- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/JPY continues to march higher, claims 15-year highs above 161.50

EUR/JPY continues to march higher, claims 15-year highs above 161.50

- The EUR/JPY continues to climb, tipping into a 15-year high.

- The Yen is fumbling across the board for Wednesday.

- Investors likely to begin watching for signs of intervention from the BoJ.

The EUR/JPY is edging into its highest bids in over 15 years, trading north of 161.50 and looking for more. The Japanese Yen (JPY) has struggled recently, being all but abandoned by a hyper-dovish Bank of Japan that remains entirely focused on propping up long-run growth expectations for the Japanese economy even as the Yen continues to tumble to record lows.

The BoJ remains firmly dedicated to their hyper-easy monetary policy framework, leaving the Yen little place else to go but to drain down the charts, and the Eur (EUR) is seeing a upshot breakaway.

With the JPY trading so poorly against other assets, it's only a matter of time before someone at the BoJ decides enough is enough and begins to intervene in currency markets in a bid to protect their domestic currency from further selling.

The early Thursday Asia market session sees trade balance figures for Japan, with the headline non-seasonally-adjusted Current Account for September expected to rise from JPY 2.2 trillion to 3 trillion.

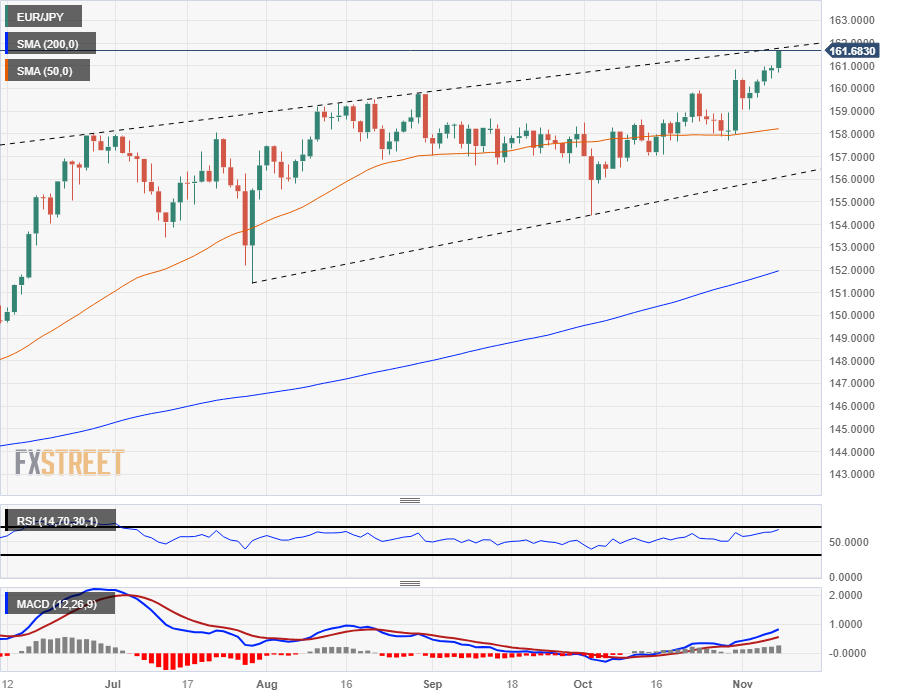

EUR/JPY Technical Outlook

The Euro is up over 2.5% against the Yen from last week's swing low into 157.70, and with little technical patterns on the high end to cap bullish momentum, the pair could see an easy break into further record territory.

The EUR/JPY caught a clean bounce from the 50-day Simple Moving Average (SMA) last week, and long-term chart support sits at the 152.00 handle with the 200-day SMA.

A rising trendline from late July's swing low into 152.00 is also pricing in a technical floor from the 156.00 region.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.