- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD rallies above $2000 as the Fed hints rate cuts

Gold Price Forecast: XAU/USD rallies above $2000 as the Fed hints rate cuts

- Gold’s rallied more than 1.30% as traders brace for Powell’s press conference.

- Federal Reserve officials voted unanimously and expect at least three rate cuts for 2024.

- XAU/USD hits a three-day high, eyeing more gains above $2000.

Gold price advanced sharply late in the New York session after the Federal Reserve decided to keep rates unchanged, opening the door for monetary policy easing next year. Buyers saw that as a green light to open fresh positions, as XAU/USD has climbed more than 1.80%, trading at around the $2000-$2020 range at the time of writing.

XUAU/USD extends its rally above $2020 as rate cut expectations climbed

On Wednesday, the Fed stuck to its plan to hold rates at the current rate despite acknowledging that growth and the jobs market have moderated; it stated that inflation. Despite that, Fed officials added that inflation has cooled but remains elevated.

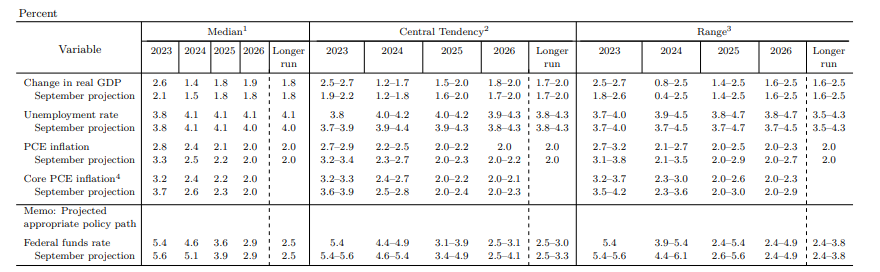

Besides that, the Summary of Economic Projections (SEP) hinted that the Fed is done raising rates and that they expect three 25 basis points for the following year. Further data was reviewed, with growth expected to increase compared to September’s, while inflation would head toward the 2% target.

Source: Federal Reserve

Aside from this, the Chairman of the Fed, Jerome Powell, stated the US Central Bank is fully committed to attaining both of its mandates. Even though he kept the door open for additional hikes, he said, “we likely at or near peak for rates,” sponsoring a leg up on the non-yielding metal. He said rate cuts “is now a topic of discussion” and added that the question is when it would be appropriate to begin easing policy.

When asked about a recession, he said they don’t see that scenario right now but that there’s always a probability next year. Although he welcomed progress on inflation, he said it’s too early to declare victory.

When asked about cutting rates until inflation hits 2%, he said it would be too late, adding that “you need to reduce restriction on economy well before 2%.”

In the meantime, Gold price continued to print gains, sponsored by the Fed’s pivot. Consequently, US Treasury bond yields are plunging more than 15 bps in the short and long end of the curve, with the 10-year benchmark note standing at 4.02%.

The US Dollar Index (DXY) tracks currency performance against a basket of six peers and is sinking 0.84%, down at 102.94. Meanwhile, the Fed’s interest rate probabilities for the next year expect more than 140 basis points of rate cuts, twice the Fed’s projections. That means investors estimate the federal funds rate (FFR) to be 4%.

XAU/USD Hourly Chart after Fed’s decision

XAU/USD Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.