- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD Index regains some balance and extends the bounce off 106.00

USD Index regains some balance and extends the bounce off 106.00

- The index reverses three consecutive daily pullbacks.

- The probability of a Fed’s rate hike loses traction.

- Investors’ attention is expected to be on the US CPI.

The greenback reverses three daily drops in a row and regains the 106.30 region when tracked by the USD Index (DXY) at the beginning of the week.

USD looks at risk trends, inflation

The index leaves behind part of last week’s corrective decline and manages to pick up some buying interest on Monday.

In the meantime, the underlying bullish trend in the greenback remains well propped up by the equally robust march north in US yields across different time frames, which in turn looks underpinned by the persistent tighter-for-longer narrative around the Federal Reserve.

It is worth noting that the US bonds market will be closed on Monday due to the Columbus Day holiday.

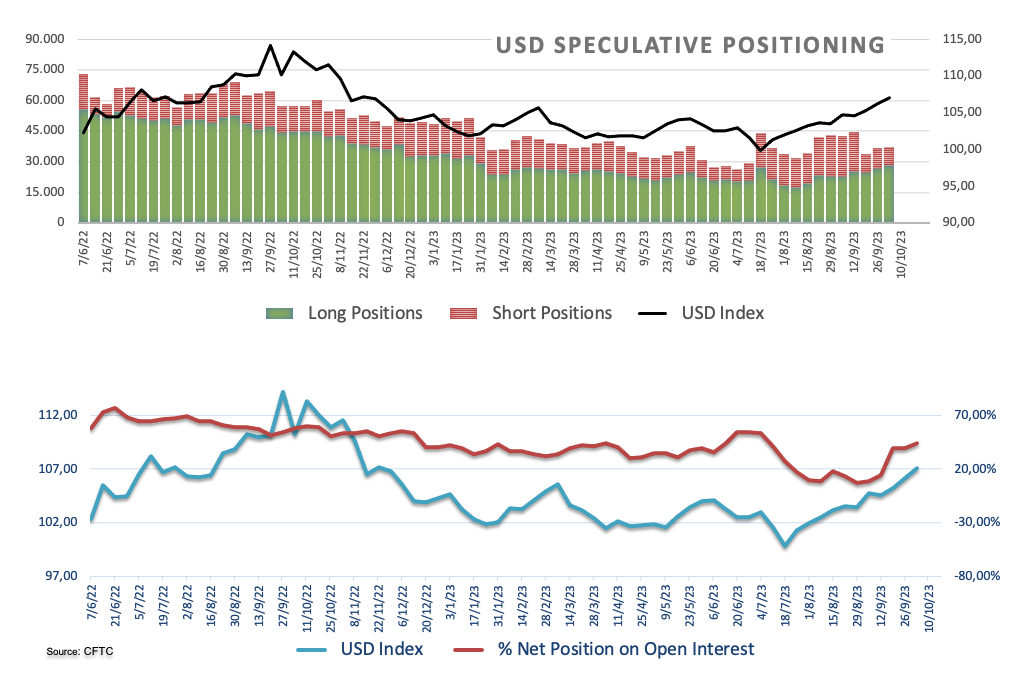

On another front, the USD net longs climbed to levels last seen in mid-December 2022 during the week ended on October 3, according to the CFTC Positioning Report. During that period, the index rose to fresh 2023 tops past the 107.00 hurdle, always bolstered by speculation that the Fed might extend its restrictive stance for longer than anticipated.

There are no scheduled data releases on Monday, although markets’ attention will likely be on the speeches by Dallas Fed Lorie Logan (voter, hawk), FOMC Governor Michael Barr (permanent voter, centrist) and FOMC Governor Philip Jefferson (permanent voter, centrist).

What to look for around USD

The index attempts a rebound after briefly piercing the key 106.00 support at the end of last week.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which at the same time appears underpinned by the renewed tighter-for-longer stance narrative from the Federal Reserve.

Key events in the US this week: NFIB Business Optimism Index, Wholesale Inventories (Tuesday) – MBA Mortgage Applications, Producer Prices, FOMC Minutes (Wednesday) - Initial Jobless Claims, Inflation Rate (Thursday) – Flash Consumer (Friday).

Eminent issues on the back boiler: Persevering debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

USD Index relevant levels

Now, the index is up 0.21% at 106.32 and a breakout of 107.34 (2023 high October 3) would open the door to 107.99 (weekly high November 21 2022) and finally 110.99 (high November 10 2022). On the downside, the next support emerges at 105.65 (low September 29) ahead of 104.42 (weekly low September 11) and then 103.17 (200-day SMA).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.