- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/JPY hits just shy of 161.00, etches in a 15-year high

EUR/JPY hits just shy of 161.00, etches in a 15-year high

- The EUR/JPY is bidding into its highest prices since 2008.

- Dovish BoJ pulling the rug out from underneath Japanese Yen.

- EU Sentix Investor Confidence improves, EU Retail Sales in the pipe.

The EUR/JPY is clipping into new 15-year highs near 161.00, coming within inches of the price handle in Monday trading. The pair hit high bids of 160.98, and further upside could be on the cards for the Euro (EUR) as the Japanese Yen (JPY) flounders under the weight of a dovish Bank of Japan (BoJ).

The European Sentix Investor Confidence Index improved for November to -18.6. October previously printed at -21.9, its second-worst reading in a year.

Eurozone Sentix Investor Confidence Index improves to -18.6 in November vs. -21.9 prior

Next up of note will be European Retail Sales on Wednesday, with the annualized figure for September expected to accelerate to the downside from -2.1% to -3.2%.

BoJ: Another disappointment for JPY bulls – TDS

The Bank of Japan (BoJ) hit Yen markets with further dovish comments, with BoJ Governor Kazuo Ueda noting that the BoJ is firmly dedicated to hyper-easy momentary policy. The Japanese central bank continues to remain concerned about inflation and wage growth both declining below the BoJ's minimum targets in the future.

A dovish BoJ stance is pummeling the Yen, sending it to multi-year lows.

BoJ Governor Ueda: Will continue massive bond buying even under new operation decided last week

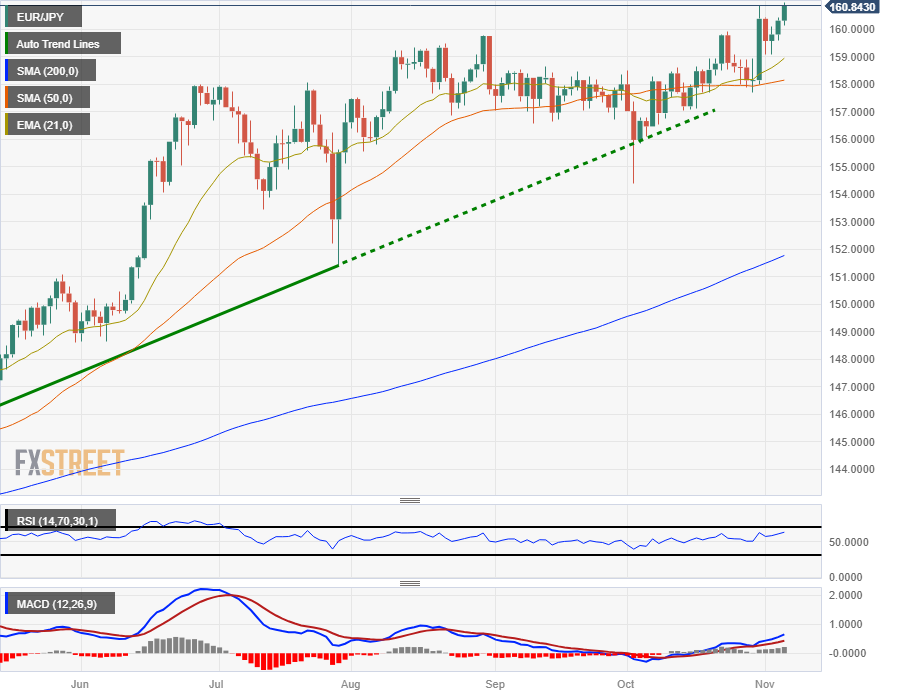

EUR/JPY Technical Outlook

The EUR/JPY tipped into a 15-year high near the 161.00 handle on Monday, climbing as the JPY gets sent into the floorboards across the broad marketspace.

The pair has accelerated away from the 50-day Simple Moving Average (SMA) currently lifting from 158.00, and little remains in the way of technical resistance with the pair tapping multi-year highs.

The EUR/JPY pair's recent consolidation has left technical oscillators hung along the midrange, and the Relative Strength Index (RIS), despite holding firmly in upper bound territory, still hasn't flashed overbought signals.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.