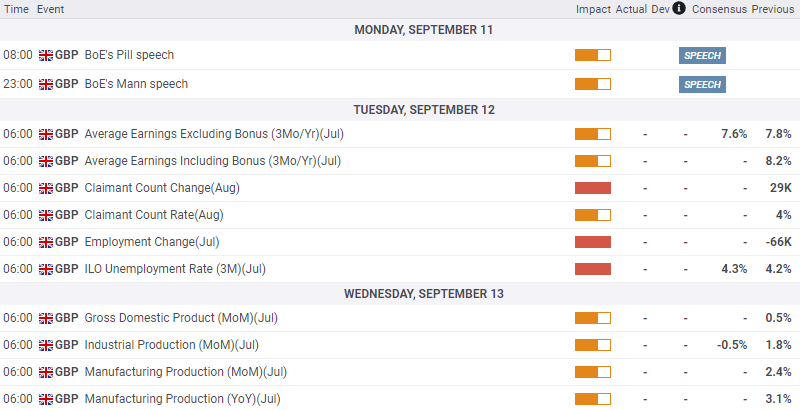

Monday sees appearances from the BoE’s chief economist Huw Pill and MPC member Catherine L. Mann. Tuesday brings UK unemployment figures and wages data, and Wednesday will bring UK manufacturing and Gross Domestic Product (GDP) data.

Wage growth, unemployment, and industrial data are all anticipated to slightly worsen.

UK economic calendar schedule, Monday - Wednesday. All times in GMT.

EUR/GBP technical outlook

The Euro-Pound pair has consolidated since June, cycling in a rough range between 0.8660 and 0.8520. A high-side resistance zone sits above, between 0.8740 and 0.8720, while any significant downside breaks could see the floor give way beneath the 0.8500 major handle.

A break below 0.8500 would see the Euro trading into 13-month lows against the Sterling.

EUR/GBP Daily chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.