- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- WTI whips on Thursday as Crude Oil markets roil on Red Sea attacks, Angola quitting OPEC

WTI whips on Thursday as Crude Oil markets roil on Red Sea attacks, Angola quitting OPEC

- Crude Oil whipsawed on Thursday as energies grappled with headlines pulling in multiple directions.

- Angola is the latest country to quit OPEC, further reducing OPEC’s market share.

- Red Sea attacks have diverted shipments between Asia and Europe, propping up Crude Oil bids.

West Texas Intermediate (WTI) Crude Oil tumbled nearly three percent to $72.50 per barrel on Thursday after Angola formally announced it would be leaving the Organization of the Petroleum Exporting Countries (OPEC), citing a lack of benefit to participating in the global oil cartel’s framework.

With Angola’s departure from OPEC, the oil consortium’s market share declines to 27% of all global oil production, which has declined from 34% in 2010.

Further reducing OPEC’s share of global oil trade is a new record for US Crude Oil production, which hit 13.3 million barrels per day. Angola, by comparison, produced 1.1 million bpd and was struggling to hit OPEC quotas for the country.

Crude Oil down, then back up as market factors spread in both directions

Despite the barrel crunch following Angola’s announcement, Crude Oil rebounded o nthe day as tensions over the Red Seas continue to mount on energies and trade. Houthi rebel forces have declared that they will continue to attack any ships that come within reach of their bases in Yemen, and have vowed to increase the ferocity of their attacks if the US interferes were to attack in retaliation.

A coalition battle group, led by US forces, is currently moving into position in the Red Sea in an effort to police trade waters, but nearly all trade through the region has been re-routed in the meantime, adding time and costs to shipping lanes.

Despite OPEC’s best efforts to curtail pumping within its consortium, global oil production continues to outpace demand and Crude Oil prices are likely to keep feeling the pressure.

WTI Technical Outlook

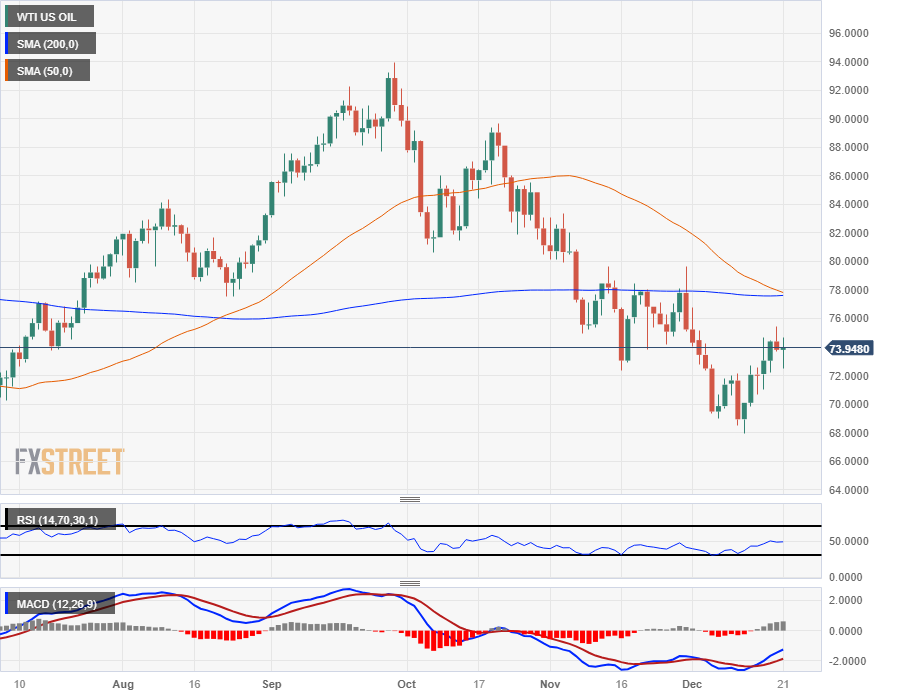

WTI’s dip-and-bounce on Thursday has Crude Oil prices near where the day started just below $74 per barrel, and US Crude Oil is bidding down from yesterday’s peak of $75.40.

Crude Oil’s near-term rally is quickly coming under threat after rising nearly eleven percent from last week’s low of $67.97 to this week’s high, but ongoing shortside pressure is capping off WTI below the 200-day Simple Moving Average (SMA) near $78.00 per barrel.

WTI Hourly Chart

WTI Daily Chart

WTI Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.