- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/JPY skids along the bottom, bears looking for 181.00

GBP/JPY skids along the bottom, bears looking for 181.00

- The GBP/JPY consolidated in the back half of Tuesday trading, pinned to the low side just above 181.00.

- The Guppy is down from Tuesday's opening bids near 181.80.

- Broader market risk appetite burst into flames on Tuesday, but Yen traders are leery ahead of Japan inflation figures.

The GBP/JPY is down nearly 80 pips heading into the Wednesday market session, with the Pound Sterling (GBP) continuing to flag against the Japanese Yen (JPY). The pair is down almost 1.3% from last week's peak, and in the red over 3.0% from August's peak of 186.77.

The mid-week is thin on the economic calendar for the Guppy, and traders will be looking ahead to Thursday's Tokyo Consumer Price Index (CPI) reading on Thursday, which will be followed by Friday's Gross Domestic Product (GDP) figures for the UK.

The Bank of Japan (BoJ) is determined to see Japanese inflation remain above 2% in a meaningful way before stepping away from its hyper-easy monetary policy regime. Japanese interest rates are currently at -0.1%, and despite inflation being over the BoJ's 2% target, fears of an inflation collapse are plaguing the BoJ.

Investors will be keeping a close eye on Thursday's Tokyo CPI reading for September, which last printed at 2.9% for the annualized period into August.

Japan's Tokyo CPI data drops late Thursday at 23:30 GMT.

Friday will bring an end-of-week juggle for the GBP, with UK GDP figures in the pipe; laboring economic growth remains a key sticking point for the Bank of England (BoE), and UK GDP is forecast to hold steady at 0.2% for the second quarter.

GBP/JPY technical outlook

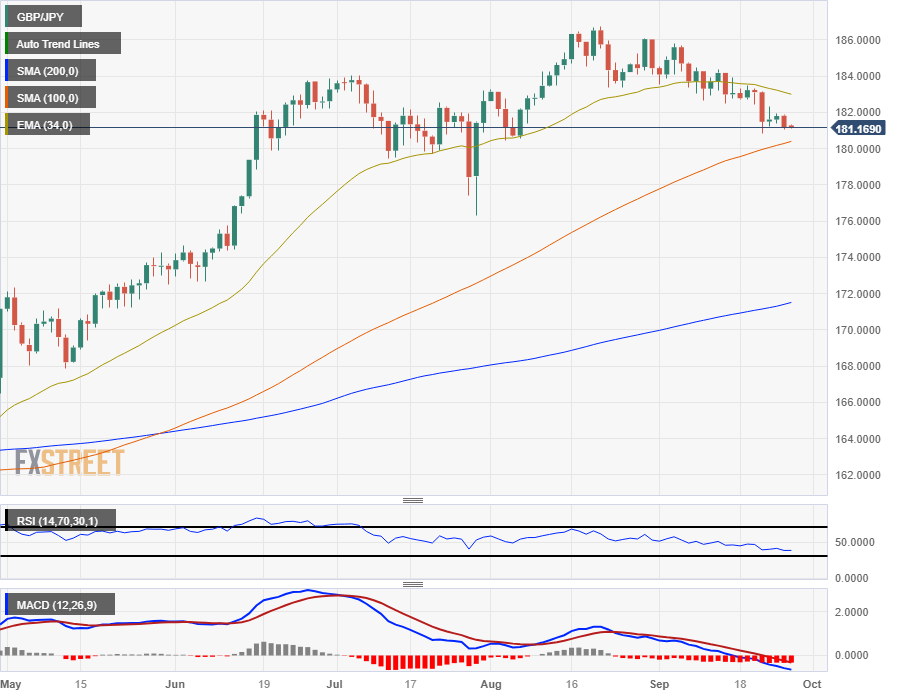

Intraday action for the GPB/JPY is decidedly bearish, with prices slumping away from the 34-hour Exponential Moving Average (EMA) near 181.40 and the 200-hour Simple Moving Average (SMA) well above current price action at 182.40.

Daily candlesticks see the Guppy on the downside as well, with the pair drifting into the 100-day SMA just above the 180.00 major handle. Despite recent bearish momentum, the GBP/JPY has soared in the medium-term and still remains almost 17% higher for the year.

Technical indicators are drifting into oversold territory thanks to the last six weeks' gradual decline, and the Relative Strength Index (RSI) is set to ping the lower boundary indicating overextended selling pressure.

GBP/JPY daily chart

GBP/JPY technical levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.