- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD steady above 0.6700 amid mixed US economic signals

AUD/USD steady above 0.6700 amid mixed US economic signals

- AUD/USD shows marginal gains in volatile session, reacting to US job strength and services sector deceleration.

- Solid US Nonfarm Payrolls and a decline in Services PMI create a mixed economic landscape, impacting currency dynamics.

- Traders eye upcoming US inflation data and Australian Retail Sales for further directional cues in the week ahead.

The AUD/USD is almost flat during the North American session, after mixed economic data from the United States (US) keeps the Greenback seesawing between gains and losses. A solid employment report in the US and weaker business activity in the services sector keep investors scratching their heads about the economy's outlook. The pair, post minuscule gains of 0.11%, trades at 0.6711.

AUD/USD remains afloat above 0.6700 amid mixed US economic data

The Institute for Supply Management (ISM) revealed the services sector slowed in December, as the Services PMI slid from 50.7 to 43.3, the lowest since May 2023. Today’s reading, along with the Manufacturing PMI revealed earlier this week, suggests the economy is slowing faster than foreseen, with both readings in recessionary territory.

Earlier, the US Department of Labor (DoL) disclosed the US economy created 216K jobs, as illustrated by December’s Nonfarm Payrolls data, while the Unemployment Rate cooled from 3.8% to 3.7%. According to Average Hourly Earnings, wages rose to 4.1% YoY from 3.9%.

In the meantime, the AUD/USD reversed its earlier gains post US NFP and ISM Services PMI release, which witnessed the pair hitting a daily high of 0.6748, before retreating somewhat toward the 0.6710 region.

Ahead of the next week, the US economic docket will feature December’s inflation data. On the Australian front, traders would be looking for Retail Sales.

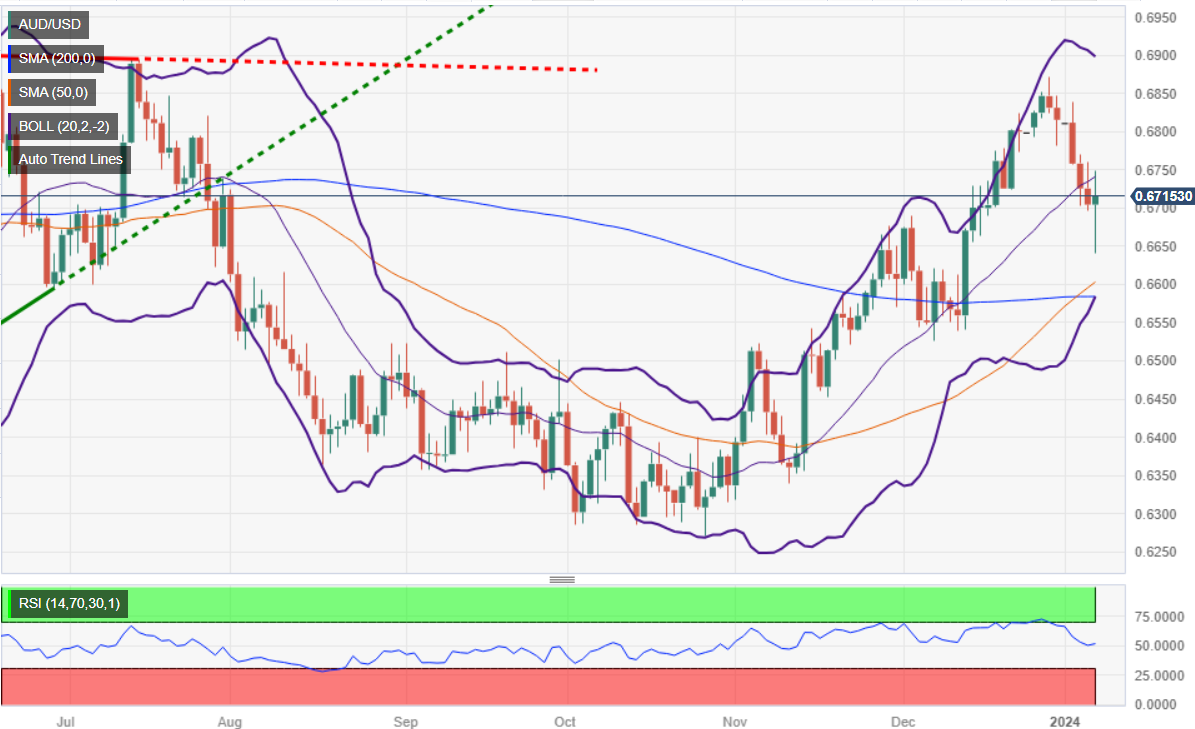

AUD/USD Price Analysis: Technical outlook

After dropping toward 0.6640, AUD/USD buyers moved in, lifting the pair shy of testing the 0.6750 area before reversing its course. If the pair closes around current exchange rates, that would form a large doji, meaning that traders remain uncertain about the pair's direction. For a bullish resumption, buyers must reclaim 0.6750, which would expose the 0.6800 figure. On the downside, if sellers drag prices below the 0.6700 figure, that could pave the way to test the confluence of the 50-200-day moving averages (DMA), at 0.6582/92.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.