- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Crude Oil dips then recovers on Thursday after US supplies draw down, China demand picks up

Crude Oil dips then recovers on Thursday after US supplies draw down, China demand picks up

- US Crude Oil stocks rose less than expected this week.

- China saw an uptick in Crude Oil demand.

- Market shrugs off more productive US Crude Oil well efficiency.

West Texas Intermediate (WTI) fell towards $77.60 per barrel early Thursday before a firm rally in the US trading session dragged US Crude Oil back into the high end for the day. US Crude Oil supplies rose less than expected this week, and a drawdown in US gasoline reserves is propping up hopes of demand outrunning supply.

China’s Crude Oil imports rose over 5% in January and February according to Chinese government data published on Thursday. The Lunar New Year holiday saw Chinese demand for fuel surge as holiday travel bolstered consumption.

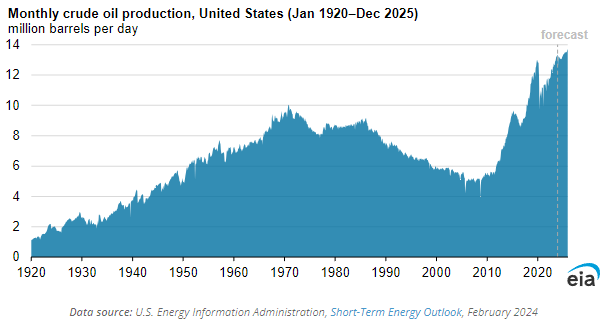

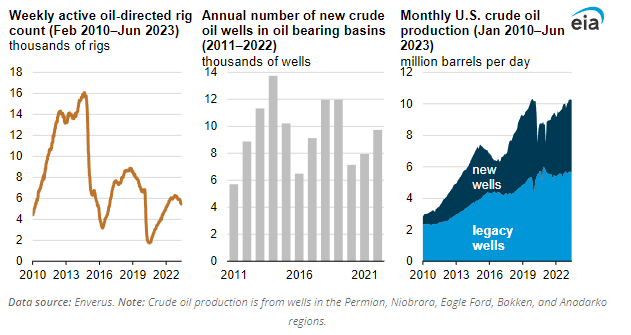

US Crude Oil production continues to rise into record levels, and according to the Energy Information Administration (EIA), that trend is set to continue. As noted by the EIA, increasing efficiency in already-existing US Crude OIl production facilities is driving the total output volume into higher numbers despite a bearish outlook on the total number of production facilities. Counts on US oil rigs are steadily decreasing and the number of new wells being produced has been easing for over a decade.

However, previously built or “legacy” wells continue to produce higher amounts of Crude Oil as the US energy market becomes increasingly efficient.

WTI technical outlook

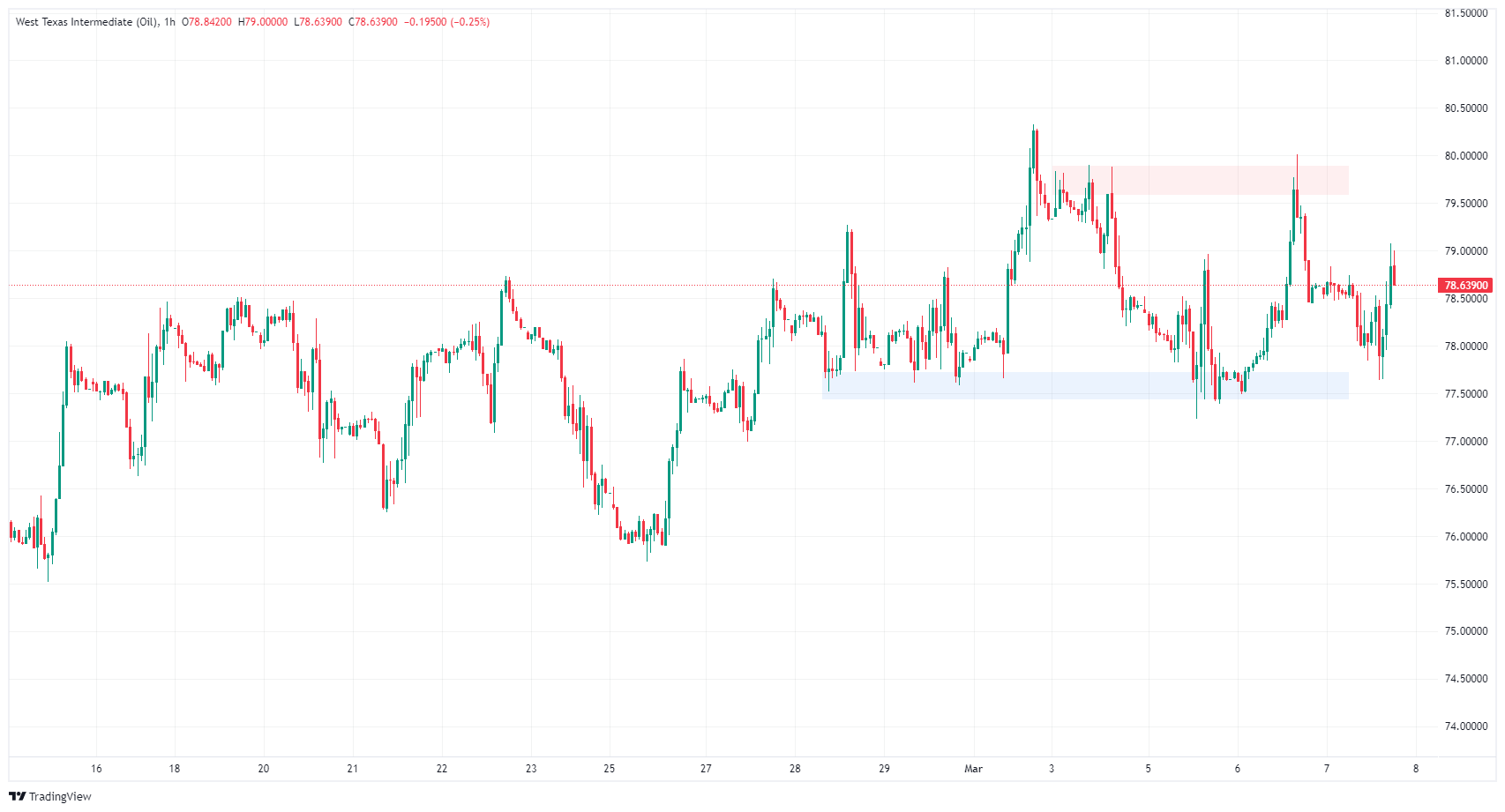

WTI’s near-term churn keeps US Crude Oil bids trapped in a rough range with the $80.00 handle acting as a technical ceiling, and Thursday’s rebound has WTI struggling to etch in chart paper above $79.00.

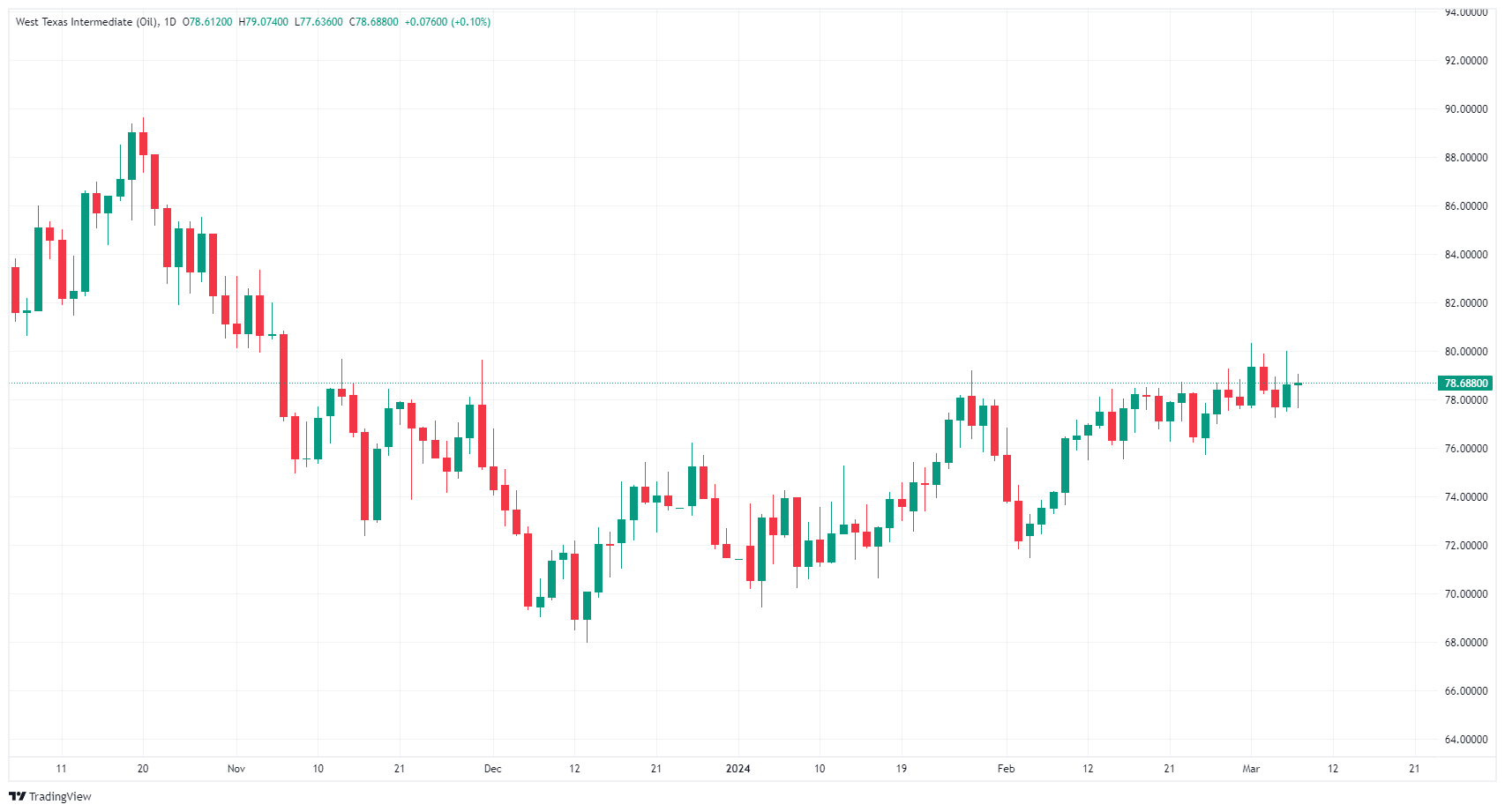

Daily candlesticks are stuck in a close pattern with the 200-day Simple Moving Average (SMA) near $77.90. US Crude Oil has risen around 10% from early February’s swing low into $71.50, but further topside moment has drained out of WTI.

WTI hourly chart

WTI daily chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.